Cabot Oil & Gas and Cimarex Energy said they are targeting annual general and administrative cost synergies of $100 million through the combination. (Source: Hart Energy; Shutterstock.com)

Cabot Oil & Gas Corp. and Cimarex Energy Co. announced plans on May 24 to combine in an all-stock “merger of equals” with the two U.S. shale producers banking on a diversified oil and gas portfolio to generate sustainable returns across a wide range of commodity price scenarios.

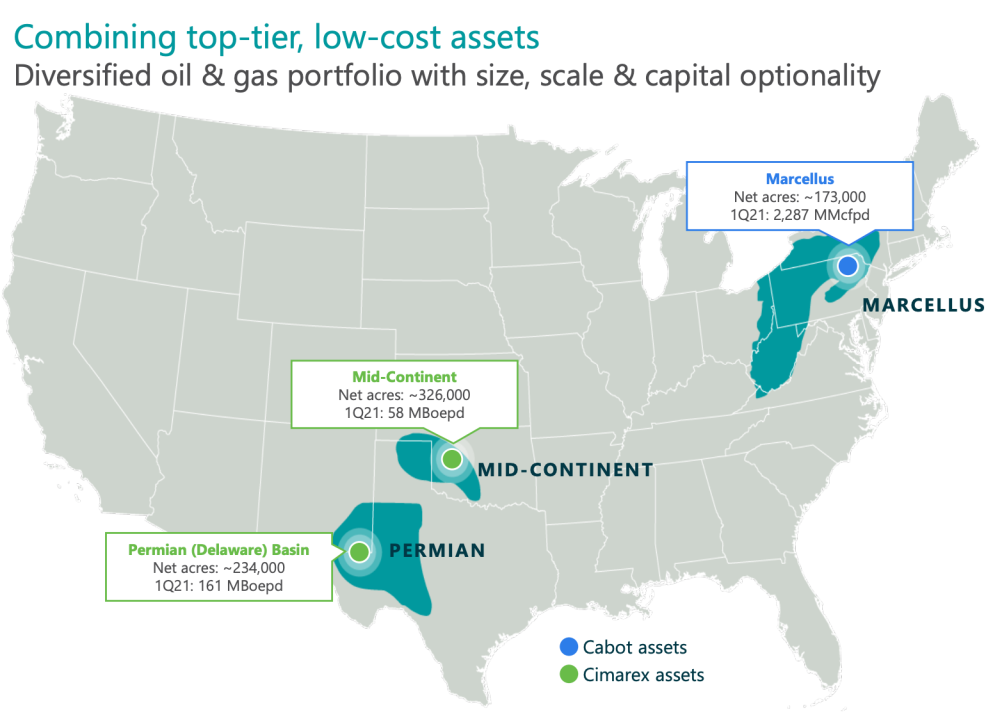

With Cabot’s approximately 173,000 net acres in the Marcellus Shale and Cimarex’s approximately 560,000 net acres in the Permian and Anadarko basins, the combined business will have a multi-decade inventory of high-return development locations in the premier oil and natural gas basins in the U.S., the companies said in a joint release.

UPDATE:

Cabot, Cimarex ‘Surprise’ Merger Bucks Pure-play Consolidation Trend

“The combination of Cabot and Cimarex will create a free cash flow focused, diversified energy company with the scale, inventory and financial strength to thrive across commodity price cycles,” Dan O. Dinges, chairman, president and CEO of Houston-based Cabot, said in a statement.

Thomas E. Jorden, chairman, president and CEO of Cimarex, headquartered in Denver, added: “We view commodity, geography and asset diversification as strategic advantages that will drive more resilient free cash flow and long-term value creation.”

The combined business, which will operate under a new name, is estimated to have an enterprise value of approximately $17 billion.

Under the terms of the agreement, Cimarex shareholders will receive 4.0146 shares of Cabot common stock for each share of Cimarex common stock owned. At closing, expected in fourth-quarter 2021, Cimarex shareholders will own approximately 50.5% of the combined company with Cabot shareholders owning the remaining 49.5%.

The combined company plans to be headquartered in Houston and maintain its regional offices. Jorden will lead the company as CEO and Dinges will serve as executive chair of the board of directors.

Additionally, Scott Schroeder, Cabot’s current CFO, will serve as CFO of the combined business. The companies said the remainder of the leadership team will include executives from both Cabot and Cimarex.

The free cash flow outlook of the combined company is approximately $4.7 billion from 2022 to 2024 based on $55/bbl WTI oil prices and $2.75/MMBtu Nymex natural gas prices. Plans are for the new business to supplement an annual base dividend of $0.50 per share with a quarterly variable dividend to achieve a target capital return of at least 50% of quarterly free cash flow.

The companies are also targeting annual general and administrative cost synergies of $100 million beginning within 18 months to two years following the closing.

Cabot and Cimarex also expect for the combined business to build on the two companies’ ongoing ESG efforts by, among other things, continuing to link executive compensation to ESG performance and maintaining strong board oversight of ESG risks and programs.

“We are aligned on our commitment to ESG and sustainability and look forward to bringing our talented teams together to unlock the tremendous potential of this compelling combination,” Jorden noted in his statement.

J.P. Morgan Securities LLC is financial adviser to Cabot for the transaction and Baker Botts LLP is serving as its legal counsel. Tudor, Pickering, Holt & Co. is Cimarex’s financial adviser and Wachtell, Lipton, Rosen & Katz is providing legal counsel.

Recommended Reading

BPX’s Koontz: The Rise of a Shale Man

2024-07-02 - CEO Kyle Koontz takes the reins of BPX Energy’s rapid onshore growth amid big changes at BP.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

CrownRock Offloads Oxy Shares Two Weeks After Closing $12B Deal

2024-08-15 - Underwriters of the offering agreed to purchase CrownRock’s Occidental stock at $58.15 per share, which will result in approximately $1.719 billion in proceeds before expenses.

ISS, Glass Lewis Push Crescent, SilverBow Shareholders to Vote for Merger

2024-07-19 - Proxy Advisory firms Institutional Shareholder Services and Glass Lewis also recommend that Crescent Energy shareholders vote for the approval of the issuance of shares on Crescent Class A common stock.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.