Presented by:

Editor's note: This article appears in the E&P newsletter. Subscribe here.

Amid the trends circulating around the oil and gas industry, companies recovering from market setbacks in 2020 are searching for ways to cut costs and emissions. Operators are relying on the service community to take on some of that competence and experience themselves, according to David Carr, Helix Energy’s senior vice president of international development.

“A lot of major projects that have come online in the last few years have been particularly prolific subsea wells, which I think just goes to show just how much in a prolonged period without intervention has affected some of the more mature wells that are out there,” Carr said.

“What we’ve seen during this pandemic period is that trend toward more renewable spend just [at an] accelerating pace, so all the big major European majors have pronounced their intentions to move further into the renewal space.”

During SPE’s recent “Tech Talks: Subsea Services Alliance” webinar, Matthew Billingham, technology director of mechanical intervention with Schlumberger Ltd., and Phillip Rice, sales and commercial manager with OneSubsea, a Schlumberger company, joined Carr to discuss current trends in the oil and gas industry as well as their companies’ alliance and the technologies they use.

“We’ve seen the price of oil literally double in the past 12 months, but we’ve not seen the usual return to an increase of drilling certainly not at the sort of scale we previously would have thought,” Carr said.

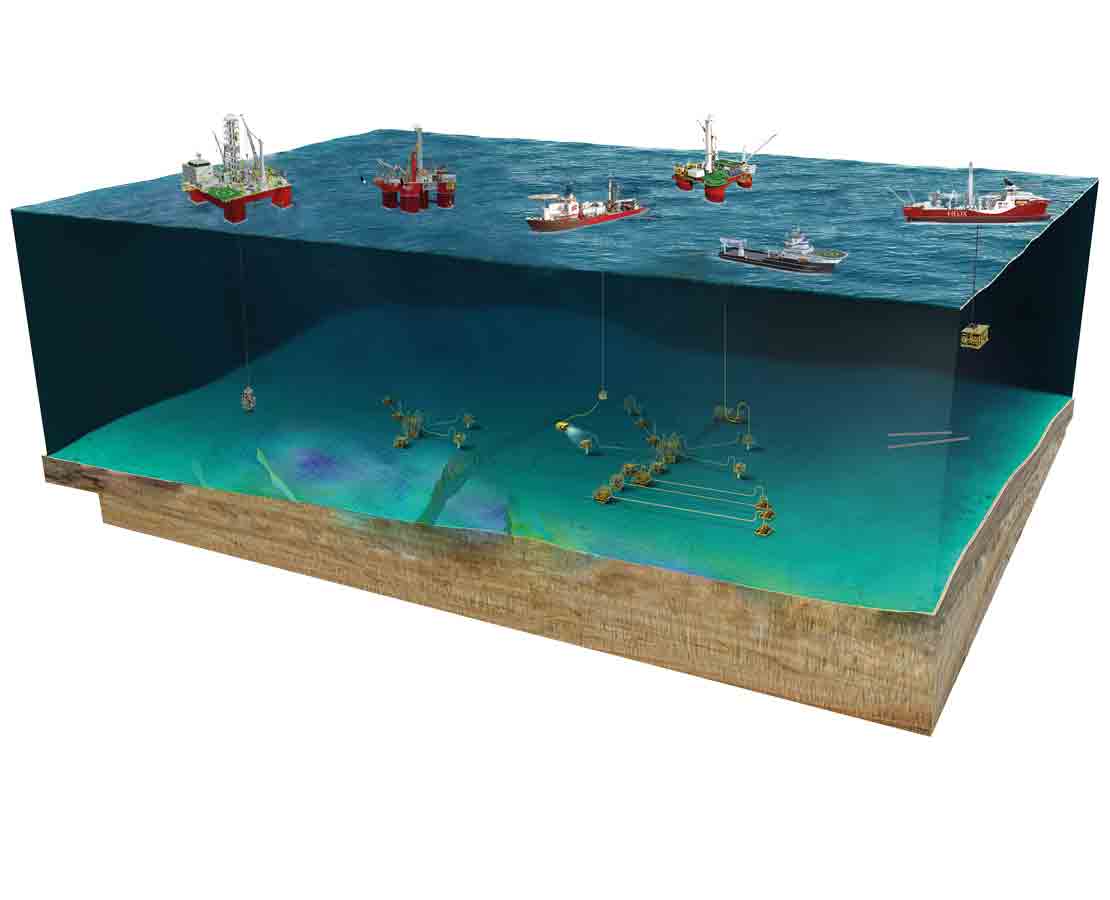

Founded in 2015, the Subsea Services Alliance is a union formed between Helix, Schlumberger and OneSubsea to create an integrated package that delivers the three verticals needed for subsea well intervention at a lower cost.

“A lot of people recognize the value of integration and the potential of a more customer-centric risk-reward commercial model. This is really putting your money where your mouth is and doing it,” Rice said. “Now having done it a few times over a few years, there’s perhaps still a ways to go, and that’s where we’re open to discuss and engage with our customers. Because the interventions are clearly out there, and the assets and the capability have come a long way.”

“We certainly like to think of ourselves as green proactive in this space,” Carr added. “Bringing the experiences of all three companies together, putting it all into an integrated package allowed us to do a number of things. One of the key ones there is that by cross training personnel across Schlumberger, Helix and OneSubsea, we were able to reduce the POB [personnel on board], which has a significant impact on safety. It has a huge intangible effect on the competency and skill of the crew aboard.”

As the Subsea Services Alliance aids clients in getting the materials they need, it requires specific advances in technology to accomplish its goals. According to Rice, the four main well access systems they use are riser-based systems, riserless systems, open water technologies and open water related to abandonment and decommissioning.

“We have this fit-for-purpose mentality these days where you’ve got to look at the requirements of the operation to understand what is it you’re trying to achieve, what are the possible outcomes, what are the contingencies,” Rice said. “So if you know you need to go and do some diagnostics and gather data, that might define a certain tool set that you require.” In addition to these technologies, Billingham stressed the importance of electric wireline mechanical intervention tools as the industry has seen “a great growth in powered intervention tools.”

“Having a full range of diagnostic and surveillance tools to help that decision-making process is so important, and then to be able to actually go in and do the intervention to resolve the issue that maybe is being seen if we’re trying to actually handle a production bottleneck or water and well-integrity issue,” Billingham said. “No one thought 15 years ago that we would do things such as mill completion accessories on wireline, but we’re doing that today. It’s opening up the possibilities with technology of what can be done from these vessels as such.”

In the wake of the pandemic, operators and investors face a lot of uncertainty. Many worry that their progress in intervention will be undone, but Billingham has a more optimistic outlook. “We’re a very cyclical industry. I think we’ve been through such an enormous amount of change, with what happened with the pandemic where we had to manage things differently, but I think also as we see this emphasis in certain areas very much to the energy transition,” Billingham said. “I think we’re in a better position than we ever have been, and I think that operators are definitely going to see that intervention-based production is a very valuable part of their asset base.”

Recommended Reading

OTC: E&Ps Improving Operational Safety with Digitization

2024-05-13 - Artificial intelligence and the digitization of the oilfield have allowed for several improvements in keeping operators out of harm’s way, panelists said during the 2024 Offshore Technology Conference.

Safety First, Efficiency Follows: Unconventional Completions Go Automated

2024-07-18 - The unconventional completions sector has seen a tremendous growth in daily stage capacity and operation efficiencies, primarily driven by process and product innovations in the plug and perf space.

ProFrac, IWS Taking the Garbage Out of Oilfield Data Transfer

2024-07-16 - ProFrac and Intelligent Wellhead Systems’ MQTT protocol promises to speed up communications at the frac site, not only by saving costs but laying the foundation for future technological innovations and efficiencies in the field, the companies tell Hart Energy.

E-wireline: NexTier Taps Oilfield Grid, Automation for Completions

2024-07-23 - NexTier Completion Solutions is using advanced electric-drive equipment, automation-enabled pump down technology and digital connectivity to optimize wellsite operations during shale completions.

Quantum Capital’s View on AI: Lots of Benefits, Pain Points

2024-05-16 - The energy industry is lagging in the race to implement AI, but Sebastian Gass, CTO of Quantum Capital Group, offered a few solutions during Hart Energy’s 2024 SUPER DUG Conference & Expo.