Chesapeake Energy President and CEO Nick Dell’Osso sees natural gas demand of at least 10 Bcf/d coming next year. (Source: Hart Energy)

Nick Dell’Osso broke it down: Beginning next year, there will be 10 Bcf/d of greater demand for U.S. natural gas.

The answer’s going to come first from the Haynesville Shale, secondly from the Permian Basin and then elsewhere — but not much from the Marcellus Shale, Chesapeake Energy Corp.’s president and CEO told Barclays CEO Energy-Power conference attendees on Sept. 6.

One of the world’s largest gas fields, the Marcellus is averaging some 35 Bcf/d currently and could produce more than 60 Bcf/d, according to industry estimates.

But “the Marcellus is a constrained basin,” Dell’Osso told Barclays managing director and E&P analyst Betty Jiang.

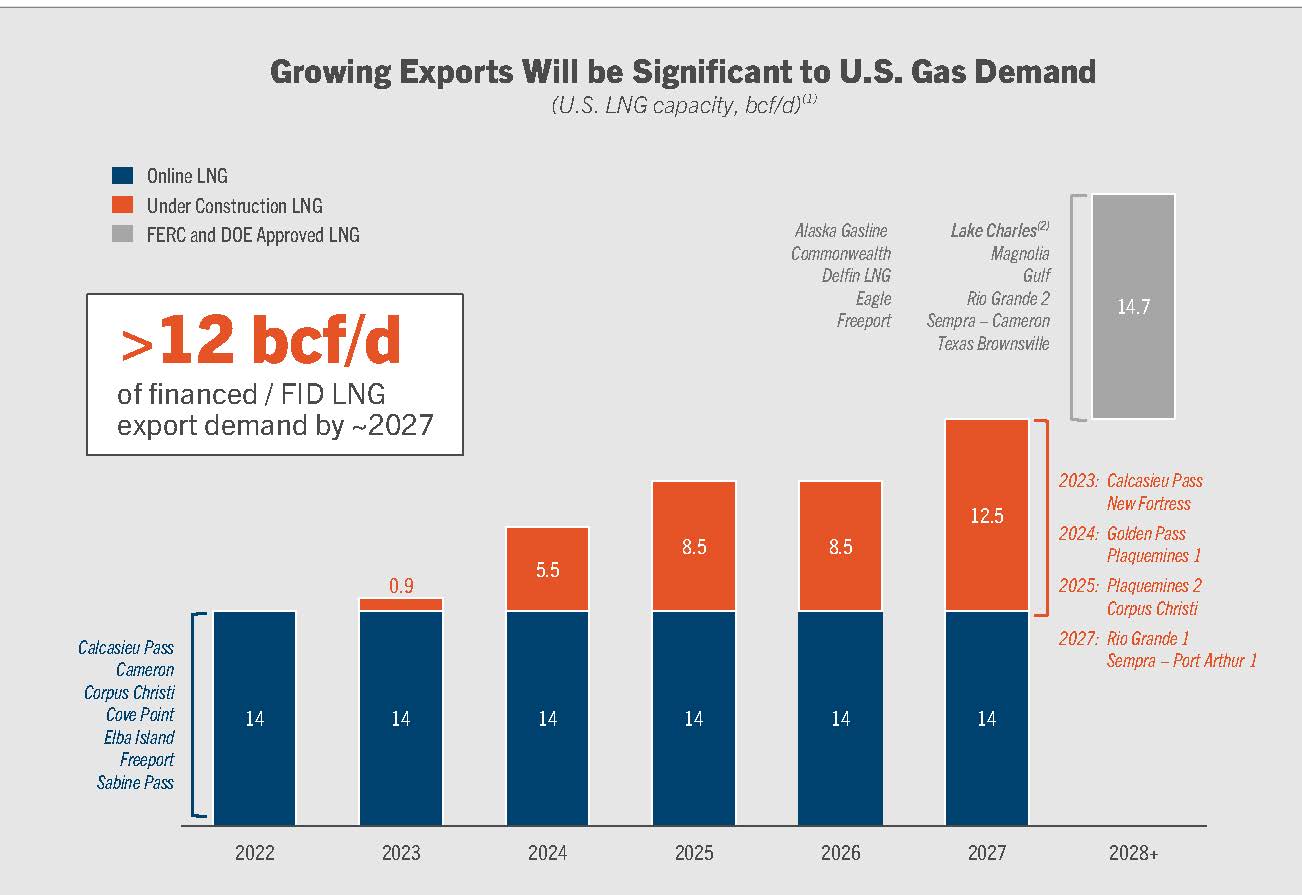

Meanwhile, 5.5 Bcf/d of additional LNG-export demand will come online on the U.S. Gulf Coast next year: Calcasieu Pass II and New Fortress. In 2025, an additional 8.5 Bcf/d call will begin at Golden Pass and Plaquemines 1.

U.S. gas futures are already anticipating the greater demand. The prompt-month contract for gas delivered to Henry Hub was $2.59/MMBtu on CME Group’s Nymex. In contango, the 12-month strip was $3.22.

Contracts for delivery after 2025 were trading at nearly $5.

“The forward curve is a good proxy for how the market is perceiving supply and demand,” Dell’Osso said. “But we watch those fundamentals a lot more closely than we do some ‘magic number’ in the forward curve.

“The forward curve—it can get separated from those underlying fundamentals.”

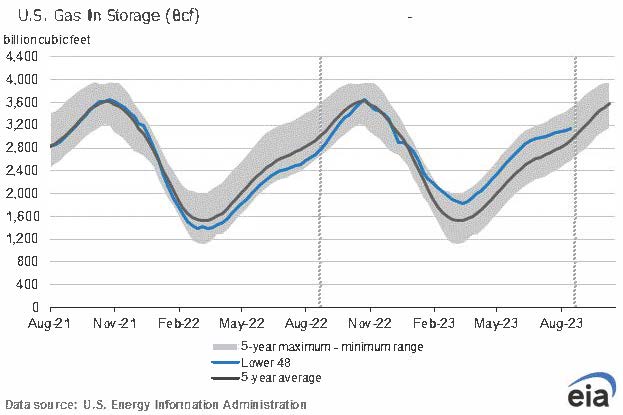

According to Energy Information Administration data, current U.S. gas storage oversupply of 500 Bcf—resulting from a half-Tcf of gas that Freeport LNG didn’t export while offline for eight months until February—is narrowing.

The overage in year-over-year storage remains, but an especially hot summer—while producers have been choking back on new drilling—has nearly flattened the refill season.

Bringing just 10 Bcf/d of additional LNG-export capacity online in the coming two years is an additional 10% call on current U.S. demand of some 100 Bcf/d, Dell’Osso said.

“That kind of growth is something that is a little bit hard to fathom when we think about how slowly the market [typically] moves over time. That growth in demand will change the underlying fundamentals of our industry pretty significantly.”

Answering the call will come “first, by the Haynesville; second, probably by the associated gas coming out of the Permian; and then after that, it’s going to pull harder to find gas in other places.”

As for the Marcellus, it needs the pipelines. “We don’t really have pipeline projects that are going to deliver large amounts of incremental volumes out of the Marcellus directly to feed that increased demand,” he said.

The Haynesville is adding pipe already, including big pipe by Williams Cos. And Momentum Midstream. Haynesville pipe to the Gulf Coast is intrastate, which is helpful in expediting new takeaway construction, Dell’Osso noted.

Meanwhile, as for how much more gas can exit the Permian, “just go look and see the pipes that are under construction,” Dell’Osso said. “That’s the cap. There can really not be any more than that.”

Chesapeake operates in both the Haynesville and Marcellus.

The problem with the U.S. gas market currently isn’t really that operators are producing too much. “While the market is oversupplied, it’s not oversupplied by a massive amount,” he said.

“When you think about us being a 100 Bcf/d to 102 Bcf/d market for natural gas in the U.S., we are probably around 1 to 1.5 Bcf/d oversupplied.”

Chesapeake and other gas drillers have been dropping rigs. The Haynesville count decreased to 44 in the Haynesville from 69 a year ago; and in Appalachia to 40 from 47 a year ago, according to the Baker Hughes rig count.

Recommended Reading

The Shape of M&A to Come: Is Devon Up Next to Join the Spree?

2024-05-31 - ConocoPhillips' recent $17.1 billion deal to acquire Marathon Oil came after the company missed out on buying CrownRock and Endeavor, two companies Devon Energy took a hard look at, Moelis’ Stephen Trauber said.

Permian Pulse: Franklin Mountain Stands Out Among Delaware M&A Targets

2024-06-04 - Franklin Mountain was a relative nobody when the company bid for Delaware Basin acreage in a 2018 BLM auction. Today, it’s one of the largest private U.S. oil producers and a major target for acquisition.

Beyond Permian? Breaking Down E&Ps’ Second Half M&A Prospects

2024-07-22 - From Permian Resources and Diamondback Energy to Matador Resources and Civitas Resources, analysts weigh in on upstream companies’ M&A mindset as second-quarter earnings season gets underway.

CEO: Devon Eyes 3-Mile Williston Wells With $5B Grayson Mill Deal

2024-07-08 - Devon Energy is digging deeper in the Williston Basin of North Dakota through a $5 billion deal with EnCap-backed Grayson Mill Energy.

WildFire Energy I Buys Apache’s Eagle Ford, Austin Chalk Assets

2024-05-21 - Private producer WildFire Energy I, backed by Warburg Pincus and Kayne Anderson, scooped up Apache’s portfolio in the eastern Eagle Ford and Austin Chalk plays.