(Source: G.B. Hart/Shutterstock.com)

As Pioneer Natural Resources Co. dives deep into the Permian Basin’s Wolfcamp D, the company says it’s no secret that the task at hand is more expensive and challenging.

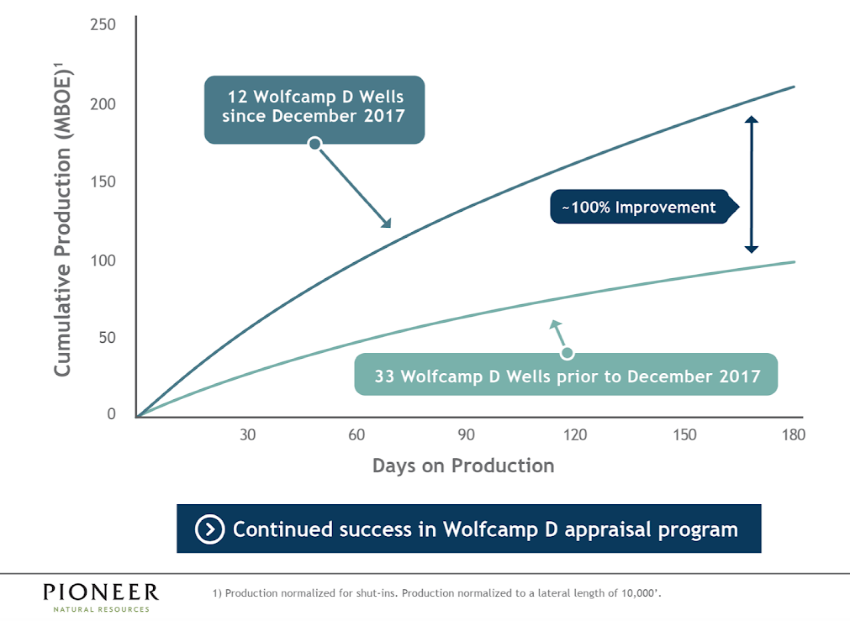

But results of the shale players’ efforts so far in the formation appear promising. The company on Nov. 4 said its Wolfcamp D appraisal program had “strong results” with 12 wells put on production since December 2017 outperforming the average of 33 Wolfcamp D wells placed online before then by about 100%.

The program had several objectives, Joey Hall, executive vice president of operations for Pioneer, told analysts on an earnings call Nov. 5.

“One was to try our completion optimization, which you can see was successful, but also intermingled in there are some spacing tests,” Hall said. “We’ve done four different spacing configurations in different areas. … It just takes time for those things to be understood and make sure that whenever we are ready to execute, we fully understand the impact of spacing completion optimization.”

As wells have been drilled, “we've learned something and gotten better,” Hall added. “But now you want to make sure that whatever adjustments you make doesn’t impact performance.”

The company is also looking to bring costs down further it at works to optimize Wolfcamp D wells—which represents a smaller percentage of its wells—and make them even more competitive.

Pioneer reported about $100 million in annualized facilities savings, ahead of schedule, through engineering and optimization.

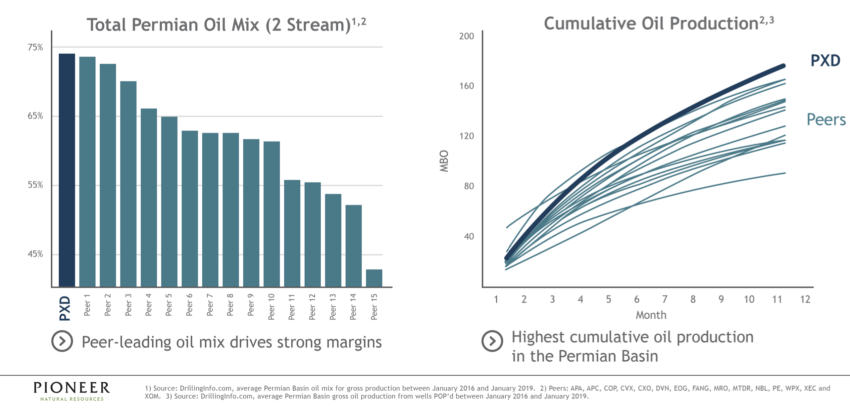

The Permian pure-play has about 680,000 net acres in the Permian’s Midland Basin with a resource base of more than 10 billion barrels of oil equivalent. Horizontal drilling across the Permian has been focused for the most part on benches in the Spraberry and Wolfcamp by shale players. But producers are still learning about Wolfcamp D, the deepest of the benches.

One of the beauties of having a large acreage position is that the company can drill in traditional zones like Wolfcamp A, Wolfcamp B and Lower Spraberry while working to understand Wolfcamp D, Hall said, noting the company’s Joe Mills wells went through a similar transition of appraisal and evaluation before slowly adding more wells.

“We are still tweaking completion designs and cluster spacing, doing more science in regards to understanding the opportunity to reduce costs, because at the end of the day, you know, we’re generating economics, not just trying to produce oil,” Hall said of overall operations. “We want to make sure that all the decisions that we make from a completion perspective have a return.”

“Looking at those curves, I don’t think anybody expects that we’re going to continue to see that kind of improvement year over year,” he added. “It'll eventually flatten out until new technology, EOR or some other opportunity presents itself, all of which are things that Pioneer is looking into.”

The update was given amid continued investor pressure on U.S. shale companies to improve earnings as lower oil and gas prices impact profit margins. Many have reported weak returns despite strides made in lowering drilling, completions and facilities costs among other areas and production gains as reservoir knowledge improves.

RELATED

- Chesapeake Energy Warns Of ‘Going Concern' Risk

- Shale Producer Pioneer Natural Resources Net Income Drops

- Chesapeake Energy Sees 30% Drop In 2020 Capex

Pioneer reported third-quarter 2019 net income of $231 million, down about 44% from $411 million a year earlier. Its production averaged 360,725 barrels of oil equivalent per day (boe/d), up from 320,659 boe/d a year earlier.

However, the company received a lower price for oil, down 6% to $53.93/bbl; natural gas, down 30% to $1.54/Mcf and and NGL, down 53% to $16.61/bbl.

Pioneer generated about $250 million in free cash flow during the quarter.

Analysts with Barclays Capital Inc. called Pioneer’s third-quarter results “solid.”

“PXD delivered on expectations by reporting a strong, straightforward Q3’19 on the numbers,” analysts said in a note.

Barclays added, “Regarding 2020, PXD now has more operational momentum heading into [year-end] ‘19 as it plans to complete 290 wells this year vs. prior guidance of 265-290 wells. Also, while management will not release a detailed 2020 outlook until next year, messaging remains the same, which is that PXD will add two to three rigs on average vs. FY’19.”

On the call, CEO Scott Sheffield said the company added a rig in November.

“We’re reducing the top end of our full year guidance, again, by additional $150 million. We’re increasing our full-year production guidance by 3% at the midpoint,” Sheffield added.

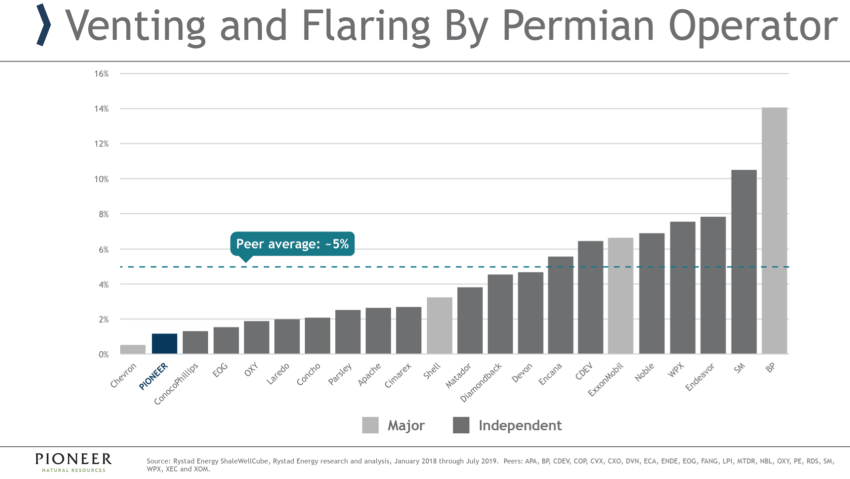

He also highlighted the company’s emissions reductions efforts, pointing out its 40% reduction in methane intensity and 38% drop in greenhouse gas emissions intensity from 2016 to 2018. Key to the performance is not connecting any new horizontal wells to production unless the gas line is already in place, Sheffield said.

“I think that’s something that should be adopted by all producers in the Permian Basin,” he said, adding Pioneer is one of the few companies that aerially monitor all of its facilities for leak detection and repair.

Sheffield also called again on other Permian Basin producers to reduce venting and flaring.

RELATED

- Pioneer, Chevron Call On Industry, Others To Tackle Permian Basin Flaring

- Pioneer CEO Calls Out Shale Industry For Permian Basin Gas Flaring

“Everybody needs to focus on getting down to 2% or below 2%,” he said. More gas pipelines from the basin to the Gulf Coast will help, and midstream companies are willing to work out agreements for those hesitant to commit volumes, he said. “We just need to figure out a way to shut it down. …We just need to take the black eye off, especially going into the next election.”

Recommended Reading

FERC Chair: DC Court ‘Erred’ by Vacating LNG Permits

2024-09-20 - Throwing out the permit for Williams’ operational REA project in the mid-Atlantic region was a mistake that could cost people “desperately” reliant on it, Chairman Willie Phillips said.

Golar LNG Enters $1.6B EPC Agreement for FLNG Project

2024-09-18 - Golar said the floating LNG vessel has a liquefaction capacity of 3.5 million tons of LNG per annum and is expected to be delivered in fourth-quarter 2027.

Bayou Midstream Secures New Equity Commitment from EIV Capital

2024-09-18 - Bayou Midstream II’s commitment from EIV Capital follows Bayou’s predecessor company's successful exit of Bakken infrastructure in 2024 to Bridger Pipeline.

Energy Transfer Says La Porte Pipeline Fire is Burning Itself Out

2024-09-18 - Analysts said they suspect that the pipeline is Energy Transfer’s Justice pipeline, and that news of the blaze has sent prices of propane and butane up since markets closed on Sept. 13.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.