The acquisition will create one of the largest private companies in the Permian Basin, with around 57,000 net acres, roughly 45,000 boe/d and 4 rigs running as of June 1, 2021. (Source: Hart Eenrgy)

Colgate Energy Partners III LLC has entered into a definitive agreement under which Colgate will acquire a majority of the assets owned by Luxe Energy LLC in an all-stock transaction, the company said June 2.

Luxe will continue to own and manage certain assets including a portion of the non-operated leasehold interests that are operated by MDC Reeves Energy LLC and its affiliates. Closing occurred simultaneously with signing of a definitive agreement on June 1, 2021.

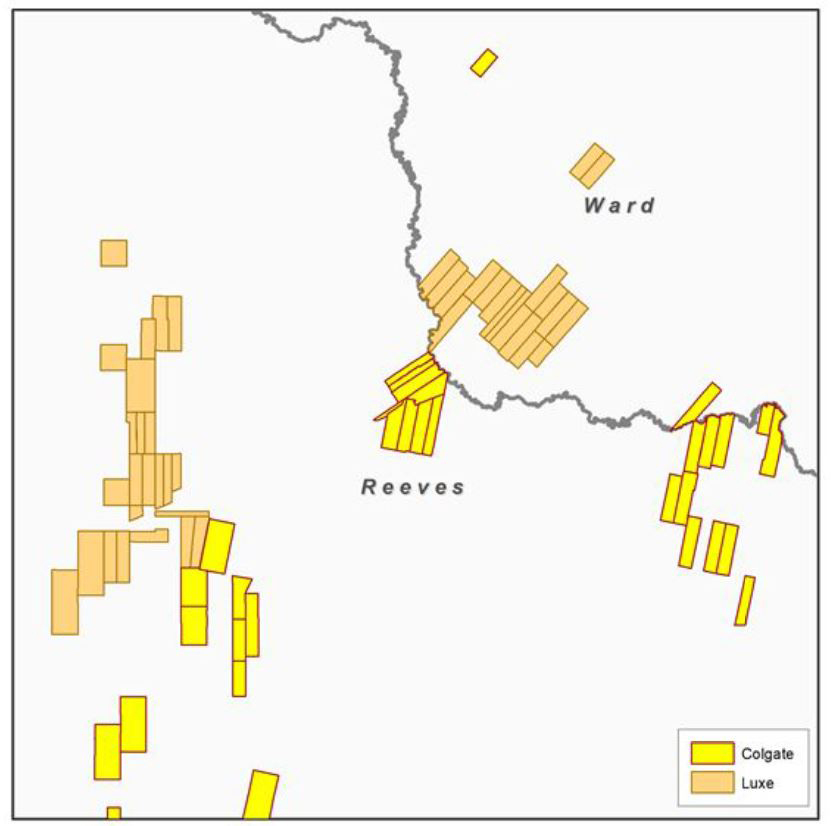

Pro Forma Acreage Map (TX Zoom-In) (Source: Business Wire)

Luxe currently holds roughly 22,000 net acres adjacent to Colgate’s existing position in Reeves and Ward Counties. The company has a net daily production of about 17,000 boe/d and roughly 5,000 gross surface acres that support go-forward development with 1 rig running focused on its existing Ward County position.

The acquisition will create one of the largest private companies in the Permian Basin, with around 57,000 net acres, roughly 45,000 boe/d and 4 rigs running as of June 1, 2021. The deal adds meaningful operational scale and synergies, which will build on Colgate’s track record of successful, low-cost execution and adds high-quality inventory directly offset Colgate’s successful legacy development in Reeves and Ward Counties.

“The acquisition of Luxe is a transformational event that positions Colgate as one of the largest private companies in the Permian. It allows both Colgate and Luxe stakeholders to take advantage of increased scale while generating substantial free cash flow. This transaction enhances our already best-in-class balance sheet and puts us in a position of strength as we look to opportunistically pursue further consolidation,” James Walter, co-CEO of Colgate, said.

Recommended Reading

Crescent Point Divests Non-core Saskatchewan Assets to Saturn Oil & Gas

2024-05-07 - Crescent Point Energy is divesting non-core assets to boost its portfolio for long-term sustainability and repay debt.

Permian Resources Adds More Delaware Basin Acreage

2024-05-07 - Permian Resources also reported its integration of Earthstone Energy’s assets is ahead of schedule and raised expected annual synergies from the deal.

Evolution Petroleum Sees Production Uplift from SCOOP/STACK Deals

2024-05-07 - Evolution Petroleum said the company added 300 gross undeveloped locations and more than a dozen DUCs.

Riley Exploration Permian Closes Delaware Basin Bolt-on

2024-05-08 - Riley Exploration Permian said it added 13,900 acres and up to 25 net locations in Eddy County, New Mexico.

CGG, Baker Hughes Sign MOU for CCS Projects

2024-05-08 - The memorandum of understanding between CGG and Baker Hughes will bring the companies’ complimentary skillsets together to explore carbon capture and sequestration solutions.