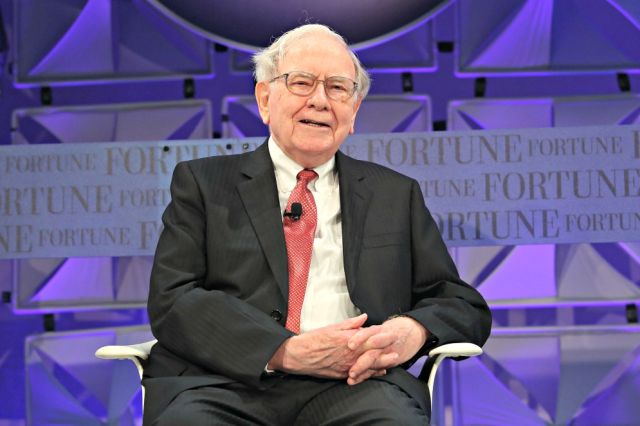

Warren Buffett, chairman and CEO of Berkshire Hathaway, speaks during a conference in Southern California in 2014. (Source: Krista Kennell/Shutterstock.com)

[Editor's note: This story was updated at 8:50 a.m. CST Feb. 15.]

Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK.A) said Feb. 14 it had taken a fresh stake in Suncor Energy Inc. (NYSE: SU) for the second time in about six years, sending the U.S.-listed shares of the energy major up 4% in after-market trading.

Suncor, Canada's biggest oil and gas company headquartered in Calgary, Alberta, specializes in production of synthetic crude from oil sands. The company is considered one of the safest Canadian energy companies to invest in, given its integrated structure and diversified business mix.

Berkshire's investment puts the Buffett stamp on Suncor and could be seen as a positive for the Canadian energy sector. The move comes at a time when global investors have been pulling away from Canada because of its carbon-intensive oil sands and struggle to approve pipelines.

Berkshire said in a filing with the U.S. Securities and Exchange Commission that it has a stake of 10.8 million shares in the company, representing about 0.7% of Suncor's total outstanding shares, according to Eikon data from Refinitiv.

Ahead of the news on Feb. 14, Suncor's shares had shed 17.3% in the last six months, due in part to Alberta's decision to force mandatory production cuts last year.

The new position comes more than two years after Berkshire sold its stake in Suncor. Berkshire took a position in Suncor in 2013 and exited its stake in 2016.

Recommended Reading

Kimmeridge’s Dell: Every US Basin Contains Both High-quality Inventory, Risk

2024-10-05 - Inventory management is a problem for the E&P space, no matter the basin, said Kimmeridge Energy Management's Ben Dell at Hart Energy's Energy Capital Conference in Dallas.

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

2024-10-04 - Utica Shale E&P Infinity Natural Resources has not yet set a price or disclosed the number of shares it intends to offer.

Private Equity Gears Up for Big Opportunities

2024-10-04 - The private equity sector is having a moment in the upstream space.

Venezuela Lost Citgo, But the Battle’s Not Over Yet

2024-10-04 - Amber Energy’s $7.3 billion purchase of Citgo fell well short of analyst’s valuations. PDVSA Ad Hoc expects to appeal the decision soon in its battle to protect its claim on Citgo.

Energy Transition in Motion (Week of Oct. 4, 2024)

2024-10-04 - Here is a look at some of this week’s renewable energy news, including the startup of a solar module manufacturing facility with an annual 2-gigawatt capacity.