Presented by:

Despite a lingering sentiment of shareholder uncertainty and the steady momentum behind alternative energy to curb fossil fuels, Permian Basin oil and gas operators are poised this year for massive profits, abundant free cash flow and, perhaps, some degree of public grace.

Global demand for oil has rebounded to 95% of pre-COVID levels, according to a year-end 2021 Deloitte report. The burst is boosting both commodity prices and corporate optimism. Russian aggression and the potential for supply ramifications create a volatile unknown. Still, February prices on global benchmark Brent oil popped, breaching $100/bbl and commanding rates at 10-year highs.

“This level of focus on and performance toward fully realizing our mandate[s] has ConocoPhillips very well-positioned to not just survive through the energy transition but to thrive.” —Ryan Lance, CEO, ConocoPhillips Co.

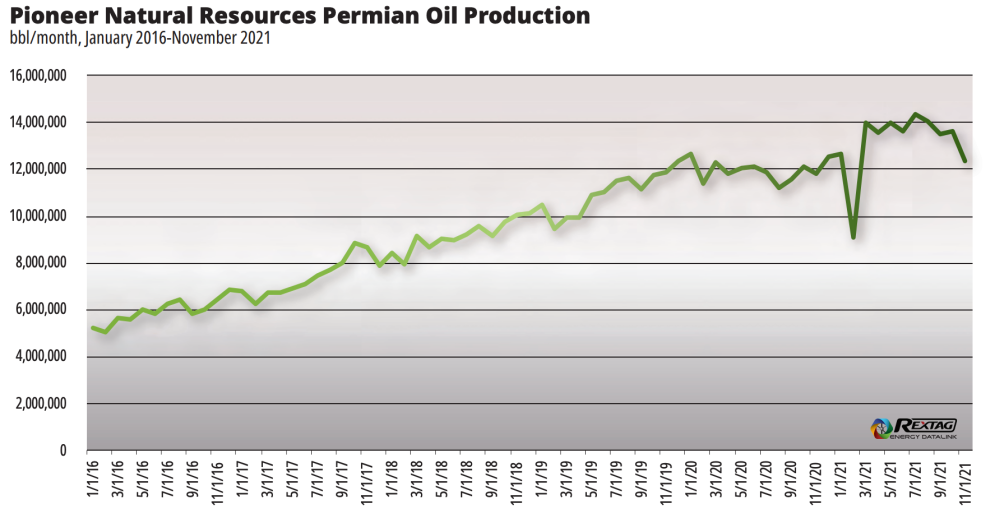

The exuberance is bringing some producers’ share prices along for the ride, too. On Feb. 22, shares in Pioneer Natural Resources Co. traded at $240.97 each, a record high in the company’s 25-year history. Devon Energy Corp. shares’ worth grew 177% and closed out 2021 as the best performing stock on the S&P 500 Index.

To be sure, the price component cannot be overstated. Geopolitical tensions and the commodity supply-demand differentials have largely fueled the increases. But Permian producers, and others across North America, have increasingly embraced the shareholder demands for capital discipline and environmental responsibility.

“We can’t escape the fact that, for the oil and gas industry in general, a large component of our share price is attributed to commodity price,” said Joey Hall, executive vice president of operations at Pioneer. “It’s simple mathematics.”

Soaring commodity prices increase corporate revenue and free cash flow. The difference today compared to the early years of the shale revolution is how executives allocate all that cash.

“We would have taken those profits and reinvested them in growth,” Hall said. “We’ve made a commitment that, to the extent that we have free cash flow, we’re going to return a large portion of that directly to our shareholders in short order.”

RELATED:

Pioneer, ConocoPhillips, Chesapeake Execs Eye Single-digit Growth in US Shale

Current oil prices in the $90s put Pioneer on target to generate more than $7 billion in free cash flow this year. And a consequence of adding a variable component to its dividend last year means the firm will return almost 80% of that cash to its shareholders.

Investors understand and endure the inherent risk of swinging commodity prices. But now they’re learning that when commodity prices sway to the high side, they will see some return, too.

The net effect?

“They are gaining confidence this is a workable model,” Hall said.

“We can’t escape the fact that, for the oil and gas industry in general, a large component of our share price is attributed to commodity price.” —Joey Hall, executive vice president of operations, Pioneer Natural Resources Co.

Capital compulsion

The upstream sector itself is surging with oil and gas stocks outperforming the broader market in North America by double digits. Within the S&P 500, the energy sector in 2020 was serving up negative returns. But by the end of 2021, the performance reversed course, and energy topped the S&P’s 11 sectors with a total return above 50%. This about-face continues to gain traction, and E&P executives say investor sentiment toward the space is gradually improving.

Several factors contribute to the sector’s invigoration. Executives are aligning with shareholders, whether it’s via incentives like Pioneer’s variable dividend and ConocoPhillips Co.’s prodigious share buybacks, or simply reining in capital spending. On average, E&Ps are limiting their budgets to growth around 5% and production increases of less than 10%.

Moreover, even the most strident firms have accepted climate change science and are committing to reducing their emissions, said Subash Chandra, an energy analyst with The Benchmark Company LLC.

Impressive cash flow is enabling many producers to develop the technology necessary to enact pledges to lower emissions. ConocoPhillips is allocating $200 million of its capital program to reduce Scope 1 and 2 emissions.

“This level of focus on and performance toward fully realizing our mandate[s] has ConocoPhillips very well-positioned to not just survive through the energy transition but to thrive,” said CEO Ryan Lance.

While just a few years ago investor angst was at a fever pitch, insiders today may breathe a sigh of relief as upstream companies lay out their upgraded business models.

“I think we’re headed in the right direction,” Chandra said. “The sector is doing all the right things.”

“Even the most strident firms have accepted climate change science and are committing to reducing their emissions.” —Subash Chandra, energy analyst, The Benchmark Co. LLC

Workforce woes, inflated inputs

But while there is abundance on Permian balance sheets, it is not reflected by the number of workers in the field. The 2020 downturn took some 100,000 jobs from the North American oil patch, and barely half of them have returned, according to Deloitte research. Both large public firms and small private companies are feeling the pinch of a tight workforce.

“The competition for workers is getting much more challenging. It’s not restrictive for us and it’s not impacting us operationally, but if you don’t put focus on it, it can certainly impact you,” Hall said.

The climate change conversation and a global move away from fossil fuels has impacted the sector’s ability to attract young talent, insiders said.

“The younger generation may not find our industry as appealing as it once did,” Hall said. Additionally, the cyclical nature of the industry is well-known, and its troughs deepened during the early months of the COVID pandemic.

“When you look at the combination of life challenges people faced during COVID and people losing their jobs, it just takes some time for people to regain confidence,” Hall said. “I don’t think that any of those factors are unique to the oil and gas industry. I think they are factors for all industries. It’s a time of transition for the workforce, and we’re all trying to navigate our way through it.”

“Many workers have abandoned the sector.” —Stephen Trauber, vice chairman and global co-head of natural resources and clean energy transition, Citi.

Many workers have abandoned the sector, said Stephen Trauber, vice chairman and global co-head of natural resources and clean energy transition at Citi.

“It’s not fashionable in the oil and gas sector anymore,” he said.

“We are short on talent. And the oil and gas sector, including service companies and midstream companies, is going to have to pay more for talent.”

But it will take more than money to win over emerging talent, said Chandra. The industry has scar tissue to treat, left over from its earlier battles on ESG with shareholders and activists.

“We don’t have a great social license right now,” he said. “There is an entire generation of younger people who don’t believe fossil fuels play any role in their future right now.”

Young professionals want to do work that offers solutions—not perform in roles that contribute to global problems, Chandra said. The momentum that is driving energy to take a role in addressing climate change is only growing, he said.

What’s the way to win over the brightest minds among millennials and Generation Z?

Chandra points out the challenge isn’t simply to win a popularity contest. Rather, the battle needs to bring down a generational framework.

“I think the very first thing you do is you go above and beyond the call of decarbonizing as much as possible. Try to create the purest product, which is going to cost money, and it’s going to require technology that is still evolving. And that’s what most of the industry is doing now,” he said.

As recently as five years ago, global warming was a hot topic of debate in producers’ boardrooms. Executives argued the science wasn’t settled or the hole in the ozone layer appeared in the earliest part of the industrial revolution. But that’s no longer part of the dialogue, Chandra said.

“There’s no one sitting at the table with a guy who’s trying to debate global warming. The trends are unstoppable,” he said. “The climate change movement has become a very influential one, and now it’s a standard and something that has filtered through every single level of financial society.”

Competition for corporate talent as well as recruiting those workers in the field where laboring under the Texas sun gets intense will be one input that heightens oil and gas costs, but operators are facing inflation across the supply chain, analysts and bankers said. The lack of workers translates to services and other inputs.

“There’s no one sitting at the table with a guy who’s trying to debate global warming. The trends are unstoppable.” —Subash Chandra, The Benchmark Company LLC

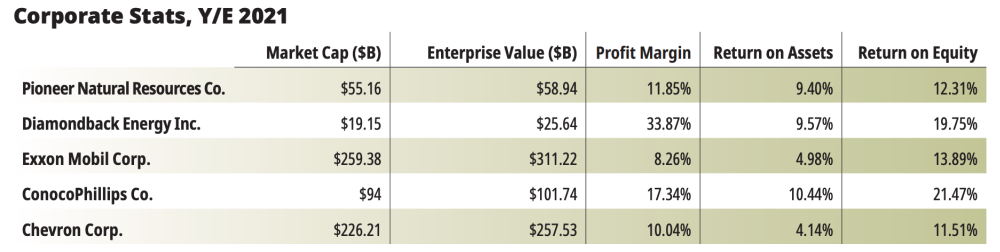

And inflation can creep up on even the most efficient Permian producers. Companies like Pioneer, Diamondback Energy Inc. and ConocoPhillips are largely focused on executing this year with the assets acquired via large-scale acquisitions, which they plan to put to work paying down debt and returning cash to shareholders.

But Permian executives said they must be vigilant to watch for costs that may quickly escalate. Late winter service costs were inflated as much as 15% to 20%. That makes operational execution and efficient integration of acquired assets critical, several insiders said.

“We’re going to see a lot of inflation, probably more than people are anticipating,” said Dane Gregoris, managing director at Enverus.

“There is also going to be a bit more discussion about infrastructure in the downstream, where projects need to get laid so that enough [product] can get up to market and grow the base. Infrastructure and inflation are the two big issues that we haven’t talked about during the last two years, but they are coming to the forefront this year.”

Inflation rates already in the double digits for some companies, especially those that haven’t locked in service contracts, will cause drilling costs to steadily climb well above 20%, Gregoris said.

Incremental activity can get pricey, Gregoris said.

“It depends on the operator and the situation, but we’re seeing some pretty high numbers,” he said.

Larger operators won’t struggle as much as smaller firms, he said. About half of Pioneer’s work this year is already contracted, CEO Scott Sheffield told investors during a fourth-quarter earnings call.

Permian consolidation worth billions of dollars in recent years can insulate some companies, and 2022 could be the moment when recent basin dealmaking pays off.

Consolidation taking shape

Consolidation has taken out many of the basin’s independent E&P companies in the largest public companies’ search for the scale necessary to put operations into manufacturing mode and generate free cash flow for shareholders.

Dealmaking slowed to a halt during the first half of 2020, but it had regained some momentum in the Permian by year-end. ConocoPhillips closed out the first year of the pandemic with its $9.7 billion acquisition of pure-play Concho Resources Inc.

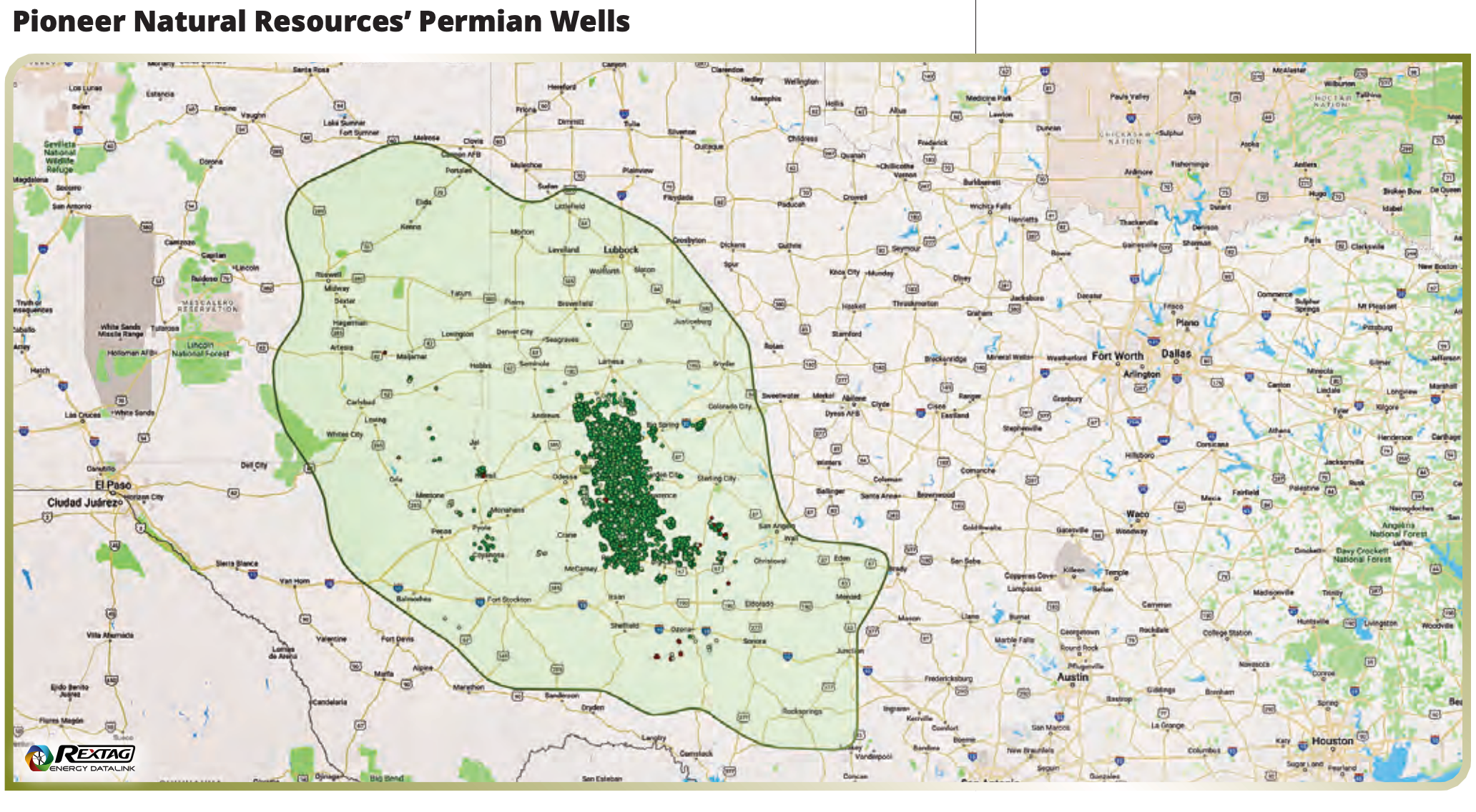

Pioneer Natural Resources shored up its position as the largest Midland pure play in 2021 with its April acquisition of DoublePoint Energy LLC, which grew the firm’s Permian net acreage past 1 million. Six months later, Pioneer rounded out its Midland position with the purchase of neighboring Parsley Energy Inc.

Diamondback Energy firmed up its Midland foothold in March, swallowing rivals Guidon Operating and QEP Resources Inc. Valued at a combined $3 billion, the deals added some 81,000 contiguous net acres to Diamondback’s footprint.

Still, upstream deals flowed in 2020 and 2021 at a rate about half that of prior years when the total neared 400 transactions. Deal value in 2021 amounted to $66 billion, compared to the $72 billion average between 2015 and 2019, according to Enverus.

But dealmaking in the Permian isn’t necessarily played out. While the Midland sub-basin is mostly in the hands of larger firms with the efficiency and knowledge to develop it, the Delaware sub-basin may set the scene for the next round of Permian deals. Combined with the Haynesville Shale in East Texas, deals in the Delaware side of the Permian accounted for 80% of the fourth quarter’s total deal value.

Indeed, the forward trend of the large Permian deals going forward could follow Pioneer’s move in December. The company moved closer to its goal of becoming a Midland-strong Permian pure play in December when Continental Resources Inc. entered the basin and bought Pioneer’s Delaware assets for $3.25 billion in cash.

Insiders say future deals will consist more of bolt-on acreage additions and coring up divestments than full-scale corporate buyouts. But large-scale deals may still be in play in the Delaware’s Tier 2 acreage.

ConocoPhillips’ $9.5 billion cash acquisition of Shell Plc’s Permian position—225,000 net acres in the Delaware sub-basin and production close to 175,000 boe/d—enhanced the firm’s footprint.

“It’s trying to rearrange the jigsaw puzzles so that they have to work more efficiently,” said Chandra.

Recommended Reading

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

Interoil to Boost Production in Ecopetrol Fields

2024-09-03 - Interoil will reopen shut-in wells at three onshore fields, which are under contract by Ecopetrol.

Chevron Boosts Oil, NatGas Recovery in Gulf of Mexico

2024-09-03 - Chevron’s Jack/St. Malo and Tahiti facilities have produced 400 MMboe and 500 MMboe, respectively.

CNOOC Makes Ultra-deepwater Discovery in the Pearl River Mouth Basin

2024-09-11 - CNOOC drilled a natural gas well in the ultra-deepwater area of the Liwan 4-1 structure in the Pearl River Mouth Basin. The well marks the first major breakthrough in China’s ultra-deepwater carbonate exploration.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.