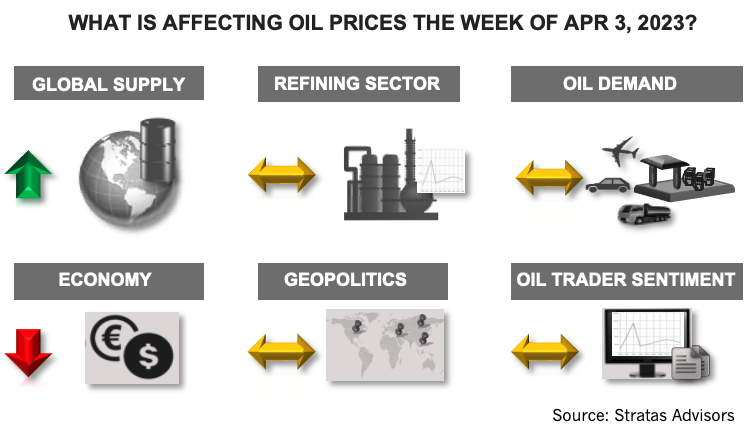

While the production cuts will provide further support for oil prices, members of OPEC+ agreed to the cuts, in part, because of concerns about the outlook for global economy and oil demand. (Source: Shutterstock)

The price of Brent crude ended the week at $79.89 after closing the previous week at $74.99. The price of WTI ended the week at $75.67 after closing the previous week at $69.26. The increases in oil prices were supported, in part, by the financial sector seeming to act as the banking difficulties have been resolved, even though depositors continue to make significant withdrawals from banks (see Economic Section of this note for more details). Oil prices were also supported by Turkey stopping pipeline flows from northern Iraq, which affected 450,000 bbl/d of oil supply (see Supply Section of this note for more details). Oil prices were further boosted by the EIA reporting that crude oil inventories decreased by 7.49 million barrels during the previous week.

In last week’s note, we put forth the view that it would take some other unexpected, good news to push the price of Brent above $80.00 and WTI above $75.00 – such as a production cut by OPEC+. On April 2, OPEC+ announced additional production cuts of 1.16 million bbl/d that are to start in May and last through the end of this year with the following breakdown:

- Saudi Arabia: 500,000 bbl/d

- Iraq: 211,000 bbl/d

- UAE: 144,000 bbl/d

- Kuwait: 128,000 bbl/d

- Oman: 40,000 bbl/d

- Algeria: 48,000 bbl/d

- Kazakhstan: 78,000 bbl/d

While the production cuts will provide further support for oil prices, members of OPEC+ agreed to the cuts, in part, because of concerns about the outlook for global economy and oil demand. Each of the major economies are showing worrisome signs to differing degrees:

- The final report for the University of Michigan Consumer Sentiment Index for March fell to 62.0 from 67.0 in February – and is the first monthly decrease since October 2022. From a historical perspective, the March reading is 27% below the average reading (with the survey beginning in 1978). The reading is also lower than typical at the beginning of a recession. The 10-year treasury ended last week at 3.518%. In comparison, the 10 year was at 4.073% at the beginning of March and 4.226% on October 19, 2022. The yield curve remains inverted with 2-year treasury at 4.102%, which is another sign of the economy being on the verge of a recession.

- The Eurozone had some mixed news with respect to inflation with annualized inflation decreasing from 8.5% in February to 6.9% in March. The decrease stems mainly, however, from a decrease in energy prices, which decreased by 0.9% in March after increasing by 13.7% in February. Core inflation, which excludes energy and food, reached an all-time high of 5.7%.

- The latest data from China indicates that even with the removal of COVID-related restrictions, economic growth in China remained moderate during the first two months of the year:

- Retail sales increased by 3.5%, but sales associated with automobiles and other high-price goods decreased.

- Industrial production increased by only 2.4%.

- Real estate investments decreased by 5.7% after decreasing by 10% in 2022

- Investments in Fixed asset investment, however, increased by 5.5%.

As such, for the upcoming week, we think oil prices will move up further, but the price of Brent will hit resistance at $86.00 and WTI will hit resistance at $82.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Barrio Energy Acquires 12-MW Data Center in Texas

2024-08-22 - Barrio Energy’s new 12-megawatt data center in Tyler, Texas, brings the company’s number of data center properties in the state to five.

Transocean Contracted for Ultra-deepwater Drillship Offshore India

2024-09-04 - Transocean’s $123 million deepwater drillship will begin operations in the second quarter of 2026.

HNR Increases Permian Efficiencies with Automation Rollout

2024-09-13 - Upon completion of a pilot test of the new application, the technology will be rolled out to the rest of HNR Acquisition Corp.’s field operators.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Exclusive: Embracing AI for Precise Supply-Demand Predictions

2024-10-17 - Dak Liyanearachchi, the CTO with NRG, gives insight on AI’s capabilities in optimizing energy consumption and how NRG is making strides to manage AI’s growth, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.