[Editor's note: A version of this story appears in the April 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

One of the most popular parlor games played by CEOs, investment bankers, analysts and investors is like charades—a real guessing game. We’re talking about lively discussions that put one E&P company with another and consider which companies would be choice merger targets—or put another way, the most vulnerable.

Sliding oil and gas prices in first-quarter 2020 turned up the pressure cooker where E&P companies already found themselves stewing, many in a pungent sauce of high debt. The downturn and uncertainty will push some companies on the margin to consider selling, in hopes of taking a buyer’s stock for some upside.

Opportunities abound. Many private-equity-backed E&P firms have reached their sell-by date of three to five years since inception. If they are in the Permian Basin, they are all the more ripe for consolidation. After all, doesn’t everyone want more Permian acreage?

It’s anybody’s guess as to when the M&A game will begin. Will we see another blockbuster deal between giants like Occidental Petroleum Corp.’s combination with Anadarko Petroleum Corp., or a marriage between two large independents such as Concho Resources Inc.’s hookup with RSP Permian Inc. for $9.5 billion—all in stock?

We asked analysts to ponder the combinations that could make sense. Any and all E&P companies are targets at the right price, but, given that, M&A is no longer an investment thesis that would woo anybody back to the sector. The focus now on the part of companies and investors is to spend on maintenance mode, repair balance sheets and get that free cash flow going. If a deal is done, it has to be accretive, and the pro forma company that results has to have low leverage.

“Acquisitions are like picking up hand grenades—a misstep (i.e. using equity!) can end poorly,” said Bob Brackett, Bernstein research analyst, in a January note. In general, companies that are likely to be acquired include those with high costs but rapidly growing production and cheap stock valuations, he said.

But will investors applaud a deal in this environment?

“I think M&A is mostly a distraction now,” said Gabriele Sorbara, managing director and equity research analyst for Siebert Williams Shank & Co.—itself the product of a recent merger of investment banks. “As an analyst I’ve shifted to other themes because we’ve seen that M&A is not going to create value. It’s just not a theme for investors like it was maybe five years ago. It’s not a call I can make for clients,” he told Investor.

Nevertheless, Sorbara said, high-quality Permian pure plays with a lot of inventory could be good targets. “I do think managements know now what makes a good deal, and they are not in any hurry to buy,” he added.

Majors to act?

Much of the deal speculation centers on which majors or international oil companies with the most firepower could make a big move, such as when Exxon Mobil Corp. acquired Bopco LP (the Bass family entities), or before that, XTO Energy Inc. It’s not clear that they should make such a move or would be rewarded if they did. But sellers like to accept stock in a major, thinking that could be rewarding compensation in the long term.

“I think what everybody wants to see is the majors coming in, but they tend to buy at the wrong times, when prices are higher,” said Sorbara. “Plus, their commentary on the recent conference calls is that they plan to be shrewd and protect their balance sheets, and no one is in a hurry,” he said.

Several observers echoed Sorbara’s theme of the majors seemingly reluctant to enter the M&A arena. Looking within his coverage group at Bernstein, Brackett said Concho Resources and Pioneer Natural Resources Co. “are the obvious meals for mega-majors (but like pythons, majors can last a long time without a meal).” He might be prescient: His top candidate to be acquired, as mentioned in a report two years ago, was Resolute Energy Corp., which was acquired by Cimarex Energy Co. in March 2019 for $1.6 billion.

In a recent research note from Cowen & Co., analyst Jason Gabelman, who covers the majors, estimated “Chevron [Corp.] would likely show flat Permian production from its current portfolio before accounting for potential Permian growth beyond plan, which is a 2023 goal, new projects, exploration success and M&A.”

A buyer has to have money and motivation. Sorbara considered the case of Marathon Oil Corp., which has about 10 years of drilling inventory and yet some concerns as its Eagle Ford position matures—that could be motivation. It has the checkbook, too: $3 billion on a fully undrawn borrowing base. However, he noted that company management has said on conference calls that it is not looking to do a deal, preferring instead to expand inventory internally, such as with its Austin Chalk play in Louisiana, under the rubric of its so-called “Rex” (resource expansion) plan. He also noted there have been rumors of Marathon merging with an equal like Devon Energy Corp., which he said could be logical.

Most analysts hesitate to name names on the record, but of course privately, plenty of fantasy combos are emerging in what-if scenarios. But Mizuho Securities USA managing director Paul Sankey did some speculating in his research note issued just before the analyst days that were scheduled in early March by Chevron and Exxon Mobil. He noted Exxon Mobil’s stock trades at a 15-year low.

“One mega-move into environmental/emission friendliness would be for either [Chevron or Exxon Mobil] to buy Occidental … which has some of the world’s largest CO2 sequestration operations. We only see this as a friendly deal, and [with] Oxy CEO Vicki Hollub in control, our view is that the Oxy dividend is safe.” [Editor’s note: Occidental slashed its shareholder dividend on March 10 due to the collapse in oil prices.]

Gabelman said he doubts Shell will do anything big in the near term, although its name frequently comes up as a Permian buyer. “They have a large capex plan of $24 billion to $29 billion this year that includes $5 billion that could be used for M&A. After this year, their annual capex budget excludes M&A, which could give them capacity to execute a larger transaction. However, we believe they have other financial priorities that could limit interest in M&A such as the buyback and the debt.

“Total has stated many times that it’s not interested in acquiring any U.S. shale. BP [Plc] is digesting what they acquired from BHP, so I don’t see them doing anything this year.”

Many are skeptical about any major deciding to do a deal, because so many of the big acquisitions they’ve made in the past few years have caused a lot of indigestion. Huge reserve write-downs have plagued these buyers.

“It’s historically been horrific. In general, majors buying independents has not worked out, so they’ll need to be picky,” said Leo Mariani, an E&P analyst for KeyBanc Capital Markets.

He cited the Exxon Mobil-XTO Energy deal, ConocoPhillips’ buy of Burlington Resources Inc. and Chevron’s acquisition of Atlas Resources’ assets in Appalachia. Each deal was weighted heavily to natural gas, but then the price of gas tanked, wreaking havoc across the U.S.

“What surprises me is if a buyer who’s in good shape buys a company that’s not giving them operational efficiencies, but it’s celebrated if what they’ve bought is on the verge of generating free cash flow,” said Subash Chandra, managing director of E&P at Guggenheim Securities.

MOEs or survival pacts

Mergers of equals (MOEs) are a tactic some analysts advocate, especially in the small- and mid-cap space, although others take a cautionary stance because value depends on the quality of the equals. Two weak sisters hanging onto each other to stand up is not a pretty picture.

Sorbara calls these “survival pacts” that won’t work if the pro forma result has too much debt.

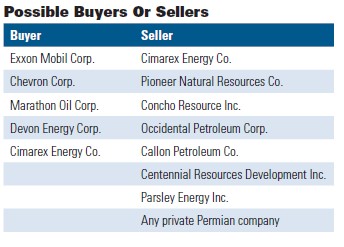

“You just end up with a larger pile of debt. Now the Parsley-Jagged Peak deal was a good combination because it created a pro forma company with low leverage and high margins. But I don’t think a major comes in and buys a Callon Petroleum [Co.]—that doesn’t move the needle. “Maybe you could see Cimarex [Energy Co.] targeted by Chevron since they already are in a JV [joint venture] in Culberson County. But I am not making a call on any of these,” he emphasized.

It may be that the most likely crew of buyers is motivated to gain scale and add to their drilling inventory, and reduce overhead, but when will they act and what can they pay?

“A lot of the obvious combinations have already happened, but I do think more of the Permian companies could get bought out,” Mariani said.

The Permian Basin remains the only region that’s consistently most attractive to buyers. There’s plenty of fish in that pond. According to data supplied by Enverus, there are almost 140 private E&Ps in the Delaware and Midland basins, excluding mineral and royalty companies. Of the 400 private-equity-backed E&Ps it identified in the U.S., nearly 65% were funded in 2016 or prior years, meaning the time to monetize is nigh.

Seeking inventory

Before E&Ps can even think about matching up, they have to get their house in order, analysts say. It’s like reentering the dating scene after a long hiatus: First, they have to lose some weight, color their hair or rewrite their online profile.

A company without enough drilling inventory is like a person with no date next Saturday night, the lack of it being a strong motivator to take action. There is no strong rule of thumb as to how much inventory a company should have—it’s subjective—but The Street generally begins to understand who’s short and who’s long, Chandra said, with short being three to five years of visibility.

“I think the industry thinks high-quality drilling inventory is becoming more limited,” Mariani said. “Most companies are in pretty good shape for the next three to five years or so on that score. And if they do make a deal, it takes time, by the time you negotiate it, close and then begin drilling on that. Certainly if you step down in [acreage] quality, you can extend that inventory life.”

There are two types of buyers, observed Chandra. The first is an over-levered company that’s heading toward cash-flow neutrality that needs more production. The second is inventory-short but with debt metrics that are reasonable. Their acquisition has to make sense at the asset level, like entering a new basin or buying adjacent acreage to support longer lateral wells.

“The dream combo is going to be a free-cash-flowing acquisition with inventory less meaningful,” Chandra told Investor. “The one thing you cannot buy is an over-levered, outspending company, no matter what. But I do think the market is a lot shorter of inventory than companies like to admit. Once you get past 2021, you have to get pretty creative about the runway.

“I don’t see a lot of companies with a lot of ‘un-mowed grass’ so I think acquisitions are going to be important.”

Should investors applaud a significant deal that brings the buyer diversity into another play or applaud a buyer that bulks up its one-basin strategy? “I don’t think basin diversity is bad … but it’s secondary to valuation. It all depends on the valuation and the price one pays,” Chandra said. “It’s neutral to your outlook for free cash flow.”

Analysts said that the list of attractive places to buy inventory has narrowed. The Bakken and Eagle Ford plays are very mature with less drilling inventory left to attract a buyer other than in noncore areas. The Utica is less economic. The Denver-Julesburg Basin has well-known regulatory challenges. “Nobody’s touching Appalachia,” said one.

“The challenge associated with larger-scale acquisitions in more mature basins such as the Eagle Ford and Williston will continue to be remaining Tier 1 inventory, which we believe to be few and far between,” said analyst Neal Dingmann of SunTrust Robinson Humphrey in a report.

“What you have left is a cheaper exploration play somewhere, or the Permian, but that’s not novel anymore,” Sorbara said. “Maybe on the small-cap side you have some of the gassy names that might try to do something transformative, like the EQTs and Ranges. Maybe Cabot Oil & Gas could buy an oily company—they’re the only name that has a good enough stock price to issue equity. But I don’t see any reason a major would get involved.”

Mariani agreed that the right target has to be seen as a low-cost player holding a good bit of drilling inventory. No one is interested in buying pure production without enough inventory ahead, he said. “Someone with seven to 10 years of inventory is top of the list. Secondarily, buyers look for a company with free cash flow but which has large capital needs that go beyond their cash flow. And oil—we haven’t seen much activity on the gas side. Gas players just have too much leverage.”

That leads to another desired characteristic, which is, of course, a reasonably healthy balance sheet. But not necessarily a pristine one, he said. “Debt is prohibitive for most purchasers. Yes, you could see some bankruptcies among the gas players where a buyer can come in and get the assets, but not have to take on the seller’s debt.”

With these traits in mind, Mariani lists oil-weighted Cimarex Energy, WPX Energy Inc., Centennial Resource Development Inc. and Parsley Energy Inc. as possible targets. “I’d be surprised if one of these doesn’t get bought in the next few years. But if the majors eventually decide to step up, they’d probably go for the larger targets like a Concho or a Pioneer,” he added.

Premiums or not?

In the slow M&A atmosphere we’ve seen for the past two years, the base price and premiums are not heading skyward anymore. In general, a low-premium model prevails now, coupled with most buyers offering some of their equity, with the seller hoping for stock appreciation.

“I just don’t think the majors will pay very large premiums in the near term, and besides, several of them already have a decent U.S. footprint,” Mariani said. “When we see smaller players, you aren’t going to see high premiums. The Concho-RSP deal had a large premium, and it was punished by the market, while the WPX Energy-Felix Energy deal was very positive. That deal was the type the market will embrace, that is, a smaller premium with a good-sized stock component.”

Guggenheim’s Chandra recently hiked his price target on WPX to $19 per share from $17, saying, “Our price target change is mainly due to a working capital surplus in 2020 as the Felix acquisition enhances the company’s FCF [free cash flow] profile.”

Naming names

SunTrust’s Dingmann issued an intriguing report in December 2019 that listed potential deals that would make sense based on geography, free-cash-flow effects and other criteria. He also cited the positive market reaction to the WPX-Felix merger as a guide to what investors would accept: a large PDP component and relatively inexpensive valuation on the part of Felix as seller and a strong balance sheet with less than 1.5 times leverage on the part of WPX, the buyer.

“We believe potential buyers could include Marathon, Devon Energy, Cimarex Energy, Enerplus [Corp.], Diamondback [Energy Inc.] and Noble Energy [Inc.], while we believe notable potential public sellers could include Oxy, Pioneer, WPX and Callon. We believe notable private sellers could include DoublePoint [Energy LLC], Encore [Energy Inc.], Ameredev [II LLC], Bruin, Camino, Venado [Oil & Gas LLC], Verdad, Vine, Indigo [Natural Resources] and Ascent (all private).”

To display his reasoning, he spoke of some potential hookups. Regarding DoublePoint Energy LLC, for example, whose core is the Midland Basin, he said, “According to a Reuters article in February 2019, the company was believed to be exploring a sale for as much as $5 billion. The company is currently running four rigs throughout its Midland position and is estimated to have drilled about 70 gross wells since its formation in June 2018. Given that the company has five different private-equity partners, we see potential for increased difficulty in negotiation given the number of parties that need to reach a consensus.

“Given the scale of the asset and breadth of the asset, we believe only larger Midland operators with a historical Midland Basin focus would be likely candidates for an acquisition of DoublePoint, including Concho, Apache [Corp.] and Pioneer.”

In a Delaware example, Dingmann mentioned Ameredev II. “We believe that given the contiguous nature of the position and sought after state-line geology, Ameredev could be attractive to a number of operators with a northern Delaware position, ample size and strong balance sheet including Marathon or Devon.”

Viewing the Denver-Julesburg Basin in Colorado, Dingmann cited Verdad Resources, founded in 2017 with private-equity backing.

“The company has a massive acreage position; however, with the Wattenberg group trading at 2.7 times, a significant premium for the acreage is unlikely as it would be hard for the acquirer to justify. Verdad could be attractive to HighPoint Resources or Bonanza Creek (BCEI), perhaps best with BCEI given its RMI midstream asset that Verdad could feed into. That being said, as BCEI trades near PDP, it is hard to see a near-term deal unless Verdad decided to ‘participate in the upside’ via the stock,” he wrote.

Dingmann also speculated about Bakken-focused Bruin E&P Partners LLC, which was founded in 2015 and is backed by private-equity firm ArcLight Capital. The company has built over 170,000 net acres, is running one rig in the basin and has drilled about 170 wells, according to Enverus. Activity is focused in McKenzie, Dunn and Mountrail counties, N.D. “Given the appetite for additional Williston acreage, we believe that the company could be attractive to Marathon, WPX or Enerplus,” Dingmann wrote.

Regardless of basin, the deal-making blueprint is clear: merge an inventory-rich, free-cash-flow machine with a larger company that has capital to drill but can’t seem to replace reserves. Any players with contiguous acreage should get together for coffee. It’s cheaper to buy reserves than to drill for them, given that valuations are down by half or more. A deal has to be done without much of a premium, and the pro forma company that comes out of it has to have low leverage.

In the end, deal metrics and the commodity price outlook may not matter: “All the names are targets at the right price,” said every analyst. “If I was a seller, I’d probably not pick this time to sell,” said Chandra. “When you look at the reception most M&A deals have gotten, it’s been awful. You’d think that would scare away the buyers, but I think deals happen because the buyer is trying to solve bigger long-term problems than the Street sees.”

Recommended Reading

TGS Releases Illinois Basin Carbon Storage Assessment

2024-09-03 - TGS’ assessment is intended to help energy companies and environmental stakeholders make informed, data-driven decisions for carbon storage projects.

STRYDE Awarded Seismic Supply Contracts in Mexico

2024-09-03 - STRYDE was awarded two seismic node supply contracts in Mexico, the company’s first projects in the country.

PakEnergy Plows Ahead with New SCADA Solution

2024-09-17 - After acquiring Plow Technologies, home of the OnPing SCADA platform, PakEnergy looks to enhance its remote monitoring solutions.

SLB Launches New GenAI Platform Lumi

2024-09-17 - Lumi’s machine learning capabilities will be used to enhance SLB’s Delfi digital platform offering for better automation and operational efficiencies.

AI & Generative AI Now Standard in Oil & Gas Solutions

2024-07-25 - From predictive maintenance to production optimization, AI is ushering in a new era for oil and gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.