If Diamondback Energy was wound up watching its peers get swallowed whole by supermajors at the end of last year, the Permian Basin pure-play picked the right time to strike.

Many long months in the making, Pioneer Natural Resources succumbed to Exxon Mobil’s charms the same week in October that Hess Corp. accepted Chevron’s advances. Two different companies, philosophies and basins, yes, but the message was the same: consolidation is back. Better buy or get bought.

And in mid-February, Diamondback uncoiled and displayed its prize: the prolific, legacy and privately held Permian pure-play Endeavor Resources.

In a $26 billion, mostly stock acquisition of Autry Stephens’ wildly successful family business in the heart of the Permian, Diamondback pulled off a feat few dared to dream. Like Stephens, Diamondback’s CEO Travis Stice is a Midland, Texas, native dedicated to his hometown. And indeed, that as much as anything else could’ve been part of the calculus that got this deal done. Stephens has spent decades saying no to would-be suitors before his health made running the company less palatable.

It’s a king-making move for Diamondback.

“[Diamondback] sought to convince investors they are assembling a must-own Permian pure-play via the acquisition of Enveavor,” said TD Cowen analyst David Deckelbaum. “Count us in the camp of convinced.”

Cowen’s model now has Diamondback generating big bucks with “a 10% free cash flow yield before leaning into synergies and added value unlocks such as midstream dedications, royalty drop downs and enhanced locations.”

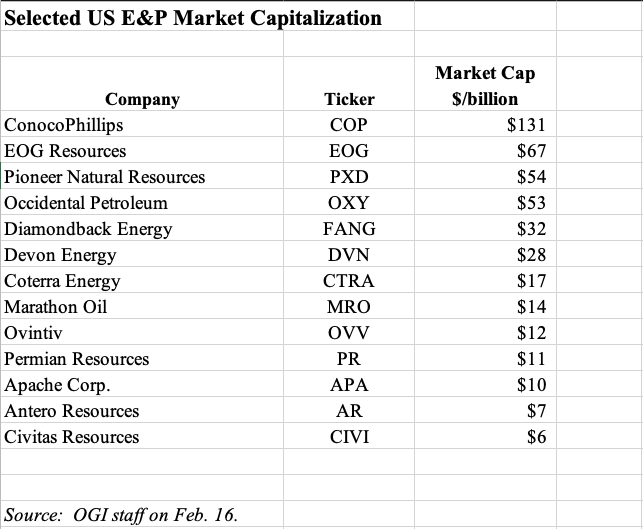

Stifel analysts saw it, too, when they said the day the deal was announced that it positions Diamondback to one day compete for Pioneer Natural Resources’ spot among the upper echelon of independents in the Permian—a group of four that individually exceeds the value of its closest peer group by some $20 billion.

But while widespread E&P M&A is creating a leaner, meaner sector, it’s also poised to reshape the services sector. Natural synergies will reduce the rig count and, following suit, the contracts. But what that means for the services space remains to be seen. Our editorial team is in the midst of sorting it out and you’ll be reading about it in coming editions of Oil and Gas Investor.

For now, Evercore ISI analysts anticipated in January the E&P consolidation trend will continue well into this year and include top-down “blockbuster roll-ups” of pure-plays into the large integrated firms, as well as bottom-up basin consolidation of “sponsor-backed and subscale E&Ps into ever larger entities.”

All told, it makes for an E&P sector in North America dominated by fewer, larger and more liquid producers able to grow modestly and return capital to their investors, according to Evercore.

Consolidation within the services space tends to be good for the industry, helping companies maintain both pricing and earnings power. Evercore points to the offshore drilling industry as a key beneficiary: A tight rig supply and no newbuild cycle leaves room for higher use and day rates, said Evercore Senior Managing Director James West.

“In the pressure pumping sector the story is similar, as higher consolidation has resulted in a more disciplined industry, more focused on returns than market share,” he said.

It’s time for the strongest among the services sector to follow the E&Ps’ lead: find fortifying prey and hunt.

Recommended Reading

Where, When and How to Refrac—Weighing All the Options

2024-07-12 - Experts weigh in on strategic considerations when deciding how to rejuvenate production from a tired well.

Goodbye Manual Control: Vital Energy’s Automation Program Boosts Production

2024-07-12 - Production, ESP efficiency soared when the company automated decisions with AI at the edge.

EOG: Utica Oil Can ‘Compete with the Best Plays in America’

2024-05-09 - Oil per lateral foot in the Utica is as good as top Permian wells, EOG Resources told analysts May 3 as the company is taking the play to three-mile laterals and longer.

The OGInterview: BPX E-fracs Push ‘Values Up, Emissions Down,’ CEO Says

2024-07-02 - BPX Energy CEO Kyle Koontz discusses the company’s role as the “nimble entrepreneurial” arm of supermajor BP in the Permian Basin and Haynesville and Eagle Ford shales.

Beetaloo Juice: US Shale Explores Down Under

2024-06-28 - Tamboran Resources has put together the largest shale-gas leasehold in Australia’s Beetaloo Basin, with plans for a 1.5+ Bcf/d play. Behind its move now to manufacturing mode are American geologists and E&P-builders, a longtime Australian wildcatter, a U.S. shale-rig operator and a U.S. shale pressure-pumper.