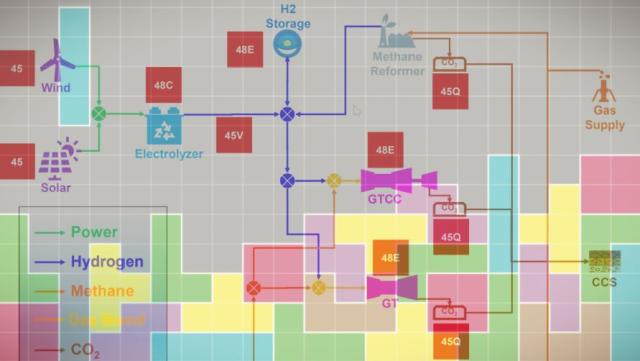

Navigating the new IRA tax credit offerings could be like playing a game of Tetris, according to Mitsubishi’s government relations manager John Young. (Source: Hart Energy / Shutterstock.com)

Stepping inside the massive Inflation Reduction Act (IRA), tax credits are now available at just about every point in the energy and commodity value chain.

However, navigating the new offerings could be like playing a game of Tetris, according to Mitsubishi’s government relations manager John Young.

Some credits cannot be stacked, while the verdict is still out on whether others can be. As hydrogen, energy storage and other energy players await more IRA guidance from the U.S. government, energy company executives are strategizing and evaluating various credits to determine the best approach to unlocking clean energy economic benefits.

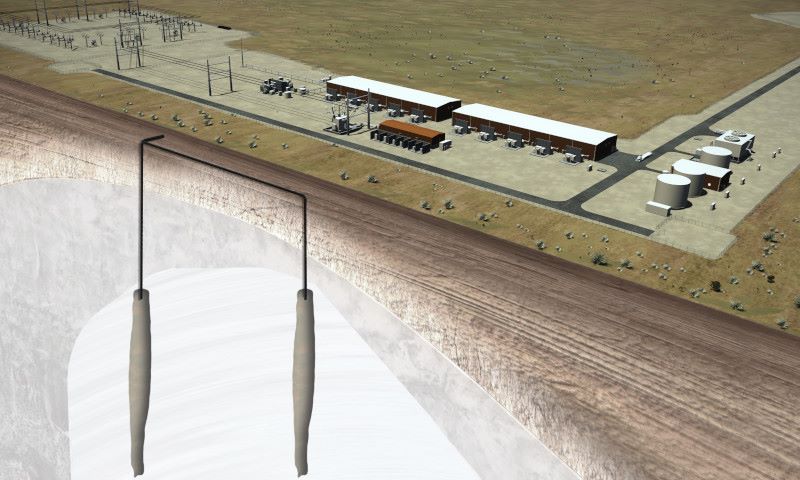

For Mitsubishi Power Americas, tax incentives could accelerate the company’s energy transition growth engine. The company, as Young explained on a recent webinar, is building what could become one of the world’s largest long-duration energy storage projects in Utah.

“As a company who makes power generation and storage equipment, develops energy projects using equipment and leverages the strong partnerships we built with both public and private sector leaders, we are particularly excited about the flexibility the IRA provides to build a framework,” Young said. “The stackability of the wide-ranging applications and the flexible eligibility for these credits taken together are truly game-changing for our business strategy here at Mitsubishi Power.”

Eyeing incentives

Among the solar incentives in the IRA is a 30% investment tax credit for solar generation facilities. Up from 26% in 2020 through 2022, the credit was set to drop to 10% in 2024 before the IRA’s passage.

“Projects that can certify that all their steel, iron and manufacture components were produced in the U.S., i.e. these domestic content requirements we hear a lot about, can qualify for an additional 10% of [those] tax credits, and so can projects located in a community that has historically relied on fossil fuel industry or energy community as defined by the DOE [Department of Energy],” Young added.

The IRA also expands the production tax credit (PTC) to include solar instead of only wind.

“That clean energy PTC is going to be available until the end of 2024, when it will become technology neutral,” he said.

Manufacturers of solar photovoltaics are also eligible for credits, including the advanced manufacturing production tax credit (45X MPTC), which could prove beneficial in alleviating some supply chain issues.

“To put it simply, the idea is if we start making cheaper solar stuff here using 45X, those supply chain issues become mitigated over time, and we start to see … our solar developers enjoying regulatory certainty in one hand and supply chain certainty in the other,” Young said.

However, he said Mitsubishi Power is most excited about standalone energy storage projects, which combats intermittency issues by enhancing grid flexibility, reliability and resilience. The company’s Advanced Clean Energy Storage (ACES) project in central Utah will produce green hydrogen and store it across two massive salt caverns.

Hydrogen incentives in the IRA include sections:

- 45Q, which increases incentives for use of carbon capture and storage, ranging from $60/tonne for utilization from industrial and power generation carbon capture to $180/tonne for storage in saline geologic formations from direct air capture;

- 45V, which creates a new tax credit of up to $3/kg, depending on carbon intensity, for the production of qualified clean hydrogen;

- 48C, which expands the investment tax credit to include facilities that manufacture energy storage systems and electric grid modernization equipment among other items; and

- 48E, which makes qualified energy storage technologies eligible for the clean electricity investment tax credit.

“We’re looking at potentially availing four layers of these credits for hydrogen production and storage projects,” Young said. “We still need additional guidance from [the] IRS and DOE on some of these credits, but we are well on our way to understanding the enormity of these tax benefits.”

Stacking credits

The approach involves determining which credit, or credits, can be used for each part of the commodity value chain and which ones are more advantageous, if more than one credit can’t be used, as Hari Gopalakrishnan, lead consultant of market intelligence and strategy at Mitsubishi Power Americas, explained.

When it comes to electrolyzers, the 45V credit is more beneficial because the credit is directly proportional to the variable costs of the hydrogen production system, Gopalakrishnan said.

“The variable costs account for 64% of the lifetime cost, and that’s why it’s more beneficial to avail the 45V credit as opposed to the 48E credit, which is a one-time credit based on the investment dollars in the electrolyzer itself,” Gopalakrishnan said.

“The IRA credits are available for a span of 10 years, whereas the service lifetime of electrolyzers is 30 years.”

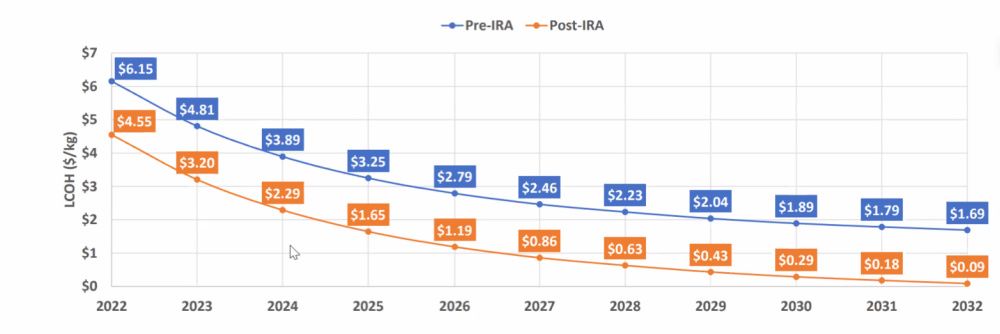

The levelized cost of hydrogen (LCOH) has already been falling. Before the IRA’s passage, the LCOH was $6.15/kg, but it drops to $4.55/kg post-IRA, Mitsubishi Power data shows. By 2030, the LCOH could be down to .29/kg post-IRA.

The story is similar for the levelized cost of storage.

Gopalakrishnan used the ACES project—which includes gas turbines, storage facilities, salt caverns, electrolyzers and upstream renewables—as an example.

“Today, the cost of that system is $185 a megawatt hour… and it declines to $96 a megawatt hour by 2032. That’s largely being driven by the declining cost of electrolyzers,” Gopalakrishnan said. “If we avail four layers of credits, which again, we are being optimistic [because] the guidance has to be provided by the IRS and DOE, the cost today goes down to $83 a megawatt hour, declining to $9 a megawatt hour by 2032,” he said.

Unfinished business

While incentives in the IRA could turbocharge the hydrogen and other low-carbon sectors, more is needed to advance clean energy, experts say.

“Congress set us up really well in the IRA with this tremendous amount of flexibility and a historic 10-year runway for many of these credits,” Young said, “but the longer it takes for a facility to get permitted and placed into service, the shorter that runway becomes.”

RELATED:

Experts: Deep Decarbonization Requires Hydrogen Pipelines, Infrastructure

Federal permitting reform, including for transmission lines, is needed to finish the job, he added, noting Mitsubishi is speaking with its “congressional champions” to make the company’s stance known. “We do need some additional next steps from Congress in this regard.”

Permitting reform legislation was proposed last year, but the effort failed. Still, there is legislative appetite to revisit the issue given it’s seen as a major challenge for the entire energy sector.

Permitting reform may be on the minds of many. Not mentioned as often is the enormous boost given by the IRA to the DOE’s Loan Programs Office (LPO). Young called it a “sleeping giant” and “an unsung hero in federal U.S. energy development.”

“Broadly, it finances these large-scale energy infrastructure projects in the U.S. by providing loans to energy projects that would otherwise have a lot of difficulty being funded by the market,” Young said. “The IRA significantly broadens the reach and capacity of the LPO by appropriating about $11.7 billion in total through the office to support issuing new loans to projects, thereby increasing the existing loan programs by approximately $100 billion in new loans. $100 billion is worth repeating.”

Recommended Reading

Hirs: AI and Energy—Is There Enough to Go Around?

2024-11-07 - AI data centers need a constant supply of electricity, and the nation’s grids are unprepared.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Range Confirms: Data Center Talk Underway for Marcellus Gas-fired Power

2024-10-24 - Deals will take a while, however, as these multi-gigawatt agreements are also multi-decade investments, said Range Resources CFO Mark Scucci.

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

Morgan Stanley Backs Data Center Builder as AI Fervor Grows

2024-10-21 - Morgan Stanley Infrastructure Partners (MSIP) is backing data center developer Flexential as demand for AI and high-performance computing grows.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.