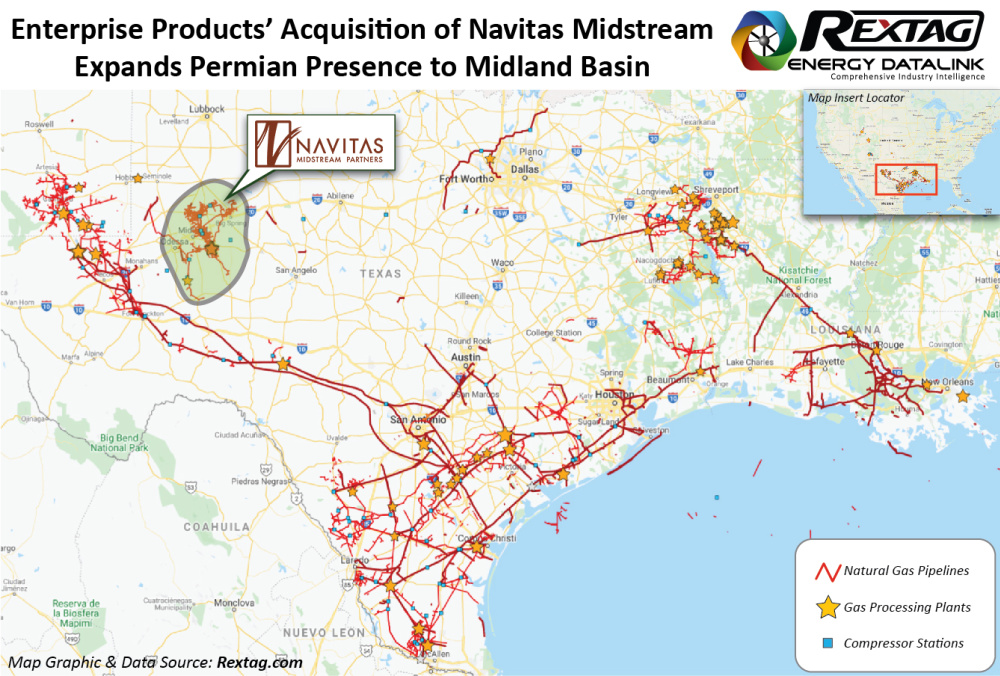

Enterprise Products Partners LP completed the acquisition of Navitas Midstream Partners LLC, a natural gas gathering, treating and processing service provider in the core of the Midland Basin backed by Warburg Pincus LLC, according to a Feb. 17 release.

The previously announced $3.25 billion acquisition gives Enterprise a foothold for natural gas gathering, treating and processing in the core of the Midland Basin of the Permian where the Houston-based midstream company already has a presence, but in the Delaware Basin.

“The Navitas management team has developed a premier system in the heart of the Midland Basin. ... This acquisition will give us an entry point into the basin,” Enterprise Co-CEO A. J. “Jim” Teague commented in a release announcing the deal in January.

Data courtesy of Rextag. Click on the map for more information about Rextag's map-based data intelligence or connect with Tyler Reitmeier at treitmeier@hartenergy.com.

Data courtesy of Rextag. Click on the map for more information about Rextag's map-based data intelligence or connect with Tyler Reitmeier at treitmeier@hartenergy.com.

Navitas Midstream’s assets, which Enterprise said complements its presence in the Delaware Basin, include approximately 1,750 miles of pipelines and over 1 Bcf/d of cryogenic natural gas processing capacity. The system is anchored by long-term contracts and acreage dedications with a diverse group of over forty independent and publicly owned producers.

The transaction isthe largest acquisition of a private gas gathering and processing business, according to Warburg Managing Director John Rowan in the January release. Enterprise had said it planned to fund the acquisition using cash on hand and borrowings under the partnership’s existing commercial paper and bank credit facilities.

Jefferies LLC was financial adviser to Navitas in connection with the transaction, and Kirkland & Ellis served as the company’s legal adviser.

Recommended Reading

Woodside’s Scarborough LNG Receives $1B Loan from Japanese Bank

2024-06-02 - Woodside Energy’s Scarborough LNG project, located off Australia’s coast, is scheduled to start shipping cargo in 2026.

Woodside to Emerge as Global LNG Powerhouse After Tellurian Deal

2024-07-24 - Woodside Energy's acquisition of Tellurian Inc., which struggled to push forward Driftwood LNG, could propel the company into a global liquefaction powerhouse and the sixth biggest public player in the world.

Woodside Energy to Buy LNG Developer Tellurian for $900 Million

2024-07-21 - Australia's Woodside Energy will pay $1 per share for Tellurian, which earlier this year sold its upstream Haynesville Shale assets to convert into a pure play LNG company, in a deal with an estimated enterprise value of $1.2 billion, including debt.

Freeport LNG’s Slow Restart Stokes Concern Over Supply Risk

2024-07-23 - The 15-mtpa Freeport LNG facility remains under the spotlight of the global market as it slowly resumes operations after pausing ahead of Hurricane Beryl’s arrival along the U.S. Gulf Coast.

NatGas Purgatory: US Gas Spot Prices Hit Record Lows in 1H24—EIA

2024-07-22 - Facing record-low commodity prices, U.S. dry gas producers have curtailed production and deferred new completions in the first half of 2024.