The price of Brent crude dropped to $82.78 from last week's $85.83. (Source: Shutterstock)

The price of Brent crude ended the week at $82.78 after closing the previous week at $85.83. The price of WTI ended the week at $76.68 after closing the previous week at $79.68.

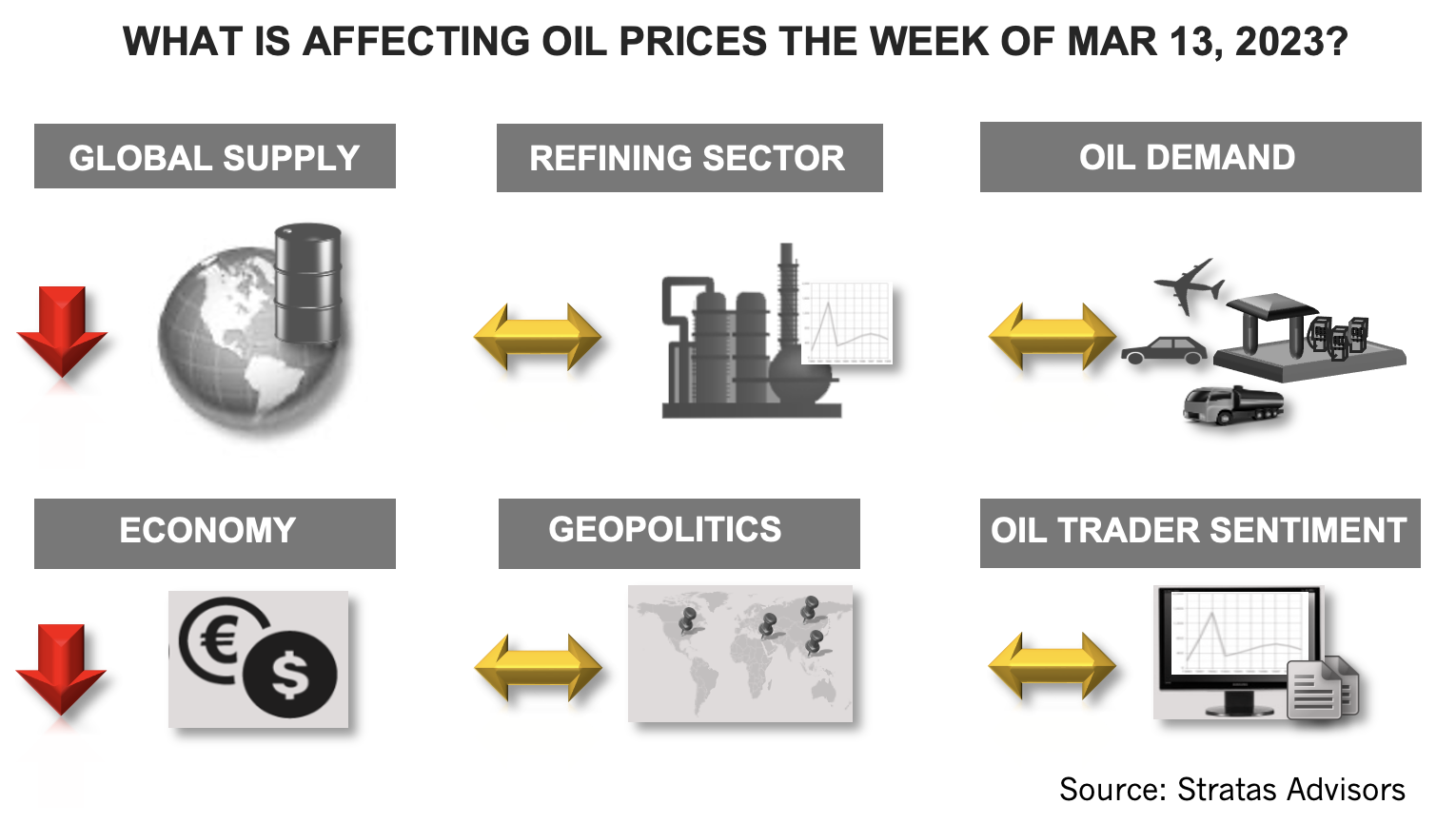

We have remained cautious about the global economy, even though the economic outlook has been improving. One of our long-held concerns pertains to the Federal Reserve being too aggressive in shifting to a tightening monetary policy and subsequently pushing the U.S. economy into a recession either through demand destruction or through a breakdown somewhere within the financial sector, which would then undermine the real economy. This concern stems from our view that the Federal Reserve has limited ability to address the root causes of the current inflation, which is not being driven by wage growth, but more so from supply-side factors. The collapse of the Silicon Valley Bank (SVB) at the end of last week is indirectly related to aggressive rate increases that have been implemented by the Federal Reserve. The bank was caught holding a portfolio of long-term Treasury bonds, which diminished in value because of the rate increases. At the same time the rate increases were negatively impacting the bank’s client base. With significant deposit withdrawals in recent days, the bank was in no position to remain open. It appears that the U.S. government will not bail out the bank, but will, instead, enable the remaining depositors to access their funds on March 13. The more lasting impact is that SVB was a major source of funding for startups in Silicon Valley. Additionally, there is always the fear of contagion when a major bank fails. Before the bank failure we were expecting that the Federal Reserve at its next meeting schedule for March 21-22 would only raise rates by 0.25% instead of 0.50%, even though inflation continues to be a concern. With the bank failure, we think a 0.25% rate increase is even in question.

We previously highlighted the efforts of China to act as a mediator for the Russia-Ukraine conflict, including the release of a peace plan that involved a cease-fire and peace talks along with removing sanctions on Russia. While the proposed peace plan was quickly rejected by the U.S. and EU, the effort was notable because of it being another sign of China taking a more prominent role in global affairs – and not only in the Asia-Pacific region. Last week, China was able to broker a deal between Saudi Arabia and Iran which will normalize relationships between Saudi Arabia and Iran after the two countries broke ties back in 2016. Such a deal could also be seen as another sign of the reducing influence of the U.S. and the west with respect to the oil market, including the decrease in oil volumes being traded in U.S. dollars.

Meanwhile, Russia has continued to export crude oil and the price for Russia crude oil has been increasing in recent weeks, in part, because of increased demand coming from Asia, including China. Russia is also reacting to the price cap that Europe placed on its refined products by shifting more refined products to Africa and to the Middle East where some of the imports are being further processed and blended for export. This is another example of the sanctions having limited impact on Russia’s export volumes, while affecting the trade flows, which are adding more inefficiencies into the crude oil and refined product markets.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Francine Closes, Restricts Oil Export Ports, Shuts in 42% of GoM Oil

2024-09-13 - In addition to hampering ports and refineries, an estimated 41.74% of Gulf of Mexico oil production, or 730,472 bbl/d, has been shut in.

EIA: Natural Gas Prices to Increase in November

2024-08-16 - Crude prices will strengthen through 2024 before falling in 2025 due to lower liquid fuels consumption, particularly in China, the U.S. Energy Information Administration reported.

BP Energy Outlook: Oil Demand Diminishes, NatGas, LNG a Wildcard

2024-07-16 - BP’s energy outlook presents a view at current trends for energy use through 2025 and a net zero case, which would require a history-defying shift from adding fuel sources to substituting them.

Hurricane Francine Shuts in Quarter of GoM Oil, Gas Production

2024-09-11 - The Bureau of Safety and Environmental Enforcement reported that 130 platforms and several rigs were affected as the storm approached the Louisiana coast.

Analyst: US NGL Market Tightens Links to Crude, NatGas Production

2024-09-02 - A boost in propane and ethane development is tied to the opening of the Matterhorn Pipeline in the Permian, evidence of the increasingly closer link between different sectors of the energy industry.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.