The extension of OPEC+ and Saudi Arabia production cuts are predicted to make oil and gasoline more expensive. (Source: Shutterstock)

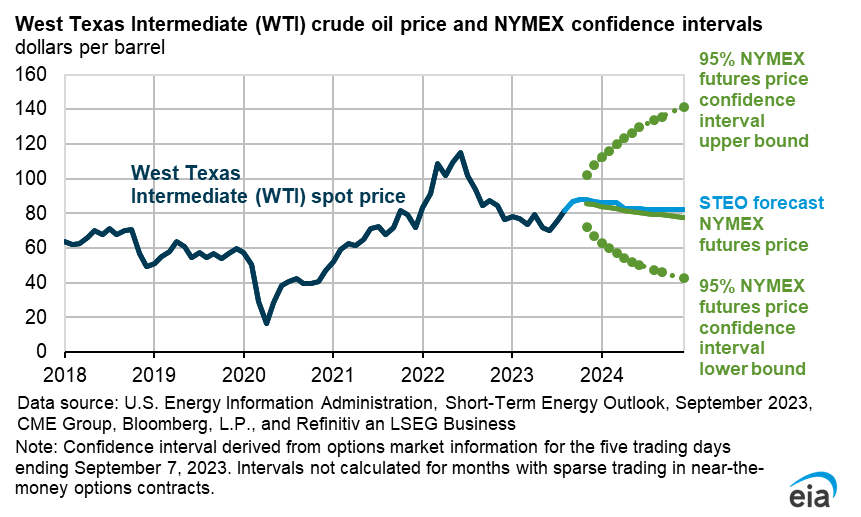

The price of Brent oil is expected to average $93/bbl in fourth-quarter 2023, according to a new forecast from the U.S. Energy Information Administration (EIA), which takes into account a recent extension of production cuts by OPEC+.

The cuts will force a decline by almost 500,000 bbl/d, according to the EIA’s Short-Term Energy Outlook.

On Sept. 5, Saudi Arabia also announced it would extend its additional voluntary cuts through the end of 2023.

“The voluntary cuts were set to expire at the end of this month. That announcement, and OPEC+ production cuts across the group, is the primary reason our current forecast for fourth quarter crude oil prices is higher than our previous forecast,” EIA press officer Chris Higginbotham told Hart Energy.

The price forecast is about 5.6% higher than what EIA predicted in August, when the agency forecast Brent crude at less than $88.

“We expect crude oil prices to rise as global oil inventories decrease through the end of this year,” EIA Administrator Joe DeCarolis said in a statement. “High oil prices combined with uncertain economic conditions could lessen global demand for petroleum products through 2024.”

However, EIA expects global production of liquid fuels to continue increasing in 2023 and 2024 due to production growth in non-OPEC+ countries.

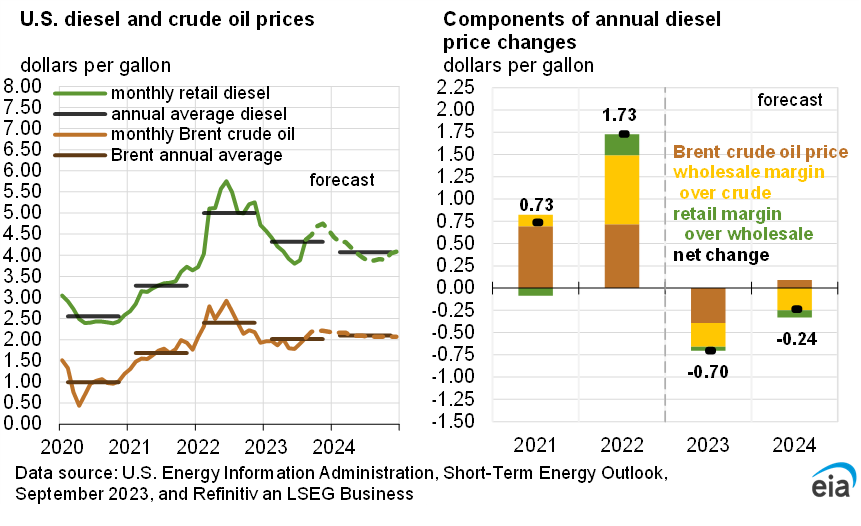

Higher crude prices are expected to lead to higher gasoline prices. The EIA forecasts the U.S. regular-grade gasoline price to average $3.69/gal in the fourth quarter. In August, the EIA forecast was $3.57/gal.

The EIA lowered its forecast for domestic gasoline consumption slightly, based on population revisions by the U.S. Census Bureau. The revisions reduced the EIA’s estimates of how many miles U.S. motorists are driving. The EIA expects U.S. gasoline consumption to average 8.9 MMbbl/d in 2023, down slightly from its August forecasts.

The EIA expects a 5% drop in propane prices at Mt. Belvieu to average $0.77/gal this winter heating season from October 2023 through March 2024 — a slight decrease from the average $0.81/gal during the previous heating season.

Recommended Reading

CEO: Baker Hughes Lands $3.5B in New Contracts in ‘Age of Gas’

2024-07-26 - Baker Hughes revised down its global upstream spending outlook for the year due to “North American softness” with oil activity recovery in second half unlikely to materialize, President and CEO Lorenzo Simonelli said.

Dividends Declared in the Week of July 22

2024-07-25 - Second quarter earnings are underway, and companies are declaring dividends.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”

Freeport LNG Parent Receives Junk-level Credit Score From Fitch

2024-07-25 - Credit-rating firm Fitch Ratings cited the 2 Bcf/d Texas plant’s frequent downtimes among the factors leading to lowering Freeport LNG Investments LLLP’s credit grade on July 25.