Key to survival will be to remain relentless in its push to improve efficiency, drive down costs and deliver projects flawlessly as well as improve their ESG credentials, Wood Mackenzie analysts noted. (Source: Hart Energy; Shutterstock.com)

Already known as a risky business, the future of the upstream oil and gas industry has been further clouded by the accelerated pace of a global energy transition, according to a new report by Wood Mackenzie.

Analysts with the energy consultancy firm said the risks associated with oil and gas have been tempered over the years by a single tenet—that demand would continue to rise indefinitely. However, that belief has all but evaporated as the energy transition toward alternative energy sources gathers momentum.

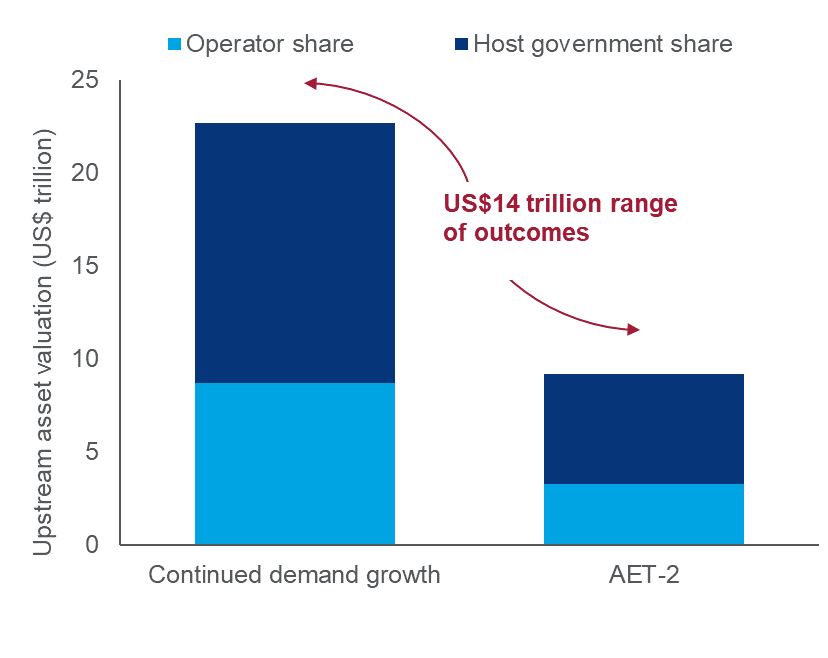

Wood Mackenzie estimates the energy transition now represents $14 trillion worth of uncertainty for upstream oil and gas, the firm said in its report published May 20.

“The industry now finds itself having to supply oil and gas to a world in which future demand—and price—are highly uncertain,” Wood Mackenzie vice president Fraser McKay said in the report. “The range of possible outcomes is dizzying.”

Still, according to McKay, even a rapidly transitioning world needs oil and gas supply for decades to come—contrary to stark warnings made earlier this week by the International Energy Agency (IEA) that called for a hard stop of funding to fossil fuel projects.

“The world will still need oil and gas supply for decades to come, and the scale of the industry will remain enormous,” he said.

RELATED:

IEA Report: Achieving Net-Zero Necessitates Huge Job, Investment Cuts for Fossil Fuels

Wood Mackenzie forecast gas demand and price to remain resilient in the long term. However, the firm’s two main scenarios for oil have a range of outcomes that depend on what strategy is chosen in order to acheive net-zero emissions.

The first scenario: demand for more oil will continue to grow for another decade or more. On the other hand, if the world heeds IEA warnings and acts decisively to limit emissions, Wood Mackenzie analysts said oil demand and prices would fall rapidly later this decade.

Still, either scenario leaves a huge amount of upstream value on the table for the oil and gas industry.

Wood Mackenzie modeling estimates the range of pre-tax future valuations for upstream is from $9 trillion to $23 trillion. On a post-tax basis, operators’ share of this economic rent ranges from $3 trillion to $9 trillion.

(Source: Wood Mackenzie Ltd.)

“Only exceptional, low-cost projects will work in all demand scenarios,” Wood Mackenzie research director Angus Rodger added in the report. “Inevitably, the cost of capital and the cost of doing business in oil and gas will increase.”

In order to survive, the industry will need to remain relentless in its push to improve efficiency, drive down costs and deliver projects flawlessly as well as improve their ESG credentials, the Wood Mackenzie analysts noted.

Though not an option for all, new energies will also play an increasing role for the largest players in the business.

“And business models must adapt to maximize value as the oil and gas sector matures,” McKay added.

As a result, specialists will carve out niches and consolidation to bolster margins will gather momentum over the next several years.

“Just a few more years of firm oil prices would strengthen balance sheets,” McKay said, “making transition strategies easier to execute.”

Recommended Reading

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Pemex Hits Debt Target, Struggles to Reverse Production Declines

2024-07-26 - Pemex achieved its long-term debt target, which aimed to gets its financial obligations below the $100 billion, while struggling to halt production declines.

Dividends Declared in the Week of July 22

2024-07-25 - Second quarter earnings are underway, and companies are declaring dividends.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.