A new year, a new decade, but the sector faces lingering issues. The oil and gas business continues to confront low prices, abundant supplies/flat demand and ESG (environmental, social and governance) concerns.

But some industry observers turned optimistic as 2020 got underway.

“Pending further hostilities between the U.S. and Iran, or other geopolitical events around the world, it is not outside the realm of possibility that WTI [West Texas Intermediate] crude prices could hit $70 per barrel (bbl) based on three factors, Ryan Dusek, director in the commodity risk advisory group at Opportune LLP, said in a recent research report.

The factors he named were:

• Political risk—“The ever increasing U.S. sanctions may continue to escalate tensions and draw a more severe Iranian retaliation, forcing prices up to this expected level;”

• Hedge prices—“The futures market is quietly indicating this risk is only temporary. While WTI prices have increased nearly 30% since August, expected hedge prices have barely increased by 5% ... My analysis indicates that we need a minimum WTI price of $70/bbl to qualify as this extreme condition;” and

• Technicals—“With minimal changes to my long-term fundamental outlook, slowing demand and strong growth in U.S. supply will continue to dominate for the foreseeable future.

Feeling better

“We’re feeling much better going into 2020 than we have the past five years—and they have been along five years,” Becca Followill, senior managing director and head of equity research at U.S. Capital Advisors LLC, told clients as the year began.

“Beyond the obvious themes of slowing production and the follow-on impact to midstream, our key themes for 2020 are:

• A forced look at corporate governance;

• The need to check additional boxes;

• Eliminating traditional ‘MLP math’; and

• The resulting bifurcated multiples from those who don t adapt to a new reality.

“So what do we think works in 2020? 2019 was an easier call, as it was a bluechip rally kind of year. But those stocks have had a tremendous run, and we think investors are willing to move a little further up the risk spectrum in 2020,” she said.

A Wall Street willing to take a second look at the midstream—and oil and gas overall—would be great news as the buildout continues. Oil and gas production continues to climb, but growth has slowed. That might help the midstream catch up.

Followill isn’t alone in assessing promise in this year.

“2019 was another volatile year—though many parts of the value chain are moving in the right direction as we move further into 2020,” Raymond James said in the introduction to its annual midstream outlook. “After appreciating moderately through the first ~8 months of 2019, the benchmark Alerian MLP Index struggled from August to early December—and finished the year just slightly in the red (although the index generated a high single-digit total return).

“Despite a lukewarm market reaction, 2019 largely featured solid earnings and operating results; however, capital allocation, governance/alignment concerns, and upstream sensitivity (e.g., contract/counter-party risk and expected production/takeaway mismatches) dominated the narrative,” the outlook said.

The export game

It added a succinct forecast for midstream later in the report: “The game is all about exports.”

In recent years, it’s a game the U.S. has played well. DNV GL published an oil and gas industry research report early this year that refers to a “meteoric rise up the oil and gas exporter charts” by the U.S.

“A decade ago, the country had an oil-trade deficit of 12 million barrels a day (MMbbl/d) but, in September 2019, for the first time in over 70 years, the U.S. recorded a full month of oil exports exceeding imports. In 2020, U.S. oil exports are expected to grow once again, from 2.8 MMbbl/d currently, to 3.3 MMbbl/d, as new pipelines in Texas increase capacity.”

The midstream sector must deal with that challenge in this decade—something absolutely unthinkable as 2010 began. The whole wellhead-to customer flow has changed as who the “customer” is has changed.

The U.S. has emerged as a major exporter of crude oil and natural gas. Meanwhile, its role as a significant petroleum product supplier has grown.

Exports? It’s a nice problem to have, but how to handle the business?

A recent Stifel report referred to a worldwide “tectonic shift toward lighter hydrocarbons”—toward exactly what the U.S. has to offer to foreign customers, thanks to the light sweet crudes typical of the shale plays. Many industry observers believe the Jan. 1 mandate by the International Maritime Organization sharply restricting high-sulfur bunkers will further speed the trend.

[SIDEBAR]

Flaring's Finale?

Multiple NASA photos taken from the International Space Station feature strange bright spots popping out of the inky black nights in the otherwise empty Sahara, Arabian Peninsula and remote corners of North America.

They are flares, the energy industry's painful, no-other-choice answer to the lingering question: "What to do with the natural gas?"

The industry and royalty owners want the problem solved because flared gas equals lost revenue. Regulatory agencies don't like it. Now, financial markets' increasing emphasis on ESG—environmental, social and governance—issues has given an additional push to end flaring.

It's hardly a new problem. Participants in Oklahoma's early 20th century oil boom told how a pedestrian could easily walk the 10 miles of rough dirt road between Drumright and Cushing at night without a lantern. The constant string of flares, adjoining nearby wells or power houses, lit the countryside nicely. Think Times Square, the area had no as-gathering network at the time. Tellingly, Cushing already had emerged as a crude oil storage and pipeline hub.

Crude oil and the heavier gas liquids are preferred products, and without gathering systems, processing plants and pipelines needed to move the gas to market, there’s nothing to do but burn it. Even if there were sufficient midstream infrastructure, who wants the gas? In vacant parts of the planet, the answer is no one.

Advancing LNG technology and growing midstream infrastructure may be slowly solving the problem.

A recent Raymond James research report estimated the 4% of the world’s annual gas production burns away on flare stacks—wasted.

“At 14 Bcf/d [billion cubic feet per day], the amount of gas flared globally is almost on par with the gas production of China, and more than Saudi Arabia’s,” the report said. Or, roughly the entire daily gas production of the Permian Basin as 2019 ended, according to the U.S. Energy Information Administration.

“There is no overarching global regulation of flaring, but the World Bank is leading an initiative called Zero Routine Flaring (ZRF) by 2030,” the Raymond James study said. “This is in the broader context of United Nations climate talks … As of year-end 2019, 32 national and subnational governments have signed up, including 10 of the top 15 flaring countries …

“In aggregate, these 32 jurisdictions account for approximately 60% of global flaring. Each participating country has committed to eliminate flaring, with the exception of what may be required for safety reasons or under special circumstances, over the next decade. Participation in ZRF does not necessarily imply national legislation to ban flaring—for example, the U.S. has no such law at the federal level—but at least there is a publicly declared commitment.”

The trend could boost share prices for producers, midstream operators and the burgeoning LNG export business.

“However, investing on this specific premise would be rather tenuous; both the timetable and the magnitude of ESG score improvement are very difficult to quantify. In thinking about how to play this theme, therefore, we would steer investors towards the relevant technology providers,” Raymond James said.

But there’s a long ways to go to put all the pieces together, the report noted. “If it were automatically a ‘slam dunk,’ there would be no need for flaring” now.

—Paul Hart

Crude oil

The world’s political hotspots seem to oddly correspond with major oil fields with one significant exception—the U.S. Repeal of the crude export ban five years ago opened a new market to domestic producers, and that created the present challenge from midstream operators: How to get the oil to docks? New infrastructure had to go in harborside to move the product.

And so investment in new, outward-facing assets continues.

EPIC Midstream Holdings LP loaded its first cargo of crude as 2019 ended from a repurposed wharf on the Corpus Christi Ship Channel, refitted to handle oil rather than grain. It can handle Aframax tankers (750,000 bbl) at 20,000 bbl/hour.

The dock complements the company’s new 600,000 bbl/d crude pipeline that links the Permian and Eagle Ford plays to Corpus Christi.

The San Antonio-based operator plans to open a second, larger dock on the Corpus channel in the third quarter. It will be able to handle Suezmax tankers (1 million bbl) and load at 40,000 bbl/hour.

“A low-sulfur barrel is going to be a very attractive barrel, so demand is strong right now” for crude produced in the Permian Basin of West Texas and New Mexico, EPIC President Brian Freed told Reuters as 2019 ended. “There’s room for a lot of projects to get done.”

And EPIC plans to go lighter, further proof of that “tectonic shift.”

The firm plans to open a 900,000 bbl/d crude line in the first quarter and will begin offering a second, ultralight crude grade—West Texas Light—as it batches Permian Basin shipments. It rates above 44 API gravity, still lighter than the light 39.6 API gravity for WTI.

NGL

EPIC will complement its existing crude system during the first quarter with a 400,000 bbl/d pipeline dedicated to Y-grade (mixed NGL) service. The firm’s building a related separator at Robstown, Texas, outside Corpus Christi.

The largest gas liquids shipping points have been at Houston, Targa Resources Corp.’s Galena Park operation and Enterprise Products Partners LP’s operation—the largest of them all. It handled an average of 509,000 bbl/d in second-half 2019 following a major expansion.

Abundant gas liquids supplies create opportunities for NGL-based petrochemicals produced in the U.S. to move abroad. Enterprise, ranked No. 4 on this publication’s Midstream 50 list of the largest publicly held midstream players, started up a new isobutane dehydrogenation unit earlier this year at the big Mont Belvieu, Texas, NGL hub, east of Houston. Enterprise said the unit eventually will have a 25,000 bbl/d capacity, producing nearly 1 billion pounds per year of both high- and low-purity isobutylene—a feedstock for lubricants, rubber goods, alkylate for high-octane gasoline and methyl tertiary butyl ether.

Worth watching in the decade ahead: The push by some environmental groups to move U.S. regular-grade gasoline to a higher octane rating—in keeping with the standard in Europe—would require a substantial increase in alkylate production.

Cheaper, U.S.-produced ethane and other gas liquids have found growing markets overseas as feedstocks for polyethylene and polyproplyene, backing out naphtha.

In January, Enterprise and Navigator Holdings Ltd. announced the first cargo of ethylene had been  shipped from their 50:50 joint venture (JV) marine terminal located at Morgan’s Point, along the Houston Ship Channel. The Liberian-flagged Navigator Europa carried 25 million pounds of ethylene for Japan’s Marubeni Corp.

shipped from their 50:50 joint venture (JV) marine terminal located at Morgan’s Point, along the Houston Ship Channel. The Liberian-flagged Navigator Europa carried 25 million pounds of ethylene for Japan’s Marubeni Corp.

The new terminal features two docks and the capacity to load 2.2 billion pounds per year of ethylene. A refrigerated storage tank for 66 million pounds of ethylene is being built onsite and will increase the capability to load ethylene up to a rate of 2.2 million pounds per hour. Tank construction is expected to be completed in the fourth quarter.

Gassing up

The unconventional plays produce natural gas in abundance, leading to woeful domestic prices. The Permian Basin’s Waha Hub spent much of 2019 in negative price territory: Producers had to pay somebody to take methane off their hands. New gas pipeline capacity out of the Permian will be a priority for the next few years. Kevin Sakofs, senior analyst for North American natural gas for S&P Global Platts, told HartEnergy that activity levels across key dry gas plays have dropped precipitously since June 2019, and “this is largely due to a softening dry gas commodity backdrop.” Appalachia and the Permian have been particularly hard hit.

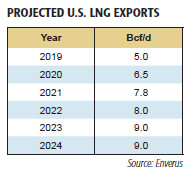

Adding to worries is a challenged global gas market and its potential impact on LNG exports, which Sakofs said is a critical component of the demand forecast. About 2.7 Bcf/d of additional liquefaction capacity is expected this year, pushing feed gas flow to terminals to new highs, the analysts said. However, market conditions could impact the growth.

“A lot is riding on Asia having a cold winter,” but it doesn’t have much storage. That means LNG molecules must flow elsewhere, Sakofs said, questioning whether Europe—which has high storage— could be the balancing mechanism again next year.

But how much worse would the situation be without exports? See adjoining stories in this issue for additional information on LNG exports.

Mexico’s midstream muddle

But not all gas exports must be liquefied. “The Mexican market is critically important to Permian producers,” RBN Energy said in a report published last year. “Rising gas demand south of the border …” is key to producers’ “plans to significantly increase production of crude oil, which brings with it large volumes of associated gas. All that gas needs a market, and nearby Mexico is a natural.” Mexico’s electricty provider, Comisión Federal de Electricidad, has worked to add multiple gas-fired power plants and the gas pipelines needed to support them.

The U.S. Energy Information Administration estimated gas exports to Mexico at 5.1 Bcf/d in late 2019—up 10% from year-earlier figures.

However, the Mexican gas market has not grown as quickly as Permian producers have hoped due to construction and regulatory slowdowns south of the border. “But what pipeline capacity has been added across the border from West Texas is already changing Mexico’s gas market,” RBN noted. “The El Encino Hub in Northwest Mexico is one such area where there are signs of a shifting supply-demand balance.”

Product possibilities

But wait, there’s more: The U.S. has a great story to tell about refined products. Some of the largest and most efficient refineries in the world can produce gasoline, diesel, etc., cheaper than smaller, dated plants overseas.

“U.S. net imports of crude oil and petroleum product fell from an average of 2.3 MMbbl/d in 2018 to an average of 0.5 MMbbl/d in 2019,” the U.S. Energy Information Administration (EIA) said in its January Short-Term Energy Outlook. “EIA estimates the United States has exported more total crude oil and petroleum products than it has imported since September [2019].

“EIA forecasts that the United States will be a net exporter of total crude oil and petroleum products by 0.8 MMbbl/d in 2020 and by 1.4 MMbbl/d in 2021.”

Entering the export business can be daunting. It’s, pardon the expression, a different world. One mistake newcomers make is to view the foreign market as a monolith, Kenneth Haynes, senior international trade specialist with the U.S. Department of Commerce, told Midstream Business. Nations’ policies and politics vary widely.

“Certain regions of the world are a little bit more problematic … the Middle East, certain countries in Africa, and some Central and South American countries, all pose unique and complex business and political climates. The U.S. Department of Commerce [and] U.S. Commercial Service is in place to assist U.S. companies with navigating some of those complexities,” he said.

Haynes cited one Latin American example.

“The new president of Brazil has moved the needle in regards to ease of access to the Brazilian market. Past complications have come in varied ways, from project approvals to the issuance of visas. As of September 2019, Brazil does not request a visa for entry and Brazil has adopted Global Entry. If you, as a U.S. company, have a Brazilian partner, Global Entry allows greater ease for your partner to visit your U.S. operations.

“Small- and medium-sized companies are who we primarily work with,” Haynes said of the U.S. Commerce Department and Commercial Service. “Unfortunately, not all companies have the expertise to go abroad on their own. U.S. Commercial Service has foreign contacts that can be of great assistance,” he added.

“If you’re a small- to medium-sized company, I would say one of the best things you can do is to do a joint venture, either with a large U.S. company that’s going into that particular market or with an international company. We can assist you with that.”

[SIDEBAR]

Operator Looks To Lift Helium Sales

Perhaps the most valuable export produced by the U.S. oil and gas business isn’t oil or gas. Rather, it’s helium, that ultralight, inert gas vital to products ranging from party balloons to MRI scanners to nuclear bombs.

Helium prices routinely float well above $100 per thousand cubic feet. Yes, you read that number right.

There’s just not much of it on earth, but the largest commercial source lies in natural gas fields below the Texas and Oklahoma panhandles, extending to western Kansas and eastern Colorado. The region’s Hugoton Field has been the largest helium souce for decades but is in steady decline.

Tumbleweed Midstream LLC recently acquired the Ladder Creek helium plant in eastern Colorado from DCP Midstream LP in hopes of cashing in on strong helium demand here and abroad.

“The U.S. is the world’s largest helium producer,” Durell Johnson, Tumbleweed CEO, told Midstream Business. “At the same time, the world supply of helium is suffering from a multiyear shortfall. This has boosted prices for natural gas with a high helium content and has begun to raise red flags in industries that depend on helium.

“The helium is there; it’s highly valuable, and by extracting it Tumbleweed can return premium netbacks to the producers in the region,” Johnson added. Some fields feeding the plant have 3% helium concentrations—among the highest anywhere.

Ladder Creek has a capacity to process 40 million cubic feet of natural gas per day (MMcf/d), expandable to 50 MMcf/d. From that stream, it can extract as much as 1.5 MMcf/d of helium.

Some 730 miles of gathering lines either side of the Colorado/Kansas border support Ladder Creek. The plant’s NGL production flows to the Conway, Kan., fractionator via a DCP pipeline.

—Paul Hart

Regulatory changes

But JVs have their own complications, thanks to recent changes in federal law. A number of new federal regulations on exporting took effect in February, Robert Soza Jr., partner with Jackson Walker LLP and an oil and gas export law specialist, told Midstream Business. The Treasury Department issued regulations implementing the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA). The greater impact will be in such areas as restrictions on upstream technology, Soza said.

“There are a number of oil and gas installations that are covered there,” he said. Specifically, “individual refiners with the capacity to produce 300,000 or more barrels per day of refined product, or the capacity to produce in aggregate 500,000 or more barrels per day of refined oil and gas products.

“Also, storage facilities that have the capacity to hold 30 MMbbl or more, and it covers all the LNG export areas.” The regulations “also cover interstate rural pipelines that have the capacity to transport 500,000 bbl/d or more of crude, or 90 million gallons per day or more refined product. Also, current pipelines with an outside diameter of 20 or more inches.

“So, if you’re one of these facilities as listed here, and you have someone who’s going to become a foreign investor, you have to really be careful about how you’re going to structure that foreign investment,” Soza added.

“Because that foreign investment allows the investor—the foreign investor—to have access to nonpublic technical information, either because they get a seat on the board, or because they have a right to it pursuant to due diligence, or they have a right to involve themselves in substantial decision making with the company.

“You’re going to have to file one of these Committee on Foreign Investment in the United States (CFIUS) disclosures. You’re going to have to go through the CFIUS process, which could take somewhere in the neighborhood of anywhere from three to six months. So this could cause some delays in some of your deals that you do in this area.”

He added the procedure has created “a Hart-Scott-Rodino-type of approval process for foreign investment that was going to be more focused on national security.”

There’s room for growth in the new decade, and early-2020 political trends make export opportunities even more important. As noted earlier, the Mideast’s lingering political instability makes the U.S. an attractive supplier to wary energy customers. Also, a prospective settlement to the U.S.-China trade dispute looks promising, even as the coronavirus scare upsets world trade. The first phase of a deal calls for China to increase U.S. energy imports above 2017 levels.

“Larger purchases of U.S. crude oil exports will be the primary method for China to comply with this agreement,” Ann-Louise Hittle, vice president-macro oils at Wood Mackenzie, said in statement after the two nations announced the deal. But meeting that multibillion-dollar target is going to be challenging. Hittle noted China imported about 300,000 bbl/d of U.S. crude oil in 2017, valued at $5.8 billion, she said.

Velda Addison contributed to this report.

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.