The recent surge in the price of WTI appears to be relinking price and permitting. (Source: Hart Energy; Zoa.Arts, Sovenko Artem/Shutterstock.com)

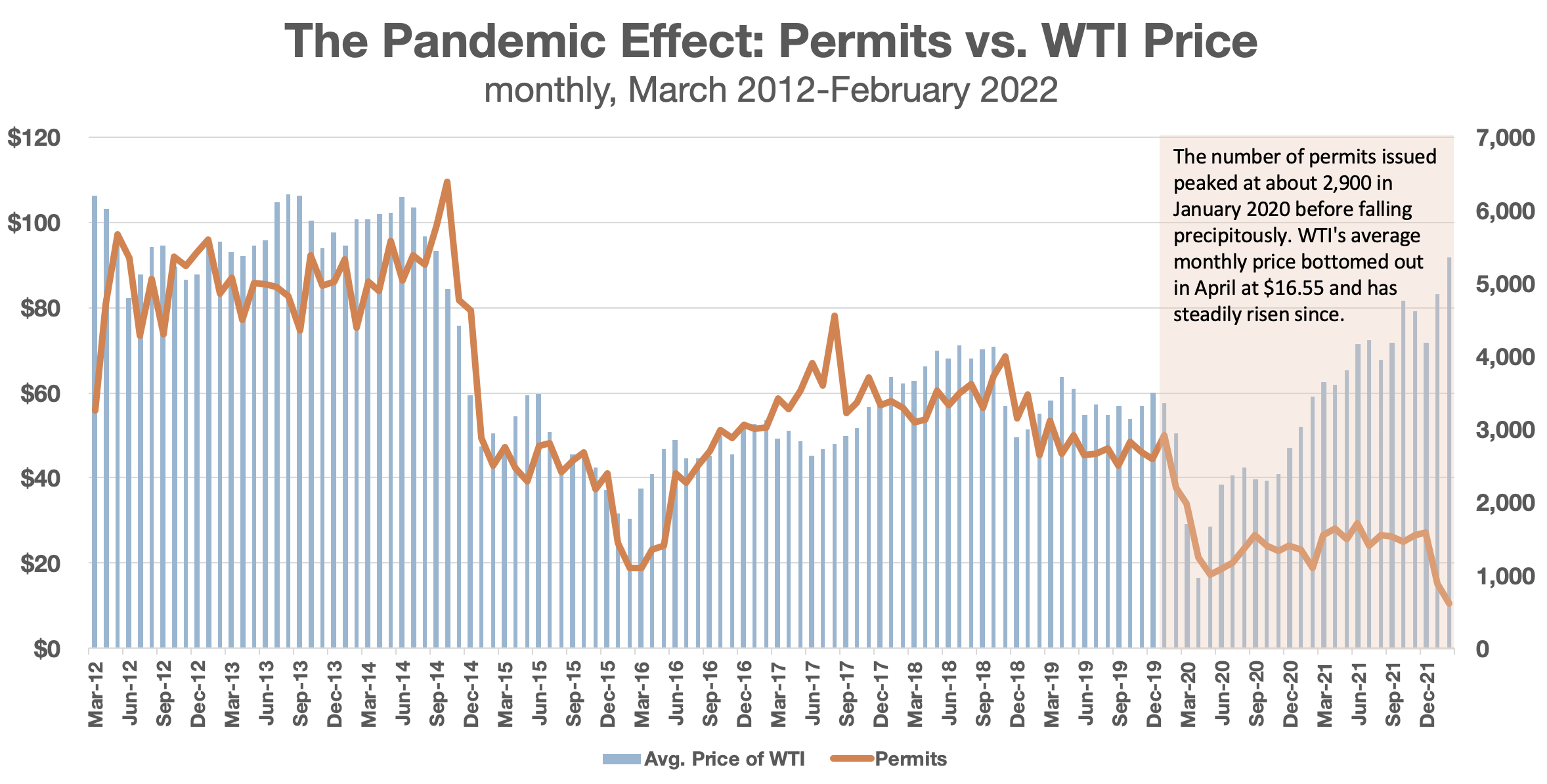

With the exception of 2017, the price of WTI and the number of permits issued to produce it have tracked each other closely throughout the shale era. Since the advent of the COVID-19 pandemic, however, the two have diverged sharply.

In January 2020, U.S. permits totaled about 2,900 and the price of WTI had dipped just slightly from December to average a sturdy $57.52/bbl for the month. After that, both suffered a harsh decline, with WTI slumping to its nadir of $16.55/bbl in April 2020 and the number of permits to barely above 1,000 in May.

From there, WTI commenced a slow but steady climb in which the February 2022 average price eclipsed $90/bbl. The number of permits issued in February, however, was the lowest in more than a decade.

The phenomenon stems from an industrywide response to investors, who have set returns as a priority over growth. Producers are loathed to pump up their capex budgets again, only to struggle with a subsequent crash in prices as a result of overdrilling.

How long will this last? It might well be over already.

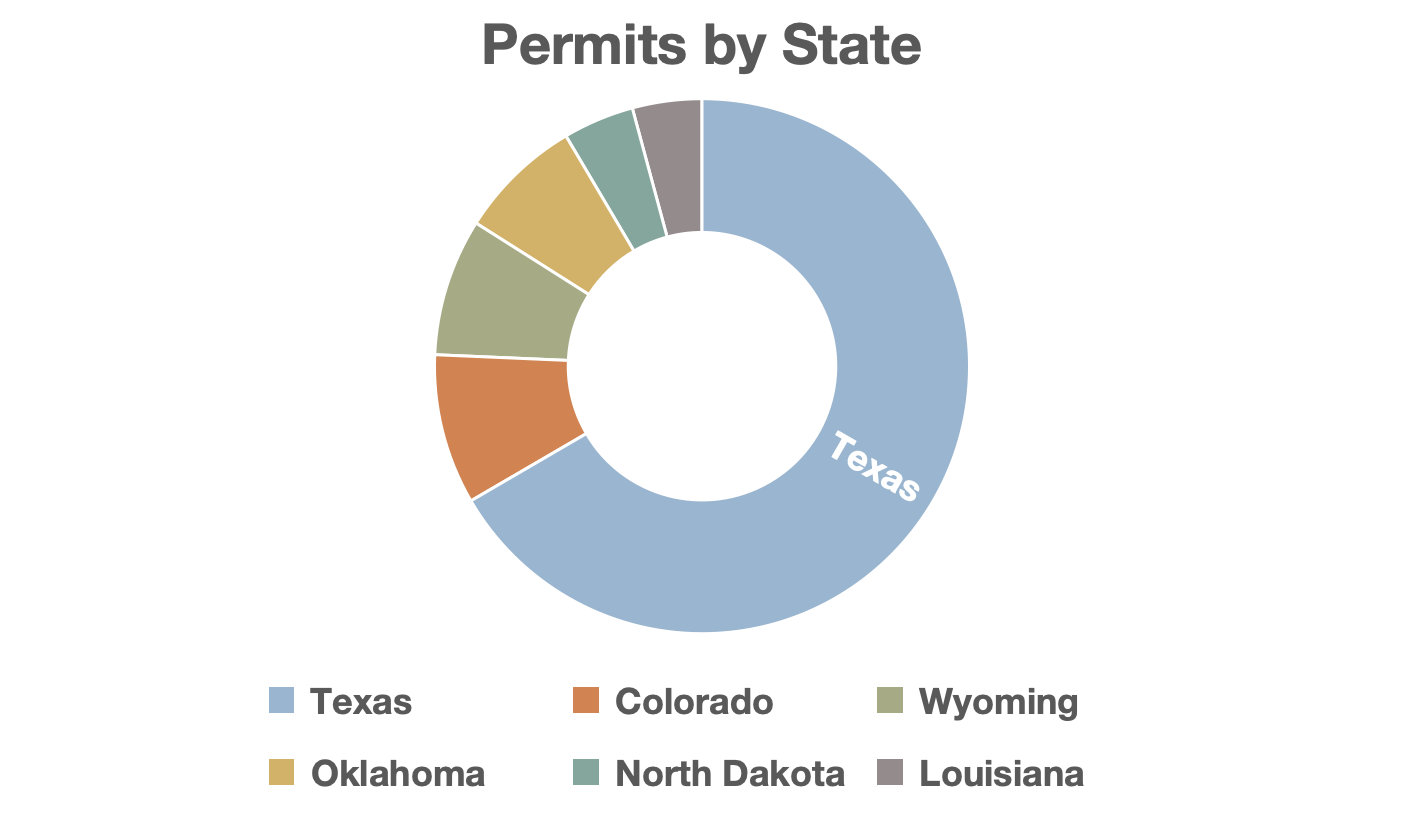

The Permian Basin finished first-quarter 2022 with a best-ever mark for its monthly permit filings in March, Rystad Energy reported. That’s a harbinger of a “robust expansion” of horizontal drilling on the way, but it’s also a continuation of healthy permit activity in the busy Permian.

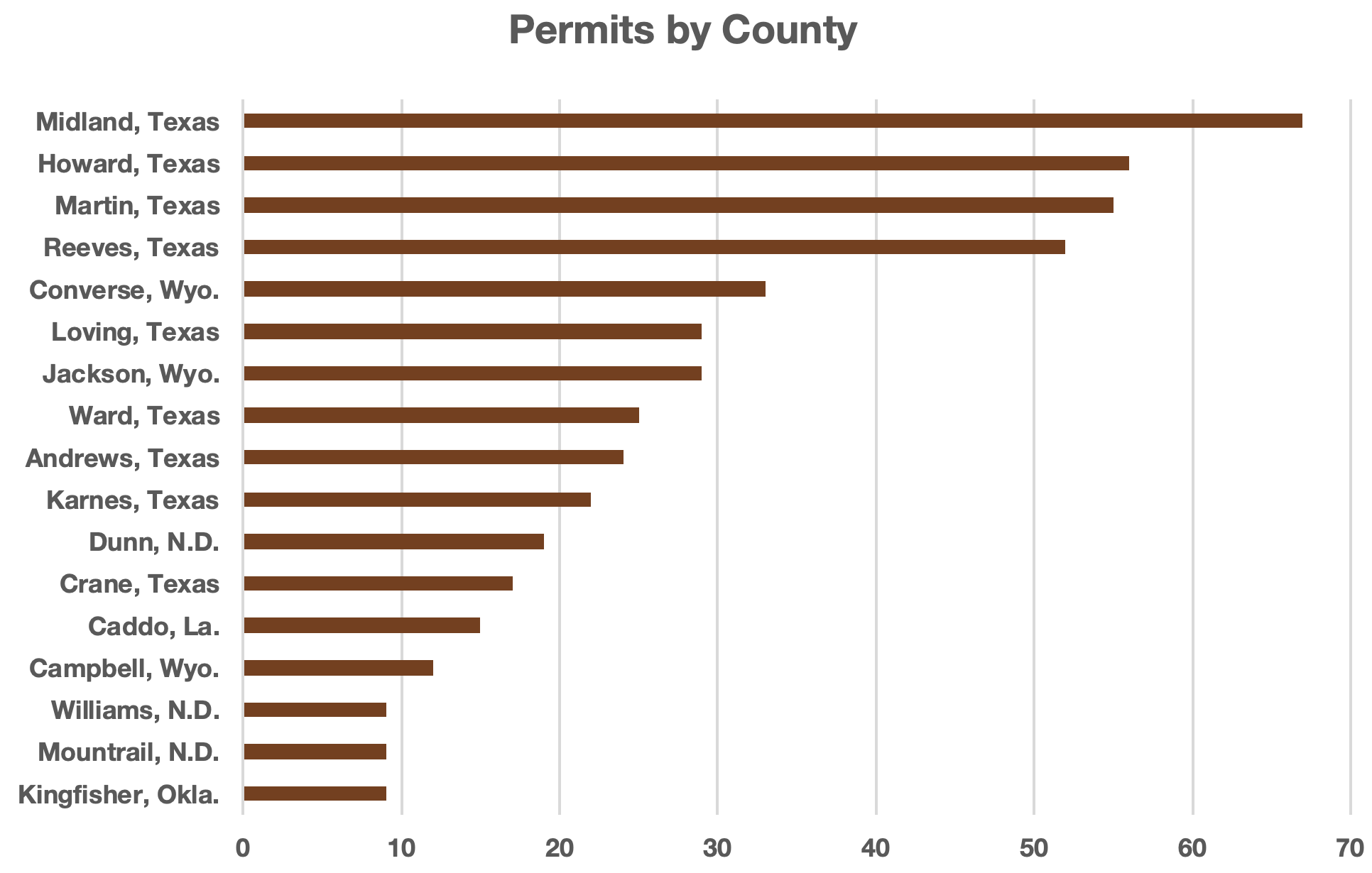

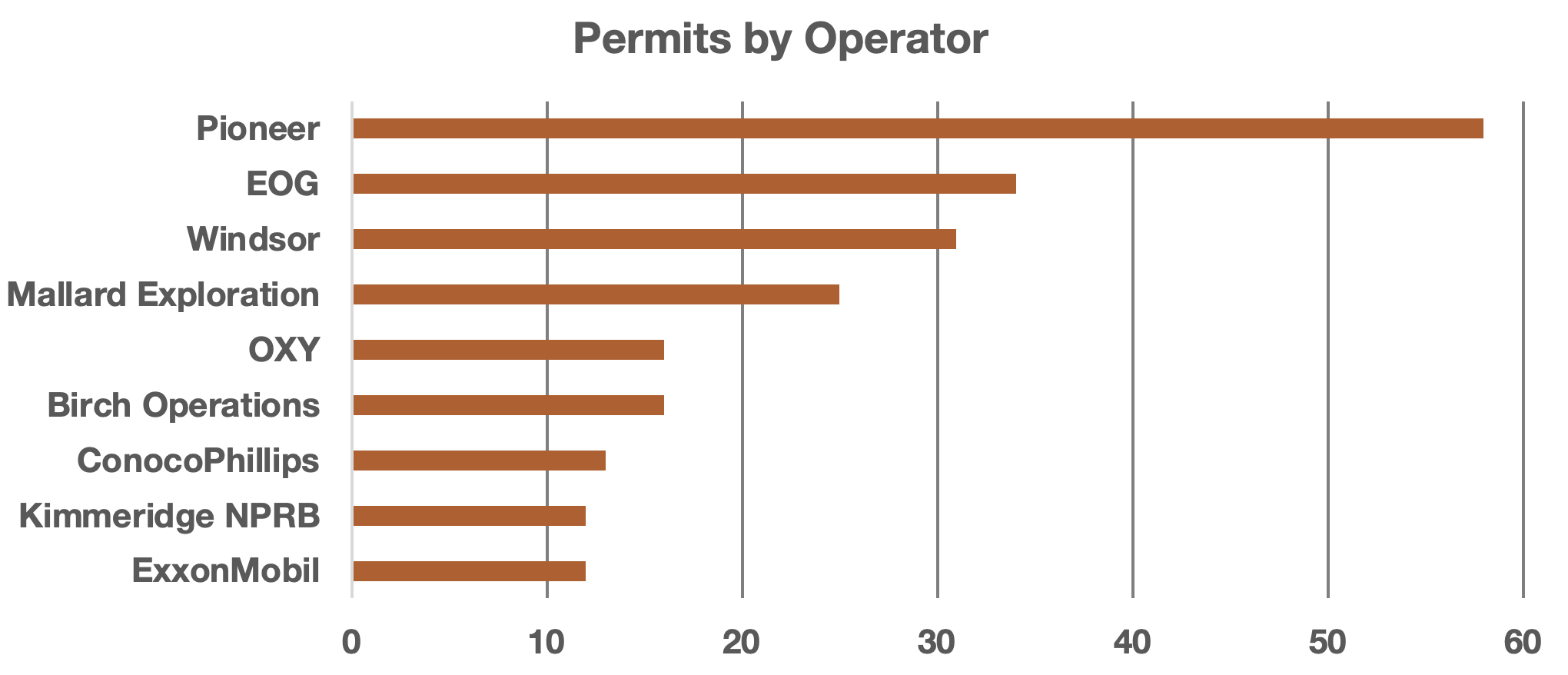

The leading permit gatherer, with 58, is Pioneer Natural Resources Co., also the leading producer in Midland County at the moment and for all time. Following Pioneer is EOG Resources Inc., with operations across a wide swath of the middle of the country. ConocoPhillips Co. is No. 2 in Midland, a spot it has always held.

Recommended Reading

Continental, Antero, Other E&Ps Make Strides in Ground Game A&D

2024-08-08 - Operators have been hard at work on ground game dealmaking from the Permian to Appalachia through the first half of the year, according to reports by Continental Resources, Antero Resources, HighPeak Energy and others.

Texas Pacific Land Acquires Delaware Minerals, Midland Acreage

2024-08-27 - Texas Pacific Land Corp. said it closed acquisitions of net royalty interests in the Delaware Basin and more than 4,100 Midland Basin acres.

CEO: Vital to Chase Less-developed Delaware Zones with $1.1B Deal

2024-07-29 - With the acquisition of Point Energy Partners, Vital Energy is growing in the Texas Delaware Basin—where Vital has already done several deals and has worked to optimize drilling and spacing designs.

Tourmaline’s $950MM Crew Energy M&A Drills Deeper In Montney

2024-08-12 - Tourmaline Oil is adding high-quality drilling locations in Canada’s Montney Shale with the CA$1.3 billion (US$950 million) acquisition of Crew Energy Inc.

Mike Wirth: The ‘Remarkable’ Rise Of Chevron’s Permian Portfolio

2024-08-20 - Chevron aims to grow Permian volumes past 1 MMboe/d in 2025—less than a decade after it averaged less than 100,000 boe/d from legacy holdings in West Texas and New Mexico, Chevron CEO Mike Wirth said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.