The Alkaid-1 well is located on the Alaska North Slope. (Source: Pantheon Resources)

[Editor's note: A version of this story appeared in the July 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Unlike some oil and gas companies deciding whether to shut in wells as prices remain at historic lows, Pantheon Resources Plc is facing a different task: finding a partner to develop its Alaskan North Slope assets amid a global pandemic.

“It’s a difficult dance,” Bob Rosenthal, chief technical director for Pantheon, told Hart Energy.

Travel restrictions have prevented some potential partners from going to Alaska, forcing the London-headquartered company—like the rest of the world—to communicate more virtually with everyone working from home. But conversations are picking up after a lull late last year, driven by recent news of a discovery that added resources at Pantheon’s Talitha project located south of Prudhoe Bay, which executives believe made the company more “visible on the world stage.”

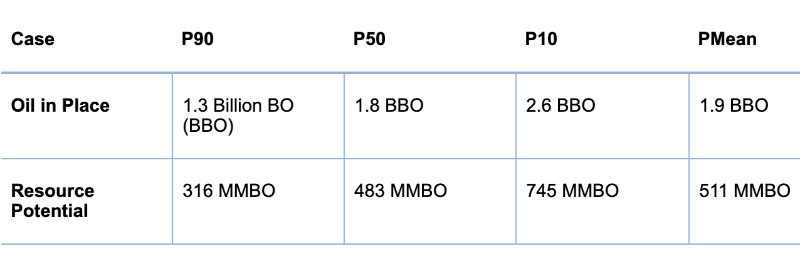

Analysis of recently completed geophysical work by eSeis Inc. indicates the shallowest of four zones at Talitha—the Shelf Margin Deltaic—is estimated to contain 1.8 Bbbl of oil in place.

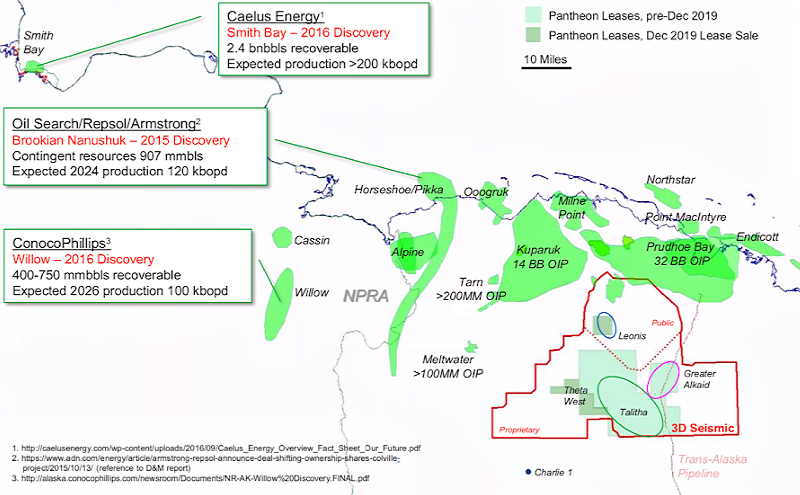

The work was undertaken as Pantheon aims to high-grade its inventory, reprocessing and merging 3D seismic data covering multiple zones at Talitha along with the Theta/Theta West projects to the west, Leonis to the north and Greater Alkaid to the northeast.

Pantheon believes Talitha could produce about 500 MMbbl of hydrocarbons. It’s near the company’s Greater Alkaid, part of the 250,000 leased acres acquired during Pantheon’s acquisition of Great Bear Petroleum in 2019.

“We’re through the idea stage. We’re through the exploration stage. We’re ready to come onstream to work with somebody that wants to reposition their portfolio to a low cost onshore huge impactful reserve position, big production,” Pantheon CEO Jay Cheatham told Hart Energy. “Just out of two reservoirs we could be averaging 100,000 barrels a day easily and then add on from there. We’re pretty excited about our position.

Pantheon’s continued appraisal work and search for a farm-in partner comes as the oil and gas industry faces one of its worst downturns in history. While other companies, including those in Alaska, are holding back production and slowing development, Pantheon is looking to drill but can’t proceed alone. Like everyone else, the company—which has only six full-time employees and a handful of contractors—has reduced its budget, earlier this month cutting personnel expenses by 20%.

Despite the headwinds, Cheatham sees a chance to strengthen the company and considers it fortunate not to be a producer at the moment.

“We are uniquely positioned in the world today, and we see that as an opportunity,” he said.

Resources

Alaska’s North Slope has been the site of some large conventional discoveries in recent years, adding several billion barrels of recoverable resources. Notable finds in the Brookian Sequence have included Caelus Energy’s Smith Bay discovery, ConocoPhillips Co.’s Willow and Narwhal discoveries and the Horseshoe discovery made by Armstrong Energy LLC and Repsol SA (now operated by Oil Search Ltd.). Both are in the Nanushuk Formation.

Oil Search Ltd. added to its production potential from the Nanushuk Formation, reporting in late March the discovery of oil from a well west of the Horseshoe discovery and hydrocarbon pay from a sidetrack.

Pantheon’s major discoveries at Talitha, farther southwest, have been in the Brookian and Kapurak formations. The latest petrophysical work at Talitha point to about 1.8 Bbbl of oil in place in the Brookian-age reservoir. Previous estimates for three zones combined were about 2.6 Bbbl oil in place, the company said in late March.

Results of an old exploration well, the Pipeline State #1 well, along with full core and log data helped the company see the scale of its Alaskan assets, according to Rosenthal, who noted the well has a more than 2,000-ft oil column. “Our next steps are to finish all our work on all the zones. ... As each individual job is done, we’ll put out a resource evaluation.”

Analysis includes two other zones at Talitha—the Slope Fan System (Brookian) and Kapurak Formation.

The site is near Pantheon’s Greater Alkaid project, where the field development plan calls for 44 long-reach, 8,000- to 10,000-ft horizontal wells with multistage fracs.

“Each well, we anticipate, will have ultimate recoveries of over 2 million barrels,” Cheatham said. “We think it’ll generate about 30,000 barrels a day peak rate for an extended period of time and then decline over time.”

Having picked up additional acreage during a lease sale in December, Pantheon is also evaluating a zone in the Pipeline State #1 well where analog oil pay was identified in the Brookian Formation. The Theta West project is just west of Talitha.

Economics

The North Slope can be an expensive place to develop oil and gas assets, particularly for areas that lack sufficient infrastructure, are remote and are slowed by icy conditions.

Today’s market conditions are making matters more challenging.

ConocoPhillips in March said it planned to lower its 2020 capital spending plans in Alaska by about $200 million, laying down a couple of rigs in its Alpine and Kuparuk fields, according to an Associated Press report. Oil Search made similar moves, revising Alaska spend to about $160 million from $230 million this year, slowing down work at its Pikka Unit.

Pantheon isn’t drilling but wants to, executives said.

“That all depends on bringing a partner. Other than bringing in a partner we’re just spending our overhead to work on what we have,” Cheatham said.

The company also has assets in East Texas, but activity there has halted due to low crude oil and natural gas prices. However, development plans continue in Alaska.

“We are we are planning to submit to the state next month a plan for two units—a unit at Greater Alkaid of 23,000 acres and a unit at Greater Talitha of 97,000 acres,” he added.

Being near existing infrastructure helps to keep costs down, Cheatham said. Pantheon’s assets are bisected by the Dalton Highway and Trans Alaska Pipeline System.

Searching for a partner now has its downsides, but there are interesting upsides, Rosenthal added.

“I think people are reevaluating their own internal portfolios,” he said. “Do you want to develop a $2 billion-barrel oil field in deepwater Gulf of Mexico and have a 10-year outlook, or do you want to get into a big project that is probably much higher in terms of NPVs onshore in Alaska?”

Pantheon’s virtual data room has been busy, the executives said, and one meeting with a potential partner—a national oil company—stretched well beyond its originally scheduled two-hour limit.

“We know the industry is going through huge upheaval, but I think our assets are going to shine in this environment,” Cheatham said.

Market conditions may force high-cost producers out of business, he added. “We won’t be producing any significant quantities of crude for two, three, four years and at that point and time, crude oil prices should be—all other things being equal—higher than they would have been otherwise.”

Recommended Reading

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

US Threatens to Not Renew Venezuelan Energy Sector License

2024-01-31 - The U.S. Department of State alerted Venezuela that it could decide not to renew General License No. 44 amid what Washington has labeled “anti-democratic actions.”