The most ideal outcome for Noble Energy, according to Tudor, Pickering, Holt & Co., would have been a full midstream exit—including its Noble Midstream stake—depending on valuation. (Source: Hart Energy/Shutterstock.com)

Noble Energy Inc. is not letting go of its midstream business quite yet, though some analysts say the move is not the most ideal outcome.

On Nov. 15, the Houston-based independent said, in conclusion of a review launched earlier this year, it decided to retain and increase its ownership in Noble Midstream Partners LP through a dropdown transaction worth about $1.6 billion in cash and stock.

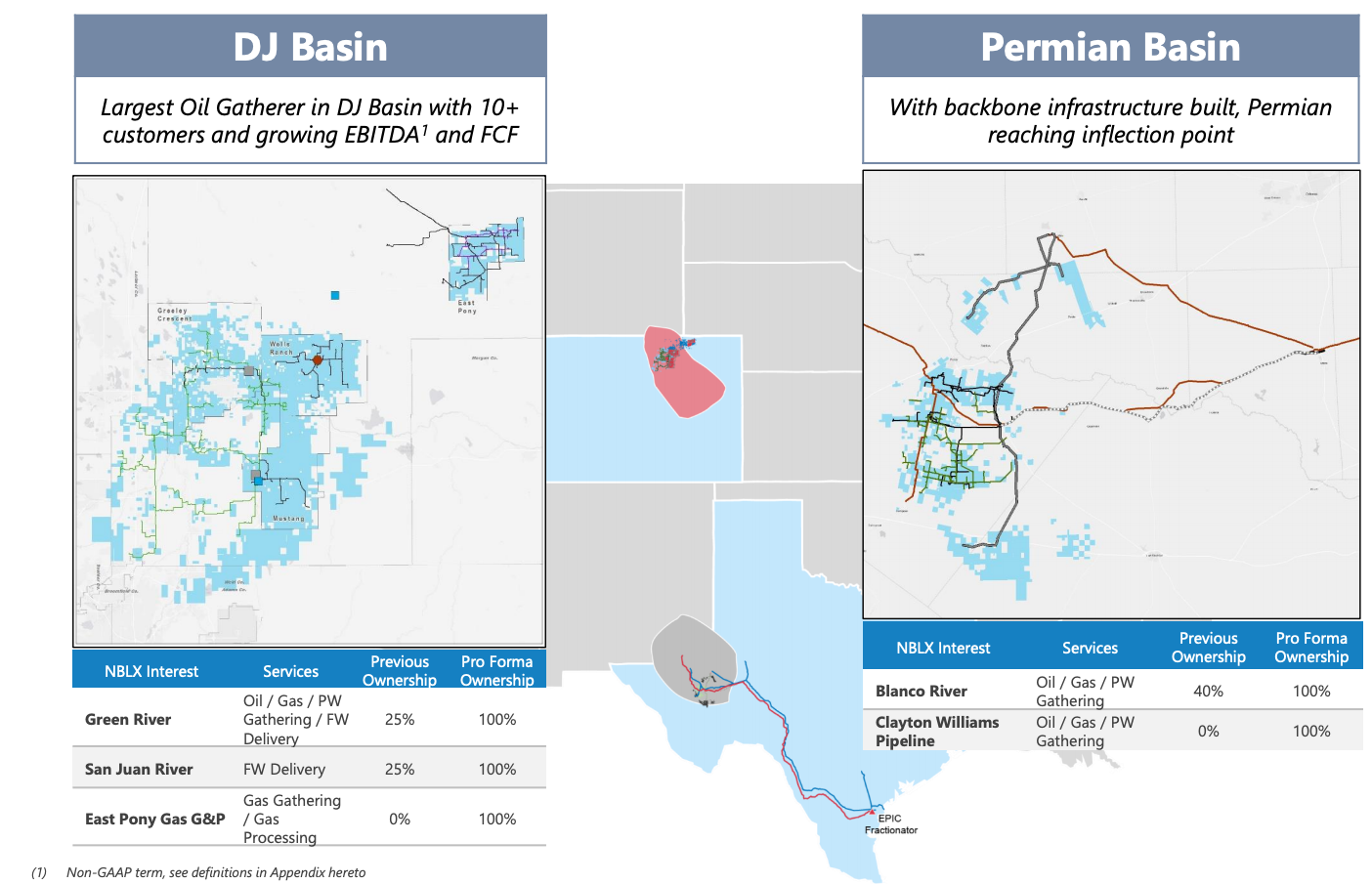

The dropdown includes essentially all of the company’s remaining U.S. onshore midstream interests and assets located in the Denver-Julesburg (D-J) and Permian basins plus the elimination of incentive distribution rights. Noble Energy estimates the EBITDA for the assets sold to be about $160 million for 2020

Phillips Johnston, E&P analyst with Capital One Securities Inc., said the transaction simplifies Noble’s midstream story and corporate structure while also allowing it to retain control of its midstream business.

“However, this outcome will likely be disappointing to some investors that were hoping for an outright sale of part or all of the midstream business to a third party, which would have brought in external cash proceeds and resulted in lower pro-forma leverage ratios and EV/EBITDA multiples,” Johnston wrote in a research note on Nov. 15.

The most ideal outcome, according to Tudor, Pickering, Holt & Co. (TPH), would have been a full midstream exit—including its Noble Midstream stake—depending on valuation.

“[The dropdown] transaction helps remove overhang associated with ongoing [Noble Energy] strategic review but raises question on depth of current midstream M&A market,” the TPH analysts wrote in a Nov. 15 research note.

Noble Midstream is an MLP formed in December 2014 by Noble Energy with the intention for the company to become its primary vehicle for midstream operations in the onshore U.S. outside of the Marcellus Shale. Noble took the company public in September 2016 in a $300 million IPO.

Following the close of the transaction, Noble Energy will own 56.5 million units or about 63% of the outstanding units of Noble Midstream. Noble Energy previously owned about 45.5% of Noble Midstream outstanding units, according to the company website.

The dropdown transaction includes:

- 60% working interest in the Delaware Basin gathering system, which services crude oil, natural gas, and water gathering;

- 75% working interest in the Mustang area (D-J Basin) gathering system, which services crude oil, natural gas, and water gathering, along with freshwater delivery;

- 75% working interest in the East Pony area (D-J Basin) gathering system, which services freshwater delivery; and

- 100% working interest in the East Pony area (D-J Basin) natural gas gathering and processing system.

The transaction will result in Noble Midstream owning 100% of the gathering systems. Additionally, Noble Midstream is set to service substantially all of Noble Energy’s U.S. onshore activity in the D-J and Delaware basins, where 90% of Noble 2019 U.S. onshore capital is expected to be invested.

The total transaction value for the dropdown comprises a mix of $670 million in cash and $930 million in 38.5 million newly-issued Noble Midstream units. The TPH analysts remain neutral on the transaction valuation.

For the transaction, the board of directors of Noble Midstream GP LLC was advised by BofA Securities on financial matters and Mayer Brown LLP on legal matters. The conflicts committee was advised by Baird on financial matters and Baker Botts LLP on legal matters. Noble Energy was advised by Citi on financial matters and Vinson & Elkins LLP on legal matters.

Recommended Reading

E&P Highlights: Aug. 5, 2024

2024-08-05 - Here’s a roundup of the latest E&P headlines, including new oil discoveries and an implementation of AI technology in operations offshore United Arab Emirates.

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

E&P Highlights: Aug. 12, 2024

2024-08-12 - Here’s a roundup of the latest E&P headlines, with a major project starting production in the Gulf of Mexico and the latest BLM proposal for oil and gas leases in North Dakota.

E&P Highlights: July 15, 2024

2024-07-15 - Here’s a roundup of the latest E&P headlines, including Freeport LNG’s restart after Hurricane Beryl and ADNOC’s deployment of AI-powered tech at its offshore fields.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.