Oil and Gas Investor Magazine - April 2019

Magazine

Ships in 1-2 business days

Download

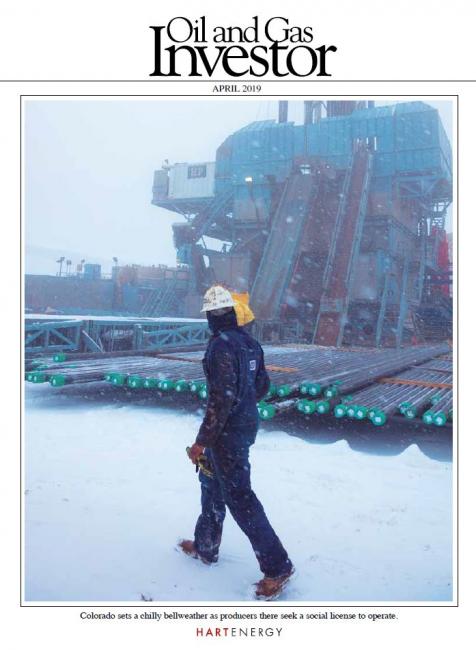

As Darren Barbee, a senior editor at Hart Energy, points out the Colorado oil and gas industry is on the state’s endangered list, fighting a running battle with activists intent on stopping fracking. Now the industry faces renewed legislative challenges. This issue of Oil and Gas Investor dives into the tense climate happening in Colorado plus more.

Also in the issue:

- Treadstone Energy Partners co-founder Frank McCorkle is able to see oil and gas challenges in a different light with creative solutions

- Investor pressure is increasing for oilfield service companies to provide returns over growth

- Oil and gas dealmakers are utilizing contingency payments to address the valuation gap

Cover Story

Colorado Oil And Gas: Battleground State

The Colorado oil and gas industry is on the state’s endangered list, fighting a running battle with activists intent on stopping fracking. Now the industry faces renewed legislative challenges.

Feature

Bakken Shale: Back In The Saddle

Stratas Advisors is shining a light on the Bakken Shale, the granddaddy of shale oil, in order to draw attention to new information that could shape the play in the near term.

Bridging The Divide

Since 2014, the domestic energy landscape has changed at a Usain Bolt type of pace.

Executive Q&A: The Treadstone Energy Identity

Treadstone Energy Partners co-founder Frank McCorkle is able to see oil and gas challenges in a different light with creative solutions. Just don’t expect his operations to remain clandestine much longer.

Nothing Tops LNG

Above power, petrochem or even Mexico imports, LNG holds the key to U.S. natural gas demand growth and price recovery. And the Haynesville Shale is pole positioned.

Oilfield Services: Rightsizing For Possible Outcomes

Investor pressure is increasing for oilfield service companies to provide returns over growth. Opportunities may improve as the second half of 2019 unfolds.

The First 100 Days

Here are key considerations when making oil and gas asset transactions.

The Return Of The Bakken

North Dakota’s production is setting new records, far exceeding the 2014 high. Bigger production volumes are coming from increasingly rubble-izing the rock.

A&D Trends

A&D Trends: Cash Only

Oil price volatility has helped cast A&D markets adrift leaving many E&P companies in a “no-wind” scenario.

At Closing

Energy Rivalries

The global footprint of U.S. shale has created heated competition between the U.S. and OPEC, said speakers at CERAWeek by IHS Markit last month.

E&P Momentum

The Rice Brothers’ Next Act

One good turn deserves another.

That’s how Rice Investment Group (RIG) sees its role as a private-equity capital provider to oil and gas.

From the Editor-in-Chief

Looking Toward The Shale Horizon

Will the shale revolution come to an end? Mark Papa, one of the founders of the shale revolution, weighs in.

On the Money

On The Money: A Mandate In Motion For E&Ps

E&Ps continue to find balance between returns to investors and growth.