The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Confluence Resources is offering for sale certain operated and nonoperated assets including minerals and ORRIs in core D-J Basin. A rare opportunity to acquire strong PDP cashflow with dozens of operated “drill-ready” locations and NRI’s >85% in many cases.

Asset Highlights:

- Premier leasehold and mineral position with 18 operated and 7 non-operated producing horizontals. Tier 1 well performance in multiple Niobrara benches and Codell.

- 8,400 BOE/D September net production (81% liquids) from diversified commodity mix

- September 2022 PDP net cashflow of $15.0MM (99% from operated horizontals), NTM PDP net cashflow forecast of $102MM.

- 3,628 net leasehold acres (~94% HBP) and 338 net royalty acres in minerals. 55% of leasehold has overriding royalties averaging 6.6%.

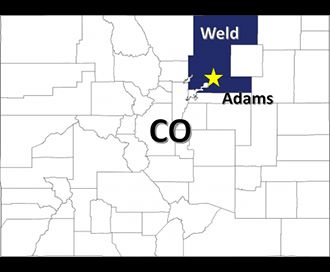

- Production from 38 operated "drill-ready" locations in Weld County adds 18,900 net BOEPD and $34MM/month operating cashflow by September 2023.

For more information, visit meagheradvisors.com or contact Nick Asher at nasher@meagheradvisors.com or 303-721-9781.

Recommended Reading

Beryl Makes Landfall East of U.S.’ Largest Energy Export Gateway Corpus Christi

2024-07-08 - Tropical storm Beryl made landfall in Texas as a Category 1. Life-threatening storm surges are expected to continue along the coast of Texas from Port O’Connor to Sabine Pass, including the eastern portion of Matagorda Bay and Galveston Bay, according to the National Hurricane Center.

The Biden Effect: LNG SPAs Fall 15% in First Half 2024 After Pause

2024-07-03 - Poten & Partners data show that the total volumes associated with LNG sale and purchase agreements fell by 15% in the first half of 2024 compared to the same period in 2023 following the Biden administration’s LNG pause.

Gulf Coast Ports Slowly Reopening to LNG After Beryl Strikes

2024-07-09 - With more than 2 million without power in the Houston area following Hurricane Beryl’s July 8 landfall, and little information on outages from CenterPoint Energy, a workaround can be found using the Whataburger app.

New Fortress Energy Receives OK to Export LNG to Non-FTA Countries

2024-09-03 - New Fortress Energy has been authorized to export up to nearly 1.4 mtpa of LNG to non-FTA countries from its Fast LNG 1 project for a term of five years.

What's Affecting Oil Prices This Week? (Sept. 16, 2024)

2024-09-16 - With expectations for more favorable supply/demand fundamentals and improvement in the sentiment of oil traders, Stratas Advisors forecast higher oil prices with the price of Brent crude moving back above $80.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.