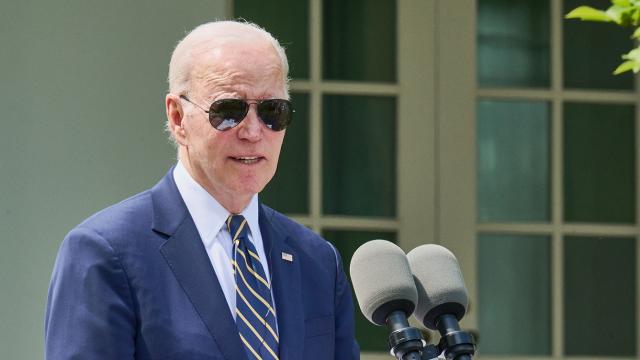

President Joe Biden and his administration “really want to see less oil and gas produced in the United States,” IPPA Chairman Steve Pruett said at Super DUG. (Source: Shutterstock)

FORT WORTH, Texas—The U.S. oil and gas industry is fighting a Biden administration intent on eviscerating production, the chairman of the IPAA told SUPER DUG attendees on May 22.

“The Biden energy policy, frankly, is schizophrenic or maybe it’s bipolar in that…my Democratic lobbyist friends tell me that when Joe Biden speaks off-script, believe what he says. And when he says ‘no new drilling,’ that’s his heart speaking,” said Steve Pruett, leader of the industry group and president and CEO of Elevation Resources.

And while Energy Secretary Jennifer Granholm is doing her best to speed up project permitting, “the reality is the Biden administration and his staff really want to see less oil and gas produced in the United States,” Pruett said. “And there’s no way that the renewable strategy or the ‘energy transition,’ as he calls it, can meet the needs of not only this nation, but of our strategic allies across the globe.”

The solution, he told moderator Nissa Darbonne, Hart Energy’s executive editor-at-large, is to enact significant changes to the National Environmental Policy Act (NEPA). In convincing Congress to tackle NEPA reform, IPAA has found what some might consider an unexpected ally: the renewable energy lobby.

“Without reforms, this country will not have the electricity it needs to implement the electrification strategy that the Biden administration has put forward,” Pruett said.

Friends in the House

What the industry wants is included in a piece of legislation labeled H.R. 1, known as the Lower Energy Costs Act. Introduced by Rep. Steve Scalise (R-La.) and passed by the House in March, the bill provides the relevant cabinet secretary with authority to deem NEPA requirements satisfied – if a proposed environmental assessment or environmental impact statement is substantially the same as a previously completed assessment or statement.

“If there’s hope that I can leave with you all today, is that we have a very qualified, interested, informed House of Representatives that have been very supportive,” Pruett told attendees. “H.R. 1 was the most comprehensive energy legislation in our time.”

If passed into law, the legislation would expedite the development, importation and exportation of energy resources by:

- Waiving environmental review requirements and other specified requirements under certain environmental laws;

- Eliminating certain restrictions on the import and export of oil and natural gas;

- Prohibiting the president from declaring a moratorium on the use of hydraulic fracturing;

- Directing the Department of the Interior to conduct sales for the leasing of oil and gas resources on federal lands and waters; and

- Limiting the authority of the administration to restrict or delay the development of energy on federal land.

The measure would also reduce royalties for oil and gas development on federal land and eliminate charges on methane emissions if it became law.

Which it won’t.

Chances of passing the Democrat-controlled Senate are nil and President Biden has vowed to veto H.R. 1 if it did.

The Biden administration “wants to work in [a] bipartisan manner with Congress to address lowering energy costs, permitting reform and addressing energy challenges,” the White House said in a statement following passage in the House. “However, H.R. 1 would take us backward.”

Biden: “No plan”

Still, as Darbonne noted, the Biden administration gave the green light to the Willow project in Alaska.

Pruett called the decision a great win for ConocoPhillips and the state of Alaska, but noted that it doesn’t resolve troubled federal leasing policies.

The Department of the Interior has yet to release a five-year offshore leasing plan following expiration of the previous program in June 2022. He called the administration’s leasing efforts “minimal” and, in federal offshore waters, well behind what is needed to maintain future growth.

“Willow, you know, that’s a move in the right direction, but that’s many years away,” he said. “But the offshore leasing just hasn’t happened, and there’s no plan.”

Recommended Reading

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Matador May Tap Its Haynesville ‘Gas Bank’ if Prices Stabilize

2024-10-24 - The operator holds 8,900 net Haynesville Shale acres and 14,800 net Cotton Valley acres in northwestern Louisiana, all HBP, that it would drill if gas prices stabilize—or divest for the right price.

Northern’s O’Grady: Most of ‘Best’ Acres ‘Already Been Bought’

2024-10-24 - Adding new-well inventory going forward will require “exploration or other creative measures,” said Nick O’Grady, whose Northern Oil and Gas holds interests in 10,000 Lower 48 wells.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row, Baker Hughes Says

2024-08-30 - The rig count is 8% below this time last year, according to Baker Hughes.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.