The Pantheon Resources-operated Talitha A well is located on the Alaska North Slope. (Source: Pantheon Resources)

Pantheon Resources Plc is a little guy among giants.

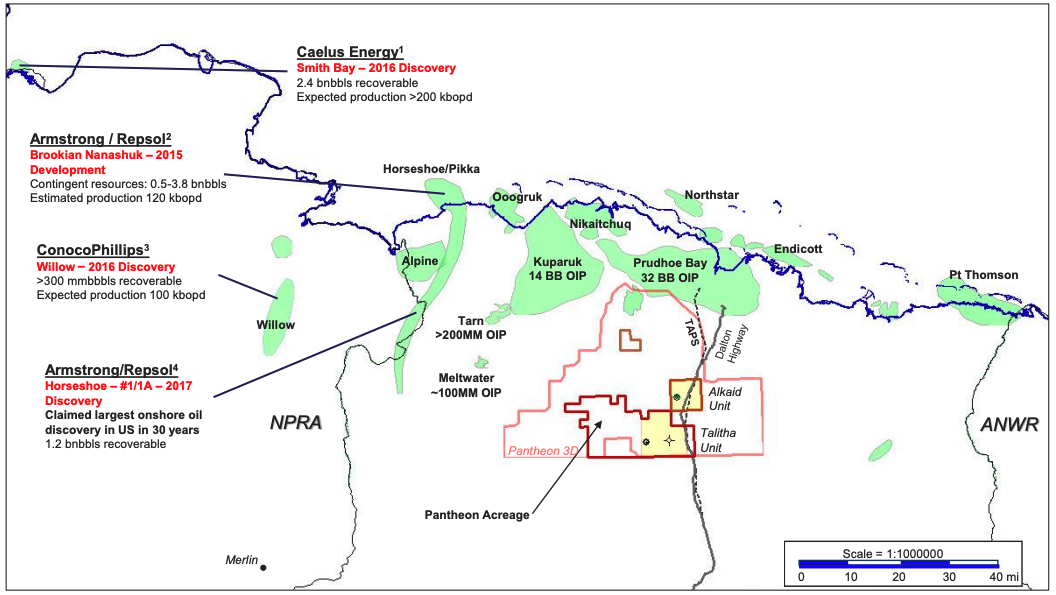

On the Alaska North Slope, the small U.K.-based exploration company weathered the storms of 2020—reducing its staff and cutting salaries, ending the financial year with a financial loss for the period, like many of its larger peers. The oil explorer, however, continues to take on risks in its quest to prove up oil potential across its 160,000-acre Alaskan position.

Pantheon said in May the company believes its 100%-owned Theta West Basin Floor Fan play project, which has been at the helm of the company’s leasing strategy, holds an estimated 1.41 billion barrels of recoverable oil based on a recovery factor of 20% in the Upper Basin Floor Fan and 11% in the Lower Basin Floor Fan.

“We’re literally talking about thousands, even horizontal, wells—if we’re right—to develop all of these zones,” Pantheon CEO Jay Cheatham told Hart Energy. “Because we think going updip at Theta West, we’re going to have a 1,200-foot section in that Lower Basin Floor Fan. … Then you add in the Shelf Margin Deltaic, the Kuparuk, Alkaid and we haven’t even talked about the Slope Fan,” for which resource estimates have not been released.

That system, he said, “looks fairly decent,” according to the logs from Talitha A and other analysis.

If its latest resource estimates are proven, it could mark another win for Alaskan oil explorers. Oil Search Ltd. added to its North Slope resources with the successful Mitquq and Stirrup prospects last year, which helped to boost its 2C contingent resources there to 969 million barrels. Australia’s 88 Energy confirmed oil at its Merlin-1 well.

Pantheon’s recent resource announcement highlights the scale of the potential in its 100% held Alaska North Slope licenses, Canaccord Genuity Capital Markets said in an analyst note May 24. Analysts called it an “undervalued Alaskan appraisal opportunity.”

“The combination of 1) the very large resource, 2) access to services and land transportation via the nearby Dalton Highway, 3) availability of export pipeline infrastructure through the Trans Alaska Pipeline (TAP) which passes across Pantheon’s licenses, 4) a politically safe location, adds up, in our view, to an unusual combination in the E&P sector of positive attributes,” the note said.

However, “there are though still uncertainties. Clearly, the Theta West reservoir (BFF) requires testing—the end of the winter drilling season in Alaska in early April precluded that in the Talitha#A well—and further appraisal drilling, before the scale of the resources can be better defined and, most importantly, commerciality demonstrated.”

The resource upgrade is based on Volatile Analysis Service, completed by Advanced Hydrocarbon Stratigraphy/Baker Hughes, that confirmed the presence of a continuous stacked oil-bearing reservoir zones over a 3,700-ft interval at the Talitha A well. In April, Pantheon said the well, drilled after the company raised about $30 million at 12% equity dilution in November 2020, hit oil in the shallowest Shelf Margin Deltaic, Slope Fan System, Upper Basin Floor Fan, Lower Basin Floor Fan and deepest Kuparuk zones, though the latter flowed at a “disappointing rate” of up to 100 bbl/d.

“No little company in the world at this stage would have 100%, but we do,” Bob Rosenthal, technical director for Pantheon, told Hart Energy. “When we drilled into the Talitha A well, we took a monumental risk for a little company. … We had this huge project called Theta West. We drilled it 1,500 feet downdip from the crest of the structure because we were targeting the shallower zones, but we knew we would intersect the Theta West.”

Pantheon interprets Theta West as a direct analog of the nearby smaller, shallower Tarn Field, a Kuparuk satellite field operated by ConocoPhillips. Pantheon said Theta West also extends east of Talitha A and was penetrated by Pipeline State #1 well, drilled by ARCO in 1988, downdip from Talitha, where oil was also found, Pantheon said. The company said it categorizes the estimates as contingent based on these discoveries.

“It’s pretty obvious that a lot of the market doesn’t believe us because our price is actually down on the news,” said Cheatham, referring to the Talitha A results released in April. “And the other thing is we’re this tiny, underfunded E&P company. … It’s difficult because we’re drilling one well a year. We need to change that dynamic, so that we’re drilling multiple wells.”

Resource estimates for Alkaid were unchanged at about 76.5 million barrels (MMbbl) with 300 MMbbl for the Kuparuk and about 300 MMbbl for the Shelf Margin Deltaic, the executives said.

Next steps for Theta West are to test it next winter and drill the crestal location, Rosenthal said. “Starting at the Talitha A location, in the vertical hole, we will pick out a section of the Theta West fan and we will flow test that in the vertical,” he said, adding several other zones above that would also be tested.

Cheatham added that the company could also return to the Kuparuk and retest it using a relative permeability modifier.

The next steps, however, are dependent on securing the needed funded.

“We have to get it funded in one form or another,” Rosenthal said.

The search for a partner for Pantheon is picking up again, following the 2020 slowdown. About a year ago, when the pandemic led to lockdowns and forced the world to deeply embrace the digital world, Cheatham said “We had a number of people in our data room, but it was clear that the least dilutive thing we could do was to raise equity and still keep 100% of the project internally.”

Rosenthal pointed out that Pantheon is not the only company looking for a partner on the Alaska North Slope. “The groups to the west of us—Oil Search, Armstrong and Repsol—are looking for a partner to come into their project,” he said. “They’ve spent billions of dollars and they’re looking for a partner to come in and spend billions of dollars to get into their project.”

Giving hope is Hilcorp Energy Co.’s $5.6 billion acquisition of BP Plc’s business in Alaska in late 2020; it’s evidence that A&D activity is happening on the North Slope.

“With $50 million as opposed to literally hundreds of millions, we can prove up Theta West, test all of the zones in Talitha A and drill a well at Alkaid and put it on long-term production, where everyone else on the North Slope, literally, as Bob says, has to spend hundreds of millions or billions of dollars to get to that place,” Cheatham said. “We’re unique, and someone like Hilcorp, who as Bob says is great at plumbing, drilling hundreds or thousands of wells, would be a pretty, pretty decent partner—someone like them, if not them.”

Recommended Reading

Dividends Declared in the Week of Aug. 19

2024-08-23 - As second-quarter earnings wrap up, here is a selection of dividends declared in the energy industry.

Gulfport Energy to Offer $500MM Senior Notes Due 2029

2024-09-03 - Gulfport Energy Corp. also commenced a tender offer to purchase for cash its 8.0% senior notes due 2026.

Pembina Completes Partial Redemption of Series 19 Notes

2024-07-08 - The redemption is part of Pembina Pipeline’s $300 million (US$220.04 million) aggregate principal amount of senior unsecured medium-term series 19 notes due in 2026.

Offshore Guyana: ‘The Place to Spend Money’

2024-07-09 - Exxon Mobil, Hess and CNOOC are prepared to pump as much as $105 billion into the vast potential of the Stabroek Block.

Bechtel Awarded $4.3B Contract for NextDecade’s Rio Grande Train 4

2024-08-06 - NextDecade’s Rio Grande LNG Train 4 agreed to pay Bechtel approximately $4.3 billion for the work under an engineering, procurement and construction contract.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.