The first well on Bruin’s Anderson pad (pictured) flowed more than 6,000 boe/d on a 24-hour IP. (Source: Bruin E&P Partners/Shutterstock.com)

[Editor's note: A version of this story appears in the November 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Matt Steele has an affinity for the Bakken Shale. In 2008—at 30 years old—he started Ursa Resources Group LLC (Latin for “bear”) and built a 120,000-acre position that he sold in multiple transactions by 2011, generating a three times multiple on investment and 100% internal rate of return. In 2015, he formed Bruin E&P Partners LLC (continuing the bear theme) and returned to the Bakken.

Following two smallish deals in 2016, Bruin landed 104,000 net acres in the heart of the play from Halcón Resources Corp. (NYSE: HK) in 2017 for an eye-opening $1.4 billion in cash. The deal was backed by Arclight Capital Partners LLC.

“It was a petroleum system that we understood inside and out,” Steele told Oil and Gas Investor. “At that point in time, a lot of capital had fled the Bakken. It was an opportunity we couldn’t pass up.”

The deal stands out as a prominent wedge in a basin that is otherwise locked-up by large operators—and at the core of the play, no less. The deal was Steele’s third under the Bruin shingle and by far the largest.

His oil and gas journey began at Shell E&P Co. Inc. where he worked South Texas assets, then with Southwestern Energy Co. (NYSE: SWN) on its Fayetteville Shale project. After a stint independently generating prospects, he formed the first Ursa.

Following the sale of Ursa I, he built and sold an oil position in the East Texas Eagle Ford as Ursa II and also built a Rockies gas position in the Piceance Basin. While Ursa II continues to operate and grow its Piceance position under the leadership of Steve Skinner, a founding partner with Steele, Steele separated the oil team in 2015, forming Bruin with new capital from ArcLight to pursue oil opportunities.

“I’m still a shareholder. I root for Ursa every day,” he said.

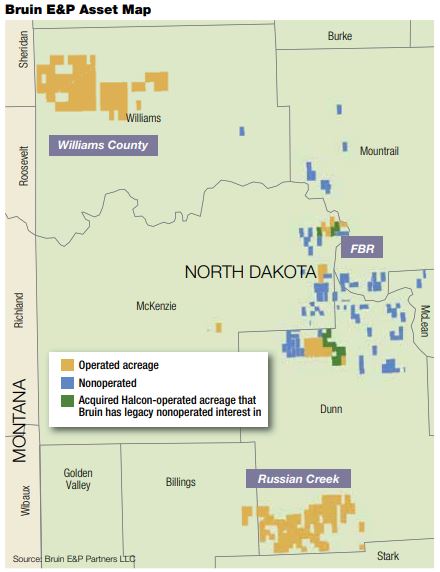

Bruin’s portfolio today features 160,000 net acres, all Bakken and Three Forks focused. The core of the position, 30,000 net acres, in Mackenzie, Mountrail and Dunn counties in North Dakota on the Fort Berthold Indian Reservation.

Bruin also holds another 70,000 net acres northwest in Williams County and 60,000 net acres south in southern Dunn in an area known as Russian Creek. The Houston-based E&P operates 400 gross wells and produces 40,000 net barrels of oil equivalent per day. It has two rigs running.

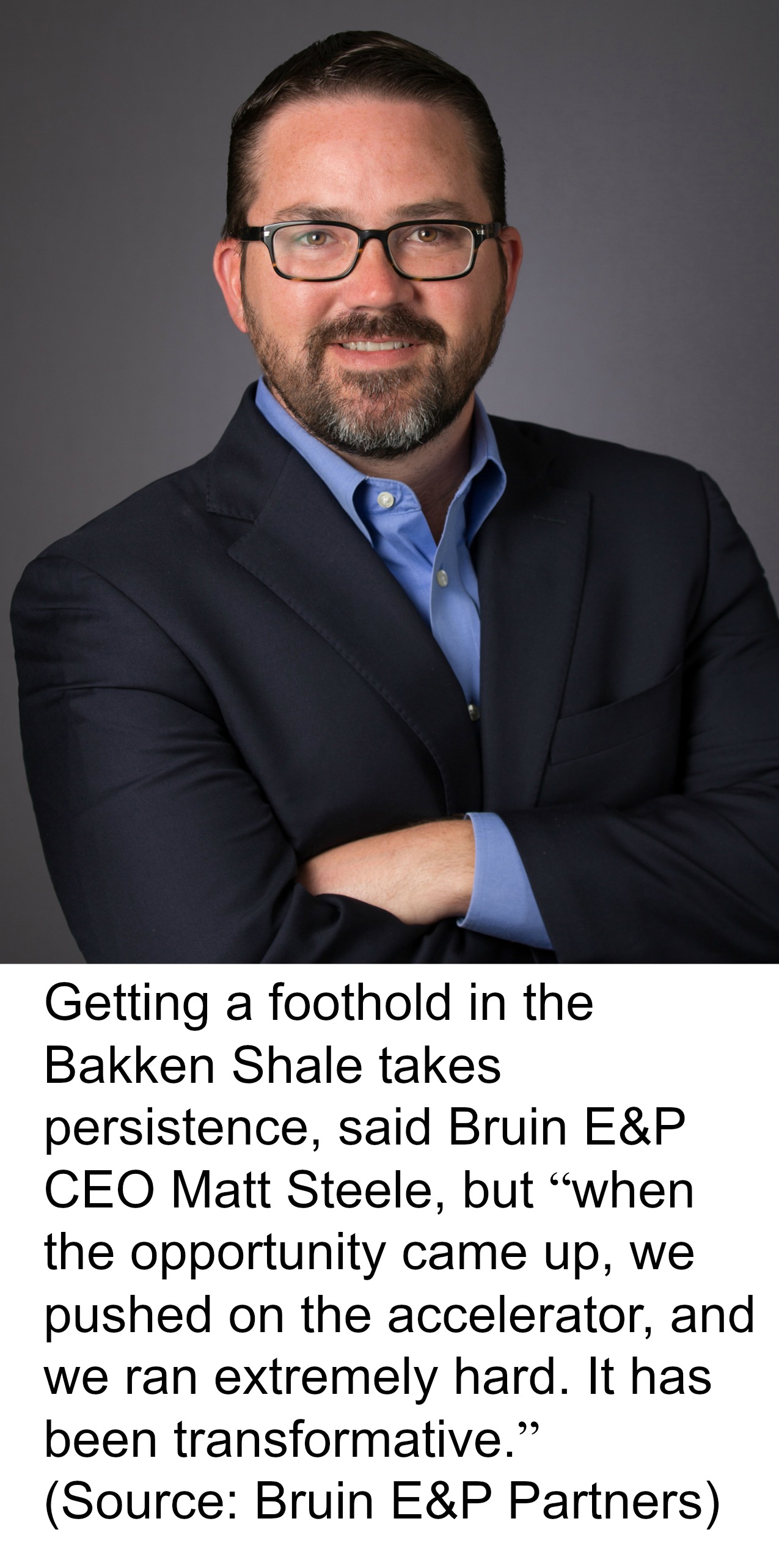

Investor: With the Bakken being such an established play, how did you get a foothold?

Steele: The state of North Dakota did a great job of unitizing the Bakken. That allowed a lot of acreage to be held very quickly. One well in a 1,280 (acre unit) holds it. So most of the acreage that you’d want in the Bakken is HBP.

The way you get into the Bakken is persistence. You identify where you want to be, and then you start hounding folks--making calls every day, making unsolicited approaches, making offers, being told “no”—a lot—and handling rejection well. That’s how you get into the Bakken. We made a ton of offers before we got any traction.

The first deal we got traction on was a nonoperated position from Enerplus (Corp.) in December 2016. We bought that position because we knew we wanted to be in the core of the reservation. As working-interest partners, that gave us access to nonpublic data from 14 operators on the reservation, which allowed us to ask a lot of questions, learn very quickly and identify further acquisition targets out there.

Almost commensurate with that, we took out a small piece from Lime Rock (Resources) that we call Russian Creek in southern Dunn County. That was an operated asset. That allowed us to get back up in the basin and establish a presence, get moving with operations, open an office and get key staff in place to do something larger.

Investor: How did the deal with Halcón come about?

Steele: We had our focus on the reservation. We knew we wanted to acquire assets on the reservation, and Halcón fit the bill perfectly.

I badgered (Halcón executive vice president) Steve Herod for the better part of a year and a half. I wasn’t necessarily looking at the whole thing. I said, “Hey, would you sell me a piece here or there?” Steve would always say, “It’s not for sale, and, if it were, we’d be in a public process.”

As time progressed we heard whispers that they may be considering a sale. Halcón had hired an advisor for a potential Bakken divestiture, and we just happened to be badgering them at the same time. Things moved very quickly.

It helped that half of our nonop acquired from Enerplus was already under Halcón, so we had analysis on their full position on the reservation. We had a model already built that we had QC’d (quality controlled) with our capital partners. We had a pretty good idea of what we wanted to do with Halcón’s assets and what we’d pay, but, when the opportunity came up, we pushed on the accelerator, and we ran extremely hard. It has been transformative to Bruin.

Investor: Was it competitive? Did you have to overpay for it?

Steele: We paid $1.4 billion—that’s a lot of money. At the time, this was an asset that, on any given day, was producing 25,000 to 30,000 net barrels equivalent per day. We saw the opportunity for completion uplift, which I don’t think was widely appreciated, even then. Completions were getting bigger, and we were seeing some early results on the reservation that were outstanding.

The way we’d look at any deal, we’d have to have returns that are appropriate for us and investors. We have to be able to create value. You don’t create value by going out and buying something and hoping on oil price. You create value through technical and operational excellence.

So we saw an opportunity, and we were thrilled with what we paid for it. I know Halcón was thrilled to get it. I have been told several times that I overpaid for it, and, if that’s overpaying, then I’m happy to do it with everybody else in the basin. As we sit here today, I’m still thrilled to have that asset.

Investor: How were you able to pull off such a large acquisition?

Steele: Arclight’s been extremely supportive of Bruin, and they had a desire to get more exposure in the E&P space. Obviously, you have to have a relationship before somebody’s willing to fund a private-equity team without assets, and we had a good foundation.

The period from September 2015 to November 2016, we looked at in excess of 150 potential transactions. We’re always very disciplined in the way we look at things. We tend not to play in publicly marketed processes. We tend to hit people with one-off unsolicited offers, and we get told “no” a lot. The good thing about participating in a public process every now and again is, if it transacts, you get to see what happened, and you get to see how you comp to what was paid. Generally, we run 60% to 75% of what cleared the market. When you go through a bunch of those with your board, they gain comfort that you’re looking at things prudently—that you’re aligned with the capital, that you’re making decisions together in the most appropriate fashion.

So, when you get to one that’s actionable, everybody’s singing from the same hymnal. It’s easy to move quickly. It’s through building trust and spending a lot of time together, that you’re able to move like that. When it presented itself, they were ready, we were ready, and the rest is history.

Investor: Why did you believe that a private, Bakken pure-play company could compete in the middle of a playing field with established, large public E&Ps?

Steele: In the Bakken, at that point in time, we saw a bird’s nest on the ground. Completion technology had not deployed appropriately in the Bakken. With 15,000 wells in the ground, why is that? Well, it’s because the Bakken was such an exceptional petroleum system that you could drill 10,000 feet down, 10,000 feet sideways, put in 200 to 500 pounds per foot of stimulation and get good results. You could make a half-million-barrel (EUR) well.

In pre-2014 when oil prices were 80, 90, 100 bucks a barrel, you could make money all day long doing that. There wasn’t a lot of impetus on the operator’s side to push the envelope when it came to completion technology. Compare and contrast that to other plays like the Permian. The Bakken was just status quo, so we saw that as a huge opportunity.

Investor: So you see the Bakken as currently understimulated?

Steele: Completions have ramped over the years. Most of the folks in the basin now are pumping 800 to 1,200 pounds per foot. Our standard stimulation right now is about 1,500 pounds per foot with 1,200 gallons per foot of fluid. So we’re pumping rather large jobs, in the context of historical completions in the Bakken, but still not on par with some of the other plays in North America.

We’ve made great strides in the Bakken, but I don’t think we’re necessarily there yet.

Investor: How far do you plan to push your completions?

Steele: We do have some tests that are up to 2,000 pounds per foot. We start off with some 100-mesh (sand) and then tail in with larger-size volumes, but, overall, sand is sand. We’ll see how those go. We’ve been very happy with our 1,500-pound-per-foot recipe.

Investor: What kind of results are you getting?

Steele: The first opportunity in which we were able to come in and do a true Bruin drilling and completion design is on the Longs pad. That is in the central area of the Fort Berthold Indian Reservation. We drilled the six-well pad out there and brought those wells on at the end of May, early June.

We’re very proud of those completions. We executed those wells with 55 stages on 10,000-foot laterals, six clusters per stage. We really engineered those completions, and we’re seeing results that are, frankly, better than our bigger offset-operator competitors.

We’ve got several wells that have produced 100,000 barrels of oil in the first month. I’m not talking in equivalent; I’m talking straight up oil. We’re about 80% oil, 10% NGL, 10% natural gas. I think that puts it on par as the best in North America. We’re happy with that result. Can we do better? I think probably so, and we’re testing that now.

The follow-up pad to the Longs is the Anderson pad. The 24-hour IP for the Anderson 16H is 5,058 barrels of oil and 5.7 million cubic feet of gas on a 48/64 choke. On a boe basis, that would put us at 6,020 (24-hour IP). That’s an example of the type of wells that I’m putting down. From an IP basis, we do pretty well.

Bruin E&P’s Longs pad on the Fort Berthold Indian Reservation (pictured) is the company’s first set of wells using its own completion design, matching the industry’s best results in the play. (Source: Bruin E&P Partners)

Investor: What about EUR?

Steele: Well north of a million barrels.

Investor: What impact is technology having on the Bakken?

Steele: A lot of folks are beginning to—more and more—buy into big data and data analytics. We actually have an expert statistician on staff. We do a lot of data analysis internally. That’s why I say we’re not yet optimized on our completions. We’ve made the best stab at completions with our current recipe, but we’re analyzing data every day, making tweaks, making changes.

We also have outside firms that we utilize to do some analytics for us, and they’re bolstering our efforts every day. It’s something that we think is important.

Investor: Is it changing the game for Bruin?

Steele: It’s a big part of how we’re formulating our completions. How do you identify trends? How do you identify areas where you improve upon predecessor operations? Analyze the data; get in the weeds.

When you go back five or 10 years, you had a bunch of engineers like me with Excel open, looking for linear trends upward and to the right. We’re now quantum leaps ahead of that as far as mathematical analysis of data. More and more people are beginning to understand that they can do more with their data.

Investor: Do you feel compelled to use the analytics to gain an edge?

Steele: It helps you gain an edge as a private company. It can only make us better. The way you optimize a system is to do a bunch of heavy lifting and understand what your previous actions are telling you about the future.

We didn’t make up the 1,500 pounds per foot. We didn’t just go out and say, “It feels good.” There was a ton of work that was done to pull it together to say, “This is our best step for this acreage. Now, let’s put it in the ground and back-check our models and see if what we get is compared to what we thought we’d get.” That’s happening right now. Our models are being tweaked every day. Our understanding is growing every day.

Frankly, if you want to look at results, the proof is in the pudding, right? If I look out into the space of every well that’s been drilled in the Bakken and Three Forks ever—in the history of the basin—I’ve got the two best wells that have ever been drilled on a 30-day, cumulative basis. I’m happy with that, but we can do better and still optimize it.

Bruin’s portfolio features 30,000 net operated acres in McKenzie and Mountrail counties, with upside in another 130,000 net operated acres in Williams and Dunn counties.

Investor: Why did you tap the high-yield bond market this summer, and how are you using the proceeds?

Steele: We’re in a better place as a company because of that. It’s $600 million of notes at 8 7/8% and a five-year non-call. Is it the best in the market? No. Will we do better in the future? Yes.

We saw the market open up for E&Ps earlier this year. We had a $300-million, second-lien, term loan associated with our acquisition of Halcón (assets) that was a higher-priced piece of paper, although we got a fair price when we did it. We paid down that debt. In addition to that, we were also able to make a dividend to our capital providers.

Both of those are important. And we now have access to the bond market, which could come into play for future acquisitions or other purposes along those lines.

It also clears a lot of the initial hurdles as far as audits and other things that you need to do—associated with the high-yield bond offering--for a potential IPO in the future, should we decide to go that route. It really starts to get our company more public-ready than we would have been prior to the offering.

Investor: Would you have the scale to IPO?

Steele: We’re preparing for that option. We’ve got 40,000 barrels equivalent net per day and 10-plus years of inventory to drill up there. I think we’ve got all the earmarks of a public company. Oh, and by the way, we’re free-cash-flow positive, and the wells that we’re drilling are highly economic. We’re talking rates of return in excess of 80%. I think that checks a lot of boxes that even a bunch of current public companies don’t have checked.

Investor: Did you ever imagine when you started this business that you would do a $1 billion-plus acquisition?

Steele: No. I remember when we got started thinking that raising $100,000 or $200,000 to test a little Frio bump was a significant achievement. It’s mind-boggling really. We’ve got a great team, we’ve got great partners, and we’re more than capable. It’s just that the numbers get bigger and bigger.

Investor: Are there more acquisitions to come? Any opportunities left?

Steele: We’re looking at acquisitions every single day. Again, we’re here to create value. If there is a compelling opportunity, and it’s accretive to our business, we’re going to chase it.

Investor: What’s your plan going into 2019?

Steele: Right now, we’re growing production. We’ll grow production on the order of 25% next year. So we’ll be at 50,000 (boe/d) net next year. At the same time, we’re free-cash-flow positive. I know that’s becoming more en vogue in the E&P universe, but we’re actually doing it on a day-to-day basis.

That allows us to pay down debt and make dividends to our investors.

We really don’t have to do anything more than that. It’s just blocking and tackling, focusing on technical and operational excellence, growing production, growing free cash flow. We’re well hedged. We’re 99% held by production. We don’t have to go out and drill anything to do anything spectacular. I continually get asked about exit. “If you’re a private-equity-backed company, what are you going to do to exit?” Well, this is a unique position: I don’t have to. I can generate sufficient returns for everybody involved just executing a simple plan. Run two rigs and drill her out.

Investor: Will you run rigs on your southern or northern positions this year?

Steele: We do have plans to potentially move on up to Williams County. That area has really come up, with what Kraken Oil & Gas (LLC) has done there. Bruce Larsen (Kraken CEO) happens to be one of my former partners at Ursa and one of my good friends. He’s done wonders to that acreage up there to turn it from ram pasture into core (Bakken property)—or “core light.” So, we’re going to move one of our two rigs up to Williams for a period of time to further delineate Bruin acreage there in the near term.

I look at the Russian Creek asset as upside in our portfolio. There hasn’t been a modern completion in the area. It’s currently outside the core, but it will get better over time. It’s something that we are investigating right now.

We have drilled a well in Russian Creek called the Sadowsky (14-11-2H) well, and I’m not talking about it. Somebody will have to buy the company to learn about that well. It’s early. It’s an exploration step out. We’ve got about two months production on it and ... we’ll see. (The well was scheduled at press time to come off state confidential status on Nov. 25.)

Investor: Over the years, have any particular words of wisdom shaped your philosophy in how you run your business or your life?

Steele: I did some deals early on with (the late) Ken Peak (founder of Contango Oil & Gas Co.). He was instrumental in allowing me to be in this business in a more independent fashion. Ken used to look at me and say, “Matt, it’s a pretty simple business. You need to get production up and cost down. You need to concentrate on things like unit margin and return to shareholders.” He said, “In the end, I want Contango to have one share, and I want it to be mine.”

He was constantly looking at returning value to shareholders—running a free-cash-flow positive business, running an E&P business like a real business, rather than just growing production and generating NAV and never producing any cash. His concentration on value creation was extremely important to me. It’s something that I still think about every day.

There’s a slide at the end of every single presentation that goes to our board and every presentation that I show to our staff. It says, “At Bruin, we are here to create value for everyone involved in the system.” Our shareholders, our employees, our lessors and our communities in which we live and work—we’re here to do it in a responsible manner. You can only do it one way, which is the right way. From a business standpoint, that is something that continues to stick with me to this day.

Steven Toon can be reached at stoon@hartenergy.com.

Recommended Reading

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-26 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

US Rig Count Makes Biggest Monthly Jump Since November 2022

2024-07-26 - The oil and gas rig count, an early indicator of future output, rose by three to 589 in the week to July 26.

BP and NGC Sign E&P Deal for Offshore Venezuelan Cocuina Field

2024-07-26 - BP and NGC signed a 20-year agreement to develop Venezuela’s Cocuina offshore gas field, part of the Manakin-Cocuina cross border maritime field between Venezuela and Trinidad and Tobago.

Nabors’ High-spec Rigs Help Keep Lower 48 Revenue Stable in 2Q

2024-07-25 - Nabors’ second quarter EBITDA was down 1% quarter-over-quarter but the company sees signs of increased drilling activity in international markets the second half of the year.

EOG: Utica Oil Can ‘Compete with the Best Plays in America’

2024-05-09 - Oil per lateral foot in the Utica is as good as top Permian wells, EOG Resources told analysts May 3 as the company is taking the play to three-mile laterals and longer.