Kirk Johnson, ConocoPhillips’ senior vice president of Lower 48 operations and assets, said the company is the only operator with top tier positions in the four premier oil basins in the continental U.S. The company has built a core inventory across its portfolio with an average breakeven of $32/bbl. (Source: Shutterstock.com)

ConocoPhillips Lower 48 stands alone, which is, of course, the point.

As one of the largest U.S. independent E&Ps, its strategy has been to corner the shale market, with operations running from deep South Texas all the way to far North Dakota.

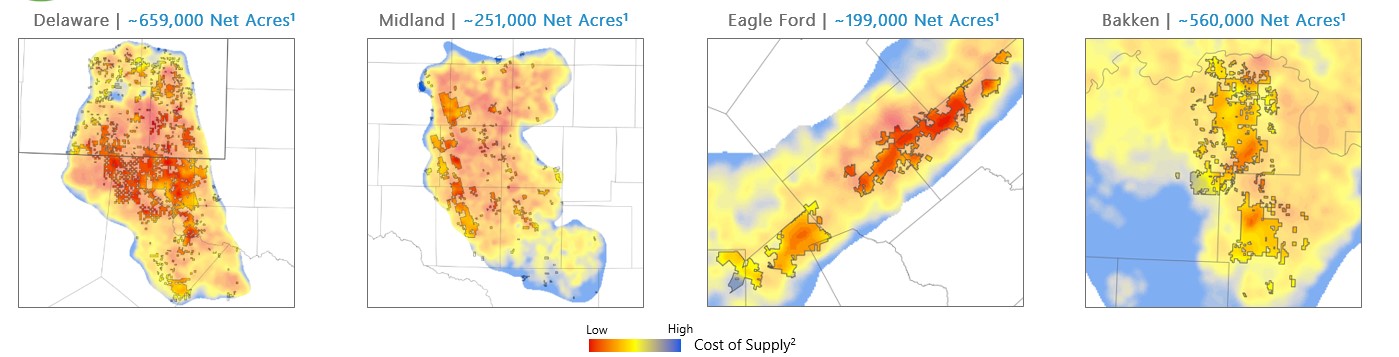

Along that meandering path, it has planted its flag in the core of each dominant oil play along the way: the Eagle Ford Shale, Delaware and Midland Basins and the Bakken.

Kirk Johnson, ConocoPhillips’ senior vice president of Lower 48 operations and assets, said the company is the only operator with top tier positions in the four premier oil basins in the continental U.S. The company has built a core inventory across its portfolio with an average breakeven of $32/bbl.

Johnson, speaking May 23 at Hart Energy’s SUPER DUG conference, described the portfolio as deep, durable and diverse.

“We've come to that position after a few pretty notable acquisitions just in the last couple years, which has put us in a position of having nearly 1.7 million net acres, specifically net unconventional acres,” he said.

"We’re not only the largest unconventional producer in the Lower 48. We also have the largest net operated inventory among our peers."

That’s headed off inventory problems that sent other companies competing for more drillable locations. Johnson noted that in the past six months to a year, a number of operators have been engaged in M&A for a reason.

“We've seen a number of acquisitions demonstrating that just in the last three months,” Johnson said. “And yet we would assert having more inventory is not enough, that inventory must be competitive.”

RELATED: Diamondback Energy Completes FireBird Acquisition for $1.75 Billion

Mature Bakken, Eagle Ford ‘invaluable’

Johnson pointed to ConocoPhillips’ holdings in the Permian Basin, which the company expects to throw off inordinate amounts of cash. ConocoPhillips’ positions in the Midland and Delaware are expected to generate $45 billion in free cash flow (FCF) over the next decade – at $60/bbl WTI.

Should the price move into the $80s, the company’s FCF will grow to $75 billion.

The more mature Bakken and Eagle Ford also plays a vital role for the company, and not from production that ConocoPhillips’ current inventory should sustain – across both assets – for the next 10 years.

“Those assets are invaluable to us” in other ways, Johnson said.

ConocoPhillips initial foray into the unconventional was in the Eagle Ford and Bakken and both continue to be areas where the company learns lessons through data analytics.

“We're exploiting those opportunities in the Bakken and customizing our completion designs through refracs in the Eagle Ford, where we’re seeing improvements on our recovery upwards of 65% recovery” compared to earlier designs.

“Those are just two examples of how we continue to exploit these more mature basins,” he said. “Not just in in their respective [areas] … but specifically across the four.”

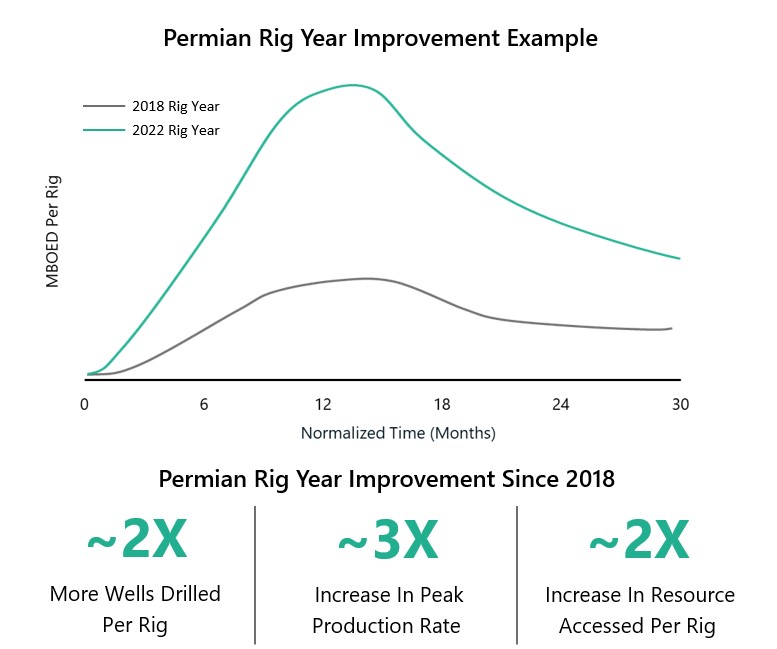

ConocoPhillips has improved its drilling efficiency by 75% in just the last five years, increasing completion efficiencies by 80% during the span.

Partly that’s been through experimentation and innovation in its more vintage plays.

“We do this through continual high-grading of our rigs brought to us by our providers and completions. We do this through simul-frac technologies…where we're actively fracturing a number of wells simultaneously,” he said. “This year, specifically, over 50% of our new drill inventory is using simul-frac. That's up 35% from last year. And we continue to look for opportunities to increase the way in which we can exploit these technologies such as simul-frac across our sector.”

Stretching laterals, meeting demand

The company is, like its peers, also drilling longer laterals–moving from one-mile lateral wells to two- and three-mile laterals, which Johnson said has improved its cost of supply by 30% to 40%.

In the Permian, “on a single rig point, we are actively drilling twice as many wells, we're accessing twice the resource and we're seeing production rates of 3x,” Johnson said. “I think [this] speaks to the collaboration, the technology, the innovation that exists for us today in this industry.”

As for demand, Johnson said ConocoPhillips sees oil and gas continuing to be a vital part of the supply mix for decades. He noted that the energy transition is not a true replacement, as the phrase suggests, but rather a series of additive fuels and energy supplies such as hydrogen, renewables and nuclear.

Even in moderate scenarios published by industry consultants, Johnson said there’s a “strong consensus” of growing demand of oil and gas over the next five years to 10 years. “Even in 2040, most of the moderate scenarios would say oil demand will be at least 75% of current levels,” Johnson said. “Now, again, that would probably be hotly contested…but 75% is still a material portion of our energy mix, which is not always what one infers from the word ‘transition.’”

Similarly, Johnson said he’s “quite bullish” on natural gas and LNG export growth.

At the same time, the company is working to reduce its emissions and be a more careful steward of land and water, noting that the company’s Permian Basin operations use “consistently upwards to 50% to 60% produced water in our hydraulic fracturing operations.”

The company has also made some notable improvements in greenhouse-gas intensity, which is down 50% and “very materially, our associated gas flaring in our operations across these four basins is down 80%.”

The industry is also realizing that chasing cleaner technologies, such as electrifying rigs, is also leading to improvements to production and the bottom line.

“Our absolutely safest rig is our most efficient rig,” he said.

And using clean design battery packs on rigs in the Eagle Ford has reduced gas and especially diesel consumption, which has lowered costs.

“We find that our pursuits with lowering emissions is also improving our larger business,” Johnson said.

Recommended Reading

Talos Buys Interests in Monument GoM Development

2024-08-13 - Talos Energy acquired a 21.4% interest in Monument in the U.S. Gulf of Mexico for $32 million in the second quarter. First production of up to 30,000 gross boe/d is expected by late 2026.

IOCs See Opportunity in Offshore Mexico, Despite Potential for Policy Changes

2024-08-14 - Five IOCs with offshore experience and capital—Eni, Harbour, Talos, Wintershall Dea and Woodside—continue to pursue promising opportunities offshore Mexico despite the country’s energy sovereignty push in favor of state-owned entities Pemex and CFE.

E&P Highlights: Sept. 9, 2024

2024-09-09 - Here’s a roundup of the latest E&P headlines, with Talos Energy announcing a new discovery and Trillion Energy achieving gas production from a revitalized field.

Genesis Energy: First Oil at GoM Field Pushed Back to 2Q 2025

2024-08-02 - Genesis Energy’s is awaiting a floating production vessel to connect its SYNC pipeline in the Gulf of Mexico to the delayed Shenandoah deepwater project.

Patterson-UTI Boosts Bottom Line with OFS Acquisitions

2024-08-06 - Less than a year out from the closing of its merger with NexTier and its acquisition of Ulterra Drilling Technologies, Patterson-UTI is taking strides not to be the latest has-been.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.