Analysts with Tudor, Picker, Holt & Co. noted the combined company will maintain an “extremely strong balance sheet” with zero debt expected at closing. (Source: Expro Group)

Frank’s International NV and Expro Group announced an agreement on March 11 to combine in an all-stock transaction that analysts say will create a better-equipped offshore-oriented oilfield services player.

The combined company will assume the Expro Group name upon completion of the merger and be led by Mike Jardon, Expro’s current CEO. The company will also retain the Frank’s International brand name for its well construction solutions as part of the combination.

In a statement, Jardon said the combination brings together two established oilfield services companies—Expro Group, a U.K.-based privately-held international energy services company with expertise in well flow optimization, and Frank’s International, a global oil services company based in Houston that provides a broad range of highly engineered drilling and completions solutions and services.

“Together, Expro and Frank’s will be better positioned to support our customers around the world and navigate industry cyclicality,” he continued. “This business combination also allows us to rationalize facilities and other support costs, optimize business processes, capitalize on profitable growth opportunities and create value for shareholders of both companies, particularly as the environment for international projects continues to improve.”

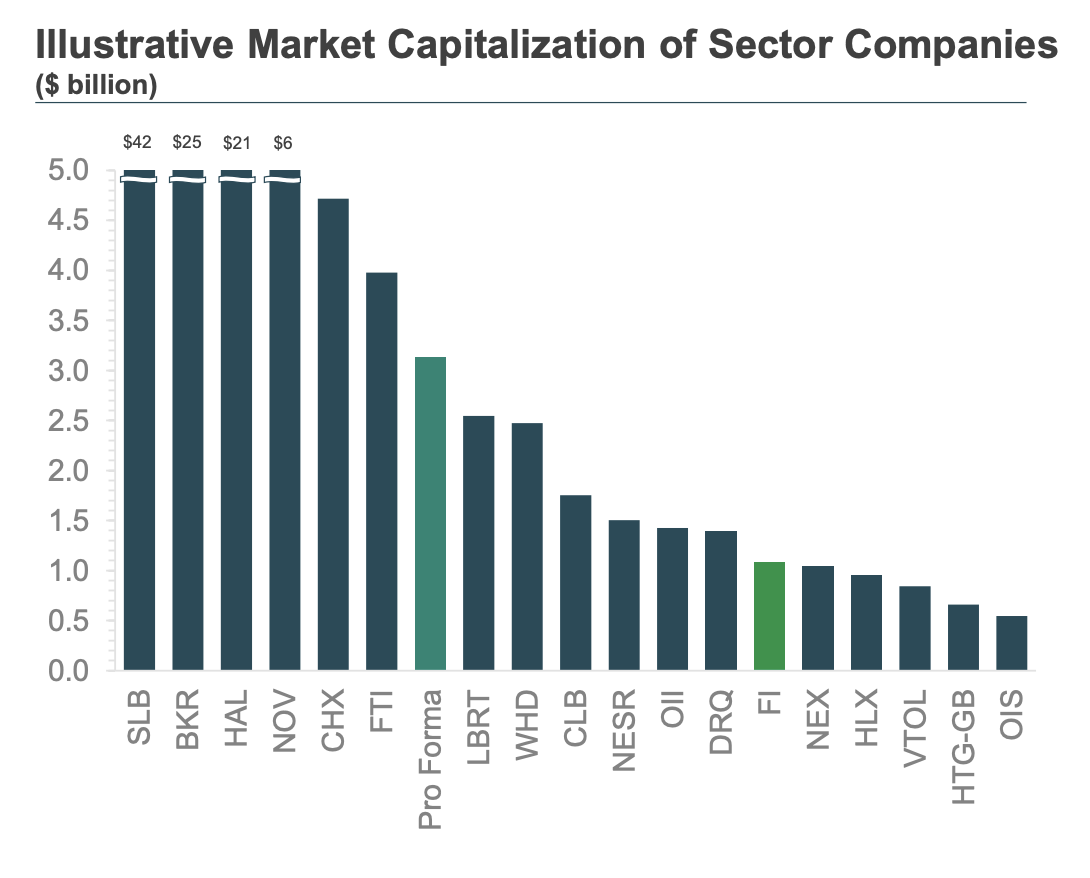

Note: Implied pro forma market cap calculated based on Frank’s market cap of $1.1 billion as of March 9, divided by pro forma ownership of 34.5%

In a research note, analysts with Tudor, Pickering, Holt & Co. (TPH) said they find the industrial logic behind the merger to be “very compelling” for a number of reasons

“First and foremost, this transaction not only brings together two (offshore-focused) companies with highly complementary product/service portfolios across the well life cycle (Expro’s well production services expertise versus Frank’s International’s well construction/completion expertise), but also creates a company with much enhanced scale (pro-forma annual revenue over $1 billion),” the TPH analysts wrote in the firm’s note on March 11.

TPH also noted the combined company will maintain an “extremely strong balance sheet” with zero debt expected at closing.

“Finally, there are non-trivial synergies to be had in this deal with the combined company targeting annual cost synergies of ~$70 million within 36-months (versus pro-forma 2020 EBITDA of ~$107 million),” the analysts wrote.

According to analysts with Evercore ISI, the combination also improves both companies’ scale and diversification of services while broadening the company company’s portfolio with multiple touchpoints across the well lifecycle

“It is exactly the type of complementary transaction that makes sense in today’s oilfield,” the Evercore analysts wrote in a March 11 research note.

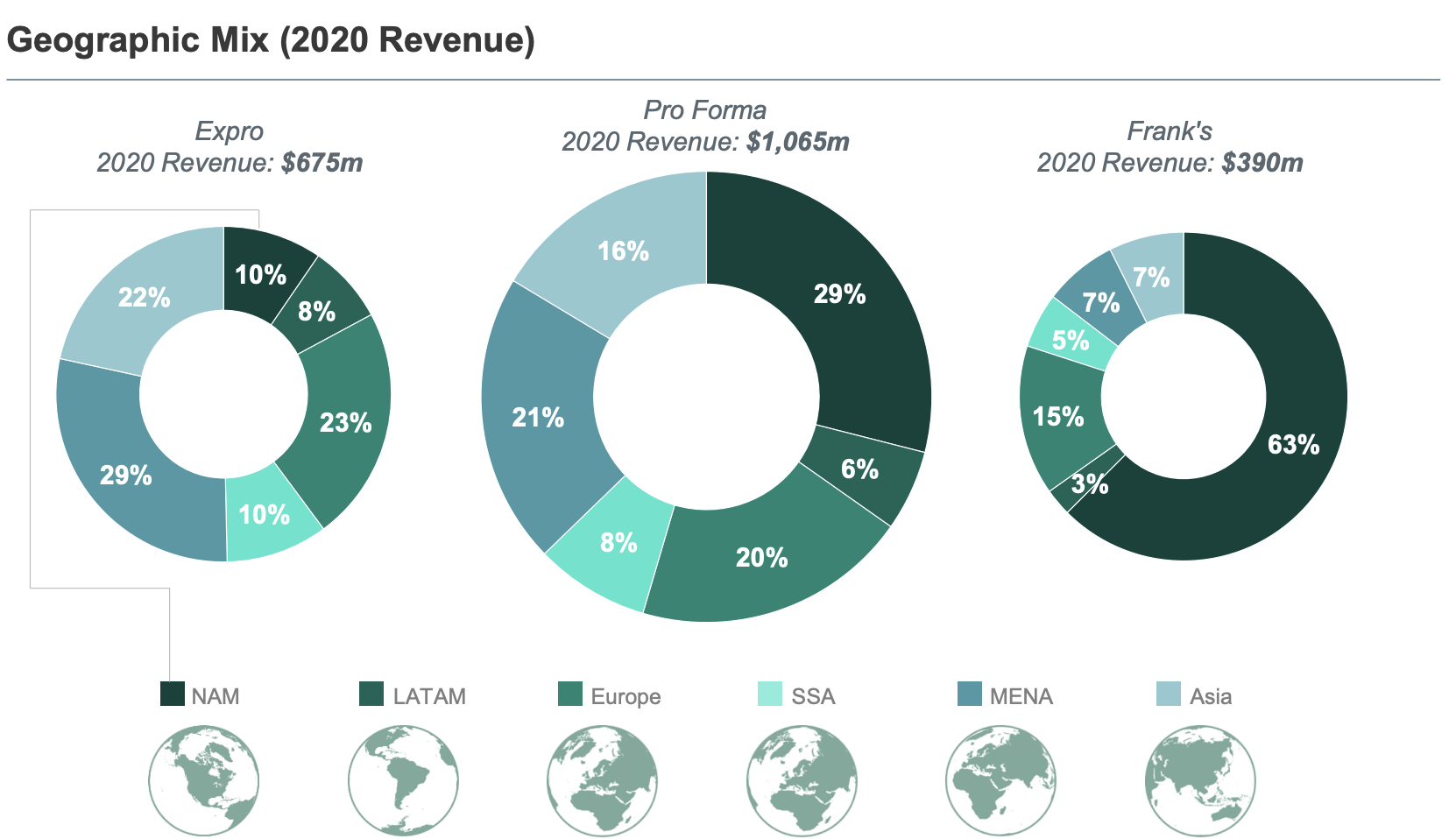

“Integration will be smoother given that both companies have compatible cultures, a services-oriented portfolio, and very little overlap in services,” the analysts added. “Even the regional orientation is complementary and can leverage Frank’s strength in the Americas with Expro’s presence in Asia and their combined footprint in Europe and MENA.”

Note: Certain figures may not add due to the use of rounded numbers

At closing, the combined company is expected to have approximately $285 million of cash with pro forma revenue of more than $1 billion and adjusted EBITDA of $107 million, excluding identified synergies. The companies also expect to complete syndication of a revolving credit facility, which will be available for direct borrowings and letters of credit, of up to $250 million prior to the close of the transaction.

“After undertaking a thorough process to consider a range of strategic alternatives, we are confident that this transaction presents a compelling opportunity for Frank’s shareholders to benefit from value creation led by returns-focused growth,” said Mike Kearney, chairman, president and CEO of Frank’s International who will serve as chairman of the combined company.

“The combination brings scale, improved profitability and free cash flow and, together, we will be better positioned for the industry recovery, of which we are in the early stages,” Kearney added in his statement.

Founded in 1938, Frank’s has approximately 2,400 employees and provides services to leading exploration and production companies in both onshore and offshore environments in approximately 40 countries on six continents. Meanwhile, Expro employs approximately 4,000 people across 50 countries worldwide.

“We are extremely proud of Frank’s history and the talented individuals of Frank’s who helped build and sustain our great company,” Kearney continued. “We expect this combination to create career development and advancement opportunities for many of our employees as part of a more balanced and stronger combined organization.”

The combined company will be operationally headquartered in Houston, and will maintain a significant operating presence in Lafayette, La., Aberdeen, Scotland and other key locations around the world. The principal executive office of the combined company will remain in the Netherlands.

Under the terms of the all-stock deal, Expro shareholders will receive a fixed exchange ratio of 7.272 shares of Frank’s International for each share of Expro owned. As a result, Expro shareholders will own roughly 65% of the pro-forma entity with shareholders of Frank’s International holding the remaining 35%.

Upon closing, the combined company will be listed on the NYSE exchange under the symbol “XPRO.” In addition to Jardon and Kearney, the remainder of the nine-member board will comprise five additional directors appointed by Expro and two additional directors appointed by Frank’s.

The companies said they expect to close the transaction in the third quarter, subject to approval by Frank’s International and Expro shareholders and customary closing conditions, including required regulatory approvals.

According to the joint release, the Mosing family representatives on the Frank’s International board have already said they unanimously support the transaction. Expro shareholders representing approximately two-thirds of ownership have also agreed to support the transaction.

J.P. Morgan Securities Plc is serving as financial adviser to Expro with Gibson, Dunn & Crutcher LLP providing legal counsel. Moelis & Co. is financial adviser to Frank’s International and Vinson & Elkins LLP is serving as its legal counsels.

Recommended Reading

Dividends Declared Week of Nov. 4

2024-11-08 - Here is a compilation of dividends declared from select upstream and midstream companies in the week of Nov. 4.

TC Energy Appoints Two Independent Directors to Board

2024-11-07 - TC Energy Corp. appointed Independent Directors Scott Bonham and Dawn Madahbee Leach to its board, the company announced Nov. 7 in a press release.

OMS Energy Files for IPO, Reports Revenue Growth

2024-11-06 - Singapore-based OMS Energy, a wellhead system manufacturer, has not yet determined its price range and number of shares.

Record NGL Volumes Earn Targa $1.07B in Profits in 3Q

2024-11-06 - Targa Resources reported record NGL transportation and fractionation volumes in the Permian Basin, where associated natural gas production continues to rise.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.