As with the E&P sector, OFS companies are under pressure to move to a new business model. But what could that look like? (Source: Robert D. Avila)

Capital allocation issues alone are hard enough to handle in a cyclical industry like oil and gas. In years past, producers would set budgets based on commodity price forecasts, and oilfield service (OFS) companies would typically take their cue from customer budgets. Much would depend on how well price forecasts held up, helping determine later tightness or slackness in an OFS sub-sector.

Today, the issues are much more complicated. Commodity volatility is in full force--witness the collapse of crude late last year—and producers are increasingly embracing a mantra of capital discipline. And like their E&P counterparts, OFS companies are coming under mounting pressure to prioritize returns to investors as they plan higher capex budgets aimed at capturing greater market share.

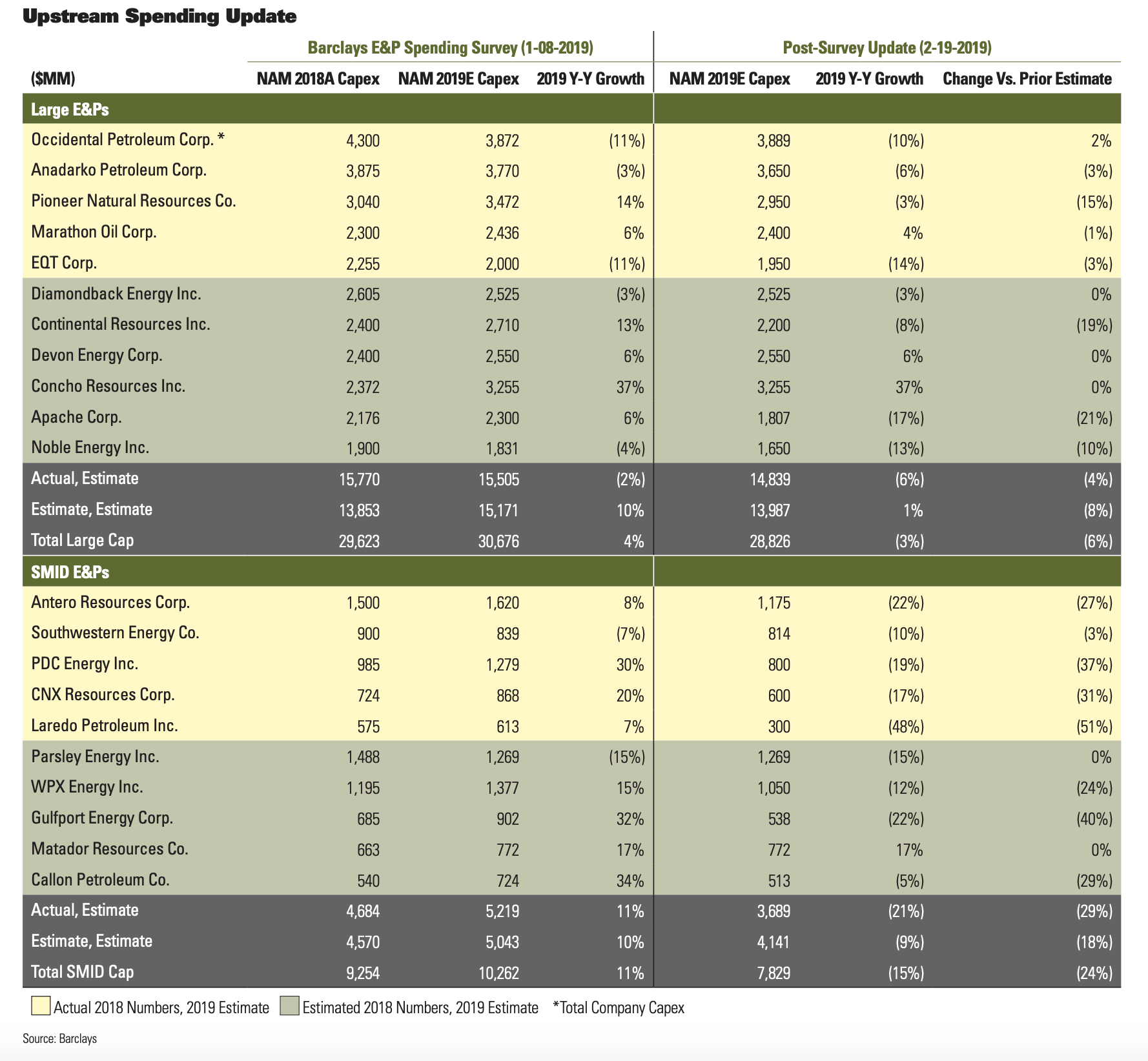

Earlier estimates of E&P capex for 2019 have already been subject to some notably steep revisions.

“Clearly, U.S. spending has been affected by the oil price collapse in the fourth quarter,” said Colin Davies, senior research analyst, oilfield services, at AllianceBernstein LP. “E&P capital guidance in recent weeks shows 2019 spending expectations have come in much lower than back in November. It’s a monumentally different position.”

However, Davies doesn’t exclude the possibility of an inflexion in spending over the course of 2019.

“I would be surprised if we truly end up with a flat-to-down year-over-year picture,” said Davies. “If we get a stronger macro environment into the spring and summer, which we’ve had for the last two years, it wouldn’t surprise me if we see some of those numbers nudging back up again. But given pressure from investors to hold the line on capex, they could only do that if the macro is a bit stronger.”

Lean Into DUCs

“E&Ps will find ways to bolster production growth on constrained budgets. One way is to lean into some of the DUCs (drilled but uncompleted wells) that have been built up by the industry,” he continued. “And then producers will start to frack more of those DUCs so they can get more production with relatively fewer dollars.”

Historically, the OFS sector has felt less pressure from investors as regards capital discipline, but that is rapidly changing, according to Bernstein.

“What’s happening is that the push to prioritize return on invested capital [ROIC] is coming across from the earlier move on the E&P side, and now it’s really becoming part of the mantra on the OFS side, especially for large-cap names, like Schlumberger [Ltd.] and Halliburton [Inc.],” said Davies. “I think that’s going to be the big investor push going forward—and quite rightly so, it’s been long overdue.”

According to Davies, there is “mounting investor frustration” at the successive years of declining ROIC metrics in the OFS sector. He attributed this to two main factors, with one being the “massive level of capacity overbuild” in earlier boom years. These investments are still sitting on balance sheets and are burdening OFS firms’ income statements with high levels of depreciation, depletion and amortization.

“Very U.S. Dominated”

The other is the degree to which the recovery during the past two years has been “very U.S. dominated.” The advent of U.S. unconventional resources has led to a lower technological intensity as well as fewer barriers to entry, which fosters “a very competitive dynamic, where people tend to chase economies of scale and market share to absorb fixed costs.”

In turn, this has “driven a behavior of discounting prices,” continued Davies, with the benefits naturally accruing to their E&P customers. “And if you take that very low pricing dynamic designed to chase market share, and combine it with the overbuild of capacity of the prior boom, you’ll find you get very low return on invested capital.”

That said, amidst ongoing uncertainty over E&P capex, Davies pointed to several sub-sectors that may offer attractive upside from a “tactical,” or shorter-term perspective.

Super-spec Rigs

Sub-sectors identified by Davies as attractive included “super-spec” rigs and, on more of a tactical basis, pressure pumping or hydraulic fracturing. In addition, although no “pure-play” vehicle exists, above-average returns are projected for rotary steerable tools, where a more concentrated set of suppliers means “you don’t get the race to the bottom on pricing that exists in areas with low barriers to entry.”

investor frustration”

at the successive

years of declining

returns on invested

capital in the oilfield

service sector,

according to Colin

Davies, senior

research analyst,

AllianceBernstein LP

Super-spec rigs, which are required to drill very long horizontal wells, are concentrated in just a few hands. Leading operators include Helmerich & Payne Inc. (NYSE: HP), Patterson-UTI Energy Inc. (NASDAQ: PTEN) and, to a somewhat lesser extent, Nabors Industries Ltd. (NYSE: NBR). Another super-spec operator is Independence Contract Drilling Inc. (NYSE: ICD).

The relatively narrow ownership of super-spec rigs and rigs that can be upgraded to super spec—has helped pricing remain “remarkably strong,” according to Davies, whose favored stock in the group is Patterson. Patterson is rated outperform by Bernstein with a $19.50 target price. (Helmerich & Payne carries a market perform rating and a $63 target price.)

Following Patterson’s release of its fourth-quarter results, Davies noted the company was able to cut its 2019 capex by 27% as it pared the pace of its super-spec upgrades to just one from 14 completed in 2018. While rig activity was slowing and “beginning to impact even the super specs,” he wrote, pricing for super-spec rigs continued to be “strong with over 90% rig utilization.”

With Patterson also having significant pressure-pumping operations, Davies described as “refreshingly differentiated” the company’s strategy of managing near-term headwinds in the sector with lower capex and pricing discipline. Patterson opted to idle three frack spreads on top of two that were stacked in the fourth quarter, reflecting “a disciplined refusal to chase share at low margin.”

As the year progresses, however, 2019 could be “a year of two halves” in the pressure-pumping market, according to Davies. “Very tough” market conditions are expected in the first half, but a “frack ramp” is likely to tighten the market in the second half as E&Ps step up activity in the Permian in anticipation of new pipeline capacity coming on and resolving bottlenecks in the basin. Conversely, as budgets swing back to fracking the DUCs, the rig market may weaken slightly in the second half.

Lure Of 4 MMbbl/d Of Takeaway

“You can’t dangle in front of the industry nearly 4 million barrels per day (MMbbl/d) of takeaway capacity out of the Permian through the end of 2020, and expect the industry not to frack those wells. They’ll frack those wells,” observed Davies. “And if you can get over 100 spreads coming back to work in a relatively short time, we believe that has to have a positive impact on pricing.”

Beneficiaries include pressure-pumping leader Halliburton, as well as Patterson. The full impact of the potential uplift is “underappreciated in the marketplace, and that’s likely to drive upside for both companies.” The recommendation is “a bit more tactical,” or short-term, in nature, and is premised on frack activity eventually catching up with new well drilling.

“We have a high level of conviction that some kind of frack ramp occurs in the second half of this year. It has to,” said Davies. “And that’s the basis for an outperform rating on Halliburton.”

Bernstein’s late January report on Halliburton carried a target price of $48 per share.

J. David Anderson, Barclays’ senior equity analyst covering oilfield services and equipment, sees brighter days ahead for OFS—but only after recent performance left it among the lowest ranking market sectors.

“The worst is probably past for oilfield service,” he said. “After four years, it feels like we’ve seen the final cuts on earnings estimates in the U.S. Earnings estimates have largely bottomed, and we can start thinking about growth in 2020 and beyond. Once the dust settles in the next month or so, people are going to say, ‘Hey, these stocks are looking like they’re at priced at attractive valuations.’”

This presumes the market has by then factored in some hefty downward revisions in North American E&P budget estimates made as recently as early January of this year.

Barclays’ widely followed 34th Global 2019 E&P Spending Outlook, released on Jan.8, showed increases in spending by large- and small to mid-cap (SMID) E&Ps of an estimated 5% and 11%, respectively, over last year’s levels. However, by Feb.19, with additional data from earnings releases, the large- and SMID-cap spending estimates were revised down to minus 3% and minus 15%, respectively.

Depleting Rock

The updated budgets for the SMID-cap E&Ps were “particularly shocking,” said Barclays, citing a note in which it said SMID-caps were “stuck between a depleting rock and a hard place.” Several “competing factors” might explain the budget reductions: accelerated base production declines, leasehold drilling obligations and pressure to spend within cash flow and return capital to shareholders.

“The SMID-cap guys are going to be faced with some very difficult challenges,” commented Anderson. “Because they’re at such an early stage of development, they have very high decline rates; they don’t have tails of production from wells that have been producing for some time. The question is whether their production holds up. What are their 2020 production numbers going to look like?”

The SMID-cap E&Ps are likely to move their capex up if they see the opportunity, according to Anderson.

“SMID-cap E&Ps don’t have a lot of options,” he said. “You can’t have it both ways. You can’t cut your capex and still have your production. One of them has to give. I would not be surprised to see the SMID-cap E&Ps revise those budgets higher a little bit later in the year.”

Capital Discipline

By contrast, the large-cap sector is expected to be held to the 2019 budgets that are being announced.

“The big guys don’t have a lot of wiggle room,” commented Anderson. “They need to hit those numbers because capex is basically a proxy for capital discipline in today’s E&P world.”

Meanwhile, the majors, with a 15% budget increase, are set to play a stabilizing role in North America.

“I think the theme for 2019 is going to be about the majors reclaiming their stake in the U.S. market,” said Anderson. “They’re going to be ramping up activity and expanding their presence in the Permian.”

If the OFS market is going to tighten later in the year, it is likely to do so partly due to activity on the part of the majors, especially with Exxon Mobil Corp. and Chevron Corp. expanding in the Permian, he said. “They’re the companies that could really take up a lot of capacity.”

While those taking positions in the OFS sector are mainly energy specialists, “value investors are starting to poke around,” according to Anderson. “And the reason they’re poking around is they’re seeing some interesting free cash flow stories. Admittedly, you have to look out a couple of years or more. People are asking me about midcycle multiples. I haven’t had those questions in years.”

Best Of Breed Approach

Anderson said recent market conditions called for a “best of breed approach,” focused on the “highest quality names.” Two names sit at the top of his list: Baker Hughes Inc. (NYSE: BHGE), a GE company; and Tenaris SA (NYSE: TS).

“Baker Hughes stands out from Schlumberger and Halliburton in that it has a differentiated business model,” said Anderson. “The sweet spot for the company is its LNG business, which offers a huge opportunity. The company estimates that about 100 million tons of new capacity is going to be announced by the end of this year.”

“The large-cap E&Ps need to hit those numbers because capex is basically a proxy for capital discipline in today’s E&P world.” —David Anderson, Barclays

The critical advantage for Baker Hughes is that the firm’s legacy GE turbine and compression business has an 80% or greater market share in these key components that are used in the construction of LNG facilities, according to Anderson. The business has a “longer cycle” in terms of returns, but offers “much greater visibility” over time. “It’s a very attractive free-cash-flow story over the next several years.”

Anderson also cited growth in Baker Hughes’ growing Middle East business, where a contract has been signed to sell tools and equipment to ADNOC (Abu Dhabi National Oil Co.) Drilling, a major national oil company.

Anderson has an overweight rating on Baker Hughes with a $31-per-share target price.

Also favored by Barclays is Tenaris, considered the largest oil country tubular goods company in the world. Tenaris has operations in Italy, Latin America (Argentina and Mexico) and, more recently, the U.S., where it completed a new plant in Bay City, Texas, in early 2018. This coincided with the imposition of quotas and tariffs on imports of welded pipe from South Korea.

Tenaris has been a beneficiary of the restrictions on Korean supplies, which have enabled it to meet higher U.S. demand from its new U.S. plant. Further, if the planned replacement trade agreement for NAFTA is completed, Tenaris will be able to take further market share in the U.S. from its Veracruz, Mexico, plant, one of the lowest cost facilities in the world, according to Anderson.

are starting to

poke around,” said

David Anderson,

Barclays’ senior

equity analyst.

“And the reason

they’re poking

around is they’re

seeing some

interesting

free-cash-flow

stories.”

Phenomenal Free Cash Flow

Tenaris has “phenomenal free cash flow. It generates more cash flow on a revenue basis than any of the other big companies I cover,” said Anderson. In addition, its balance sheet is “rock solid.” Markets are being developed in new regions, with “toeholds” gained in the Middle East and Russia. Naturally, the company is already a dominant supplier to the Vaca Muerta play in Argentina.

Anderson has a top pick rating on Tenaris. His target price for the stock is $44 per share.

Marc Bianchi, a Cowen & Co. analyst covering oilfield services and equipment, also favors Baker Hughes as his top pick, while offering a number of selections across market cap ranges.

Away from Baker Hughes, these selections are in large part guided by a view of the U.S as “truly the swing supplier” and holder of the “biggest wedge of oil supply.” However, supply can move up or down in a relative tight range, with production growth increasing above $50 per barrel WTI [West Texas Intermediate], but faltering at lower levels and falling “out of the money at $45 per barrel,” according to Bianchi.

The implications for the OFS sector of this effective U.S. spare capacity—putting in a price floor at lower levels, but also a ceiling at higher levels—is that “it limits you mostly to U.S. onshore services, such as pressure pumping and land drilling,” he said. “These areas can run at a healthy level of demand, but the rig count is not going to go to 1,500. It will probably stick around this 1,000 rate.

“Until we work off the U.S. spare capacity, there’s not going to be a real need for meaningful growth in the offshore and international sectors,” Bianchi continued. “That’s unfortunate because offshore, especially deepwater, and international areas offer high-margin businesses with high barriers to entry. They’re the sectors that the long-term investors want to own. But we just don’t need it yet.

“Instead, we’re stuck with relatively lower barrier-to-entry, lower technology U.S. onshore-levered businesses.”

In the interim, the OFS sector is likely to see choppy market conditions, alternating between periods of tightness and slackness, according to Bianchi. This will make the sector “a little more volatile, but the amplitude of that volatility is going to be narrower. You won’t have as big a swing up or down as the market corrects itself to a large degree.”

The market’s ability to adjust to changing conditions is reflected in Cowen’s capex estimates for 2019 vs. last year. As with other surveys, an initial Jan.17 Lower 48 capex estimate of minus 2.9%, year-over-year, ceded further ground to minus 6% by Feb. 21. Data then indicated U.S. E&P capex down by 9%, while capex in the U.S. by the majors was estimated up 7%, for a blended 6% decline.

As investor focus turns away from recent weak sector earnings and toward a stronger 2020 outlook, which stocks offer the most attractive returns?

The super-pec rig area offers the best supply/demand fundamentals, although the question is how much is already priced into the stocks, according to Bianchi. For example, as regards Helmerich & Payne, the strong fundamentals are “largely reflected in its stock price,” he said, while Patterson’s mix of land drillers supplemented by pressure pumping offer greater upside.

“The Swing Piece”

“If you think activity is going to gradually increase over the course of 2019, there are areas that have more upside,” he commented. “Drilling is not going to double, but pressure-pumping profitability could more than double. It’s the swing piece. Patterson is guiding to $35 million of pressure-pumping gross margin in the first quarter. In the first quarter of 2018 it was $86 million gross margin.”

Pressure pumpers are “very cheap on any of several metrics: free-cash-flow yield, EBITDA multiples, asset values, including replacement value—on all those metrics they look attractive,” said Bianchi. His target price for Patterson is $19, based on midcycles multiples of 2020 EBITDA that are fairly modest: 6.5 times for the drilling component, and 4.5 times for the pressure pumping.

off the U.S. spare

capacity, there’s

not going to be

a real need for

meaningful growth

in the offshore

and international

sectors,” said Marc

Bianchi, analyst,

Cowen & Co.

Other pressure pumpers favored by Bianchi include: ProPetro Holding Corp. (NYSE: PUMP), which he describes as the “easiest to own” in terms of quality and safety; Keene Group Inc. (NYSE: FRAC), which has a strong stock buyback program; and FTS International Inc. (NYSE: FTSI), which offers the most upside, but with more risk. Target prices are $24, $16 and $15 per share, respectively.

Massive Intensity Change

Pure-play pressure pumpers may also be poised to benefit from tighter market conditions driven by a “massive” intensity change on equipment from 24-hour operations and zipper fracks, noted Bianchi.

“I think we could reach a point around the end of 2019 or early 2020 when we’ve absorbed all the spare capacity that we have,” he observed. “In the second quarter of last year, we were fully utilized on all the equipment. The rig count was about the same level as now, about 1,000 rigs, and we saw the same amount of pressure-pumping demand as in 2014. There’s been this massive intensity change.”

But, overall, Bianchi’s top pick is Baker Hughes, offering a “buy and hold” type of business that should grow steadily “even in a flattish demand environment.” In addition to its LNG exposure, the company offers products related to both upstream and downstream. However, with a lower level of capital intensity than its peers, it should generate greater cash flow.

In terms of timing of a purchase, the stock is currently weighed down by the “overhang” of GE’s stock, which is set to come to market over time once a lock-up period expires in early May, according to Bianchi. “GE’s exit from the stock probably happens at some point this year, and once that’s gone I think the stock goes up as well.”

As with the E&P sector, OFS companies are under pressure to move to a new business model. But what could that look like?

“If the sector isn’t growing as fast, U.S. OFS companies should have fewer requirements in terms of growth capex, and they should be running mainly on maintenance capex,” said Bianchi. “And in that world, if they’re generating an OK margin, they’ll throw off a bunch of free cash. And then they’ll mature into more of a yield-driven, capital return vehicle rather than a traditional growth vehicle.”

Chris Sheehan can be reached at csheehan@hartenergy.com.

Recommended Reading

Fervo Energy Achieves ‘Record Breaking’ Geothermal Well Flow Rates

2024-09-10 - Fervo Energy’s Cape Station project will generate 90 megawatts of renewable energy capacity during its first phase.

ArcLight Forms Renewables Management Team, Acquires Texas Wind Farm

2024-07-30 - Infrastructure investment firm ArcLight acquired a 160-megawatt wind farm, located in the Midland Basin.

Woodside to Acquire OCI’s Texas Clean Ammonia Project for $2.35B

2024-08-05 - Woodside’s purchase of OCI Clean Ammonia Holding’s project, which is under construction, is targeting first ammonia production scheduled for 2025 with lower-carbon ammonia following in 2026.

Atlantic Shores Submits Bid to Provide Offshore Wind in New Jersey

2024-07-12 - Atlantic Shores, a joint venture between Shell and EDF Renewables, would become the initial provider of offshore wind for New Jersey.

Clean Energy Begins RNG Project at Texas Dairy Farm

2024-07-24 - Clean Energy Fuels said it has broken ground on an $85 million RNG facility in Dimmitt, Texas, that the company said would become one of the biggest RNG production facilities in the U.S.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.