(Source: Hart Energy; Shutterstock.com)

[Editor's note: A version of this story appears in the December 2020 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

As experts look to 2021, their carefully constructed models for oil and gas production and pricing have been upended by the pandemic’s stubborn resurgence and the resulting harm to businesses, industries and economic projections.

The recovery is coming, but its timing, strength and duration are not known, now that the COVID-19 impact will last longer than anyone hoped—and yet, the vaccine news is positive for the second half. We may finally get this thing under control in the new year, which, when combined with a new stimulus bill from Congress, could set off a V-shaped economic recovery.

First, let’s talk about oil. Some twists and turns depend on what member nations of OPEC+ decide to do, which was not clear at press time. But the head of oil markets for consulting firm Rystad Energy, Bjornar Tonhaugen, said recently in his daily oil report, “All smoke signals point to a three- to six-month extension of the current [OPEC] cuts.”

That would be good news to reassure the market, especially given that Libyan production is back above 1 MMbbl/d, and OPEC+ was originally supposed to add back another 2 MMbbl/d in January. Rystad also projects that U.S. tight oil production will start increasing in the second half, rising enough to average 10.8 MMbbl/d next year.

The EIA’s latest forecast said Brent crude oil prices will increase to $47/bbl in 2021. It said when the final tally is made, the global use of petroleum and liquid fuels will be 8.6 MMbb/d less in 2020 than it was in 2019.

Many commentators focus on oil dynamics, but what about natural gas? EOG Resources Inc.’s recent discovery in Texas reminded us that there is still plenty of it to be produced.

Henry Hub spot prices averaged $2.39/MMBtu in October, but the EIA was optimistic prices will rise from there, saying it expects growing global demand for U.S. LNG exports and rising domestic demand for space heating will increase prices to an average $3.42/MMBtu in January 2021.

E&Ps polled by the Federal Reserve said they expect to see a narrow band of no more than $2.30/Mcf to $2.60/Mcf. Raymond James thinks $4 by year-end 2021, although it says there is still “a massive imbalance” in gas supply next year. Others have said $5 is possible.

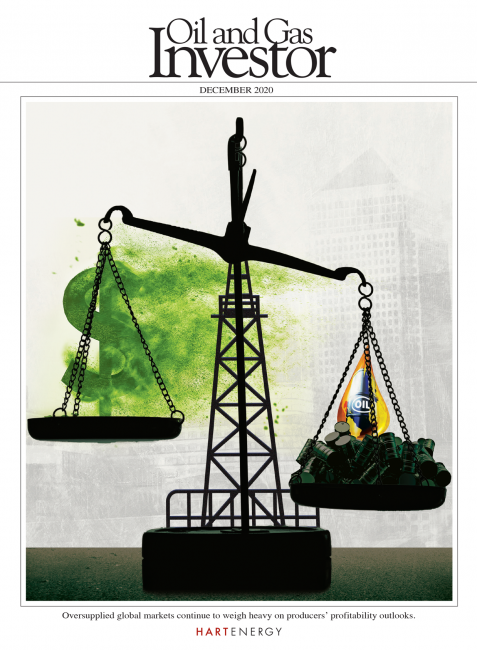

Check out “A Re-Balancing Act,” the cover story for the Oil and Gas Investor December 2020 issue where Leslie Haines addresses the imminent challenges in 2021 and how E&P companies should position themselves.

On separate webcasts in October, the gurus from Range Resources Corp. and speakers on a panel at the Center for Global Energy Policy and the Aspen Institute were optimistic about the role of natural gas domestically and globally, as they reacted to the latest projections from the International Energy Agency (IEA).

The pandemic has created a new, special focus on natural gas, with emerging Asian demand to help propel a 2021 recovery in gas usage, according to Keisuke Sadamori of the IEA. On the webcast, he said gas is an economically attractive fuel to form the bridge to an energy transition and to cut methane emissions.

Many people count on increased LNG demand to help U.S. gas prices. But Sadamori cautioned that about a third of active LNG contracts will expire between 2020 and 2025, most of them in Asia-Pacific, while global liquefaction capacity is set to grow by 20%, “thus quadrupling the amount of uncontracted volumes,” he said. That doesn’t bode well.

Sempra Energy senior vice president Lisa Alexander was cautiously bullish. “Timing is everything. As we come together to propel the global recovery, we see natural gas playing a big role. We think now is the time to go long on renewables, digitalization and natural gas.” She also sees more coal-to-gas switching ahead, particularly as U.S. coal production continues to decline and gas has a supply-cost advantage.

Record production declines, less gas drilling, rebounding demand, and possibly a colder winter, could boost prices as high as $5/MMbtu, according to Morgan Stanley analysts. They increased their average 2021 Henry Hub forecast to $3.25 from $3.05 previously.

“To address the impending supply-demand imbalance, we see the need for materially higher 2021 prices to incentivize much needed investments in additional supply and coal-to-gas switching,” their report said. However, they warned that weak balance sheets and minimal access to external capital limit many producers’ ability to drill enough to offset the coming tight gas market.

Is the rise in the gas outlook too good to be true? Robert Yawger, director of energy futures for Mizuho Securities USA, thinks so. In a November note, he said, “I’m afraid this rally will not end well. Specs are pushing higher despite fundamentals that do not support the size of the rally. Natural gas is arguably bubble material.” He said investors’ combined net long position in seven gas contracts was at a three-year high, yet storage was above the five-year average.

The folks at Range were optimistic. As demand rises, the year-end 2020 supply will be down to 2018 levels.

Recommended Reading

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

Interoil to Boost Production in Ecopetrol Fields

2024-09-03 - Interoil will reopen shut-in wells at three onshore fields, which are under contract by Ecopetrol.

Chevron Boosts Oil, NatGas Recovery in Gulf of Mexico

2024-09-03 - Chevron’s Jack/St. Malo and Tahiti facilities have produced 400 MMboe and 500 MMboe, respectively.

CNOOC Makes Ultra-deepwater Discovery in the Pearl River Mouth Basin

2024-09-11 - CNOOC drilled a natural gas well in the ultra-deepwater area of the Liwan 4-1 structure in the Pearl River Mouth Basin. The well marks the first major breakthrough in China’s ultra-deepwater carbonate exploration.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.