BCG’s low-carbon strategy for upstream players focuses on reducing their carbon footprint while providing financial value to companies in the low-price environment. (Source: Leonid Ikan/Shuterstock.com)

[Editor's note: A version of this story appears in the September 2020 edition of E&P Plus. Subscribe to the magazine here.]

Despite a rebound in oil prices, resurgent waves of the COVID-19 show the industry’s recovery remains fragile. In addition to dealing with the volatility of the near-term market environment, upstream companies face a longer-term challenge of reducing emissions, with growing pressure from regulators, investors and other stakeholders. Although many upstream companies have made considerable progress in meeting climate change goals, they will have to play a bigger part going forward as stakeholder pressure and expectations continue to rise. Boston Consulting Group (BCG) has outlined a cost-effective approach, which offers to shrink a company’s carbon footprint and strengthen its social license to operate and increase revenue growth. “The industry is facing a challenging time. Upstream players are making spending cuts, and it is likely they will focus on core operations and avoid making additional investments,” Thomas Baker, managing director and partner with BCG, told E&P Plus. “That being said, we think there is still a role for decarbonization, and in fact, the current environment creates an important opportunity to potentially accelerate these activities. Many of these measures can be cost-effective and provide lower capex, improved output and have a financial benefit for the players.”

Objectives

To design an effective decarbonization strategy, BCG suggests it is crucial the company meets regulatory requirements of the country in which it operates. “Regulatory environment is a critical piece in decarbonizing the oil and gas sector,” said Ilshat Kharisov, managing director and partner with BCG. “What we’ve seen working effectively is when regulatory bodies work together with oil and gas companies to figure out the most economical solutions to decarbonize. In areas such as the EU and California, where regulations are progressive, we have seen great examples of bold actions taken by companies to reduce emissions and carbon footprints. Regulatory bodies will need to work with oil and gas companies to figure out best opportunities to steer investments in carbon capture to achieve climate change goals.”

While the EU has clearly established carbon-pricing schemes and net-zero emissions targets, carbon emission rules in the U.S. vary considerably from state to state. For instance, California’s Low Carbon Fuel Standard Program incentivizes upstream players to produce low-carbon intensity crude oils. Other local regulations, such as fracking bans in New York and water-disposal policies in Pennsylvania, have a strong impact on company operations in those states.

In addition to meeting regulatory requirements, BCG’s strategy also stresses the importance of communication with key stakeholders to ensure the strategy is tailored to suit the needs of the company, which should adopt transparency while setting low-carbon goals and establish a tracking mechanism to monitor progress over time. An effective decarbonization strategy should also ensure the company retains its social license to operate, which demands active engagement with its stakeholders. The plan should include involvement of communities through job creation and communicating to them the local environmental effects of the business.

Companies should also discuss low-carbon policies and sustainability goals with current and potential employees to attract and retain top talent.

A cost-effective plan to decarbonize operations must also identify business opportunities that emerge as a result of meeting climate goals. BCG has outlined possible opportunities that include initiatives that leverage a company’s core business and capabilities, such as the monetization of project management capabilities or offering a new technology as a service, such as solar assets, hydro- gen fuel as well as carbon capture, utilization and storage (CCUS). Companies could also acquire conventional assets and manage them in a way that reduces the assets’ carbon intensity.

BCG’s strategy emphasizes “value-accretive” decarbonization that is tailored to each company’s set of constraints and opportunities. One of the most important goals while designing a low-carbon plan is to identify potential new revenue sources, while providing financial value to companies.

For instance, BCG designed a decarbonization plan for a U.S.-based upstream operator focused on the acquisition of low-carbon assets, adoption of energy-efficient measures aimed at optimizing operations and reducing costs, realization of new revenue streams based on reg- ulatory incentives and the launch of step-out businesses. Once fully implemented, the strategy increased the company’s enterprise value by 30% and put the company on course for a roughly 90% reduction in its carbon emissions by 2040.

Approach

According to BCG’s findings, most companies could reduce their carbon emissions by 10% to 20% without a negative impact on the company’s return on investment. Also, many companies could further slash their emissions by 30% to 40% while still maintaining a positive internal rate of return, depending on the type of assets the company owns and the regulatory mandates where it operates. BCG’s outline for reducing a company’s carbon footprint is based on a company-specific approach tailored to suit each player’s operating environment, assets and regulatory constraints.

Instead of targeting emissions of individual hydrocarbon streams, BCG suggests companies should focus on cutting the overall carbon intensity of their operations, which has proven to be the most efficient approach for companies in reducing net emissions.

After outlining the goals, the company should evaluate external factors such as population, demographic shifts and societal concerns about climate change and the environment. External factors also include regulatory constraints, incentives to grow acceptance, usage of green technologies, and progress toward carbon pricing and related schemes.

Once external factors have been evaluated, BCG explores different phases of the company’s value chain to identify opportunities of reducing carbon emissions. For instance, the exploration phase should reflect the growing importance of low-carbon-intensity assets in a portfolio.

As Kharisov explained, “Investments made at the exploration stage are typically long-term. Therefore, it is a very critical to look at the carbon intensity of the crudes and study regulatory developments as well as the final requirements, expectations and the economics of those oil fields.”

For instance, in California, where oil reserves are highly carbon- intensive, unless the current oil and gas companies start decarbonizing actively, there is no business case to produce crudes actively over the next 10 to 15 years.

“I think carbon intensity of the crudes will play a critical role in port- folio decisions over the next few years. We can already see major moves like divesting high-carbon-intensity assets from major oil companies’ portfolio as a way to reduce their carbon footprint. As this happens, we might see some of those assets being stranded,” Kharisov added.

During the design and sourcing phase, BCG suggests companies could realize decarbonization goals by applying lean principles and tools to asset operations, electrifying operations where possible and using remote control centers. Upstream players can create incentives for suppliers to reduce their emissions footprint by employing carbon as a key metric in vendor selection and evaluation.

Lastly, in the operations phase, decarbonization levers include optimizing operational cycle times, improving fleet performance and routing, using zero-carbon electricity, improving energy efficiency, reducing flaring and methane leakages, and installing CCUS technologies.

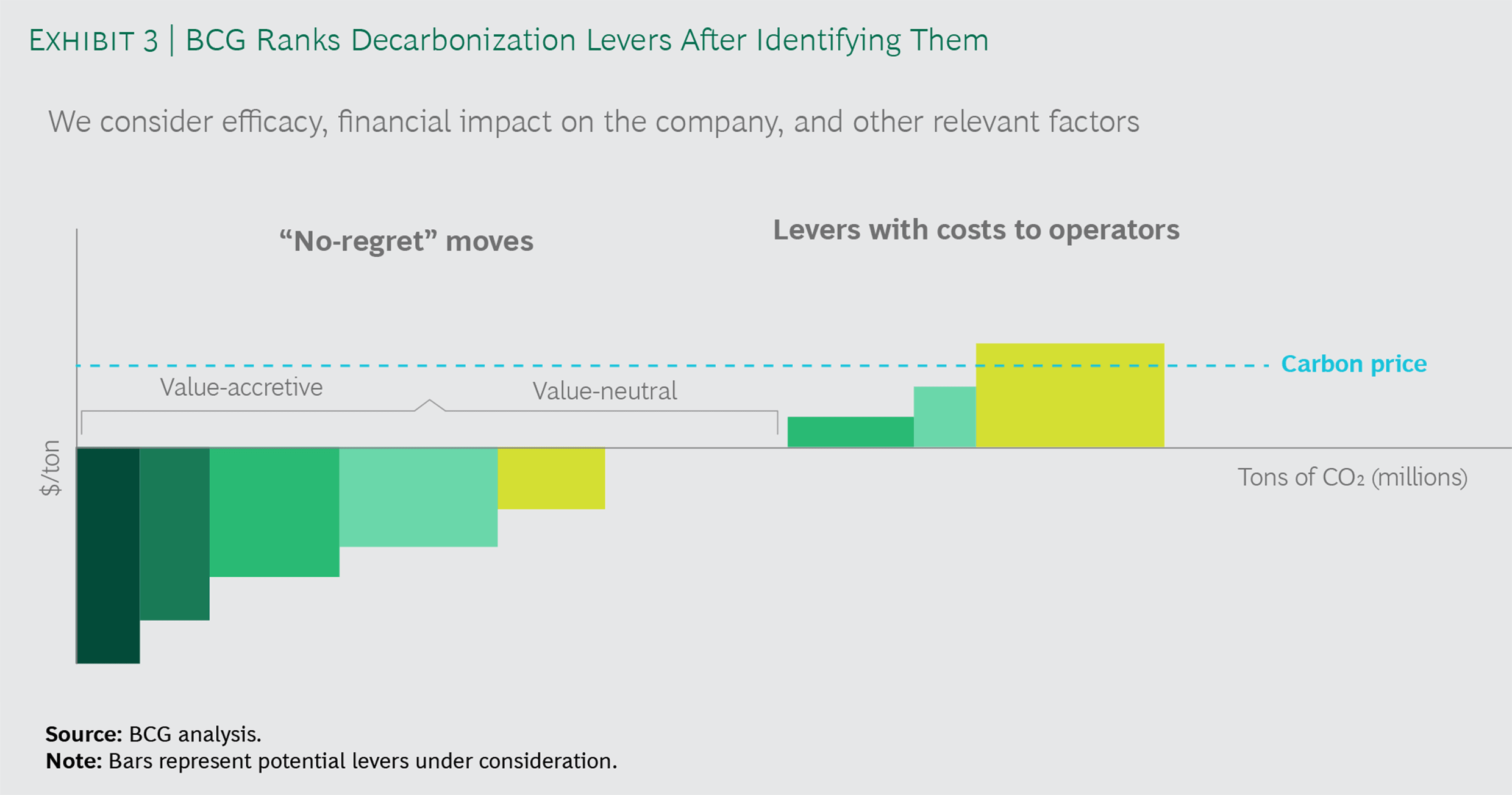

Once available measures across the value chain are identified and their efficiency is determined, BCG combines these measures with key social, regulatory and market trends to produce a ranking of potential decarbonization actions the company could take.

“In our study, we call these actions the ‘no regret’ moves, whose implementation provides negative cost for the company,” Baker said. “In our experience working with operators, these moves could reduce up 25% to 50% of emissions and ultimately support companies in the low-price environment.”

Recommended Reading

Oil Prices Fall as Investors Take Stock of Biden Exit, Rate Cuts in Focus

2024-07-22 - Oil prices fell on July 22 after Joe Biden announced he would not seek a second term as U.S. president.

Oil Settles $1 Down After US Job Data Revised Significantly Lower

2024-08-21 - U.S. employers added far fewer jobs than originally reported in the year through March, the Labor Department said on Aug. 21.

What's Affecting Oil Prices This Week? (July 22, 2024)

2024-07-22 - While oil traders have been adding to their net long positions in recent weeks, the rate of increase has slowed. Last week, traders of WTI increased their net long positions by only 4.25% by increasing their long positions while decreasing their short positions, while traders of Brent crude decreased their net long positions by increasing their short positions.

Oil Prices Up Slightly as US Crude Oil Inventories Fall

2024-07-03 - The U.S. Energy Information Administration reported a 12.2 million draw in the country's crude oil barrels in storage last week.

Brent Crude Falls $1/bbl on Demand Fears

2024-09-04 - Brent crude oil prices fell to $72.75 on Sept. 4 on fears about demand in the coming months as crude producers offered mixed signals about supply increases.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.