The sun sets on the piney woods near Greenwood, La., where a rig is drilling a well in the Haynesville Shale. (Photo by Tom Fox, courtesy of Oil and Gas Investor)

The Haynesville Shale’s location is helping keep interest in the play high. Stretching across East Texas and North Louisiana, the primarily dry gas play offers players shorter access to Gulf Coast ports. The rise of U.S. LNG and gas exports has made the Haynesville attractive with its proximity to hubs in South Louisiana and Texas, according to Drillinginfo.

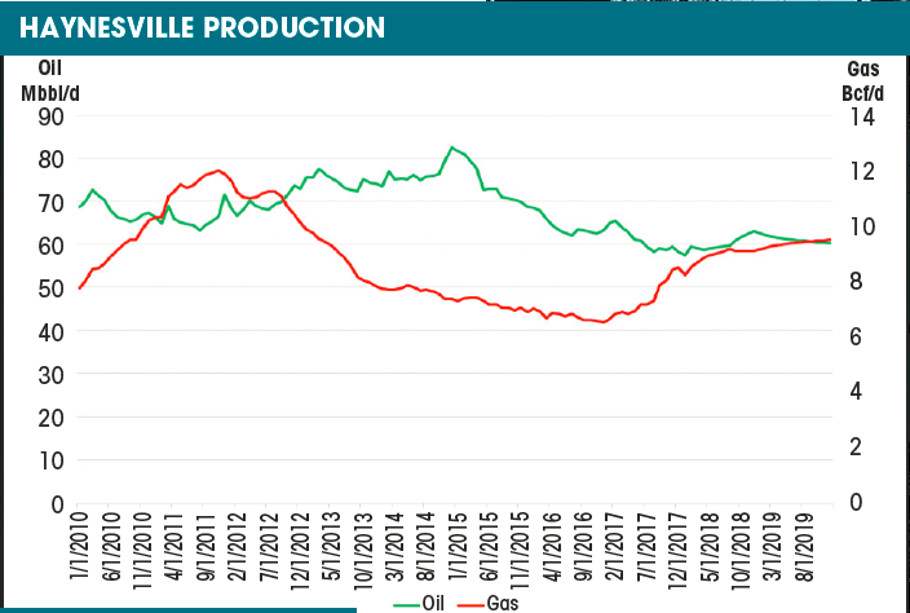

In the decade or so since the opening of the Haynesville Shale play by Chesapeake Energy, the region’s fortunes have peaked, troughed and are now ascending again. Gas production for the fourth quarter of 2018 was forecast to hit about 221 MMcm/d (7.8 Bcf/d), according to Drillinginfo, up from about 164 MMcm/d (6 Bcf/d) in the fourth quarter of 2016. Production for year-end 2019 is forecast at about 229 MMcm/d (8 Bcf/d).

In an exclusive report provided to E&P, Drillinginfo noted that more than 7,000 horizontal wells had been spudded in the Haynesville over the past decade. Spudding activity declined from 2010 to 2016 but has rebounded in recent years. Wells coming online in 2017 and 2018 are reaching 24-month cumulative values that were higher than EURs for wells completed before 2016, according to the market analysis firm.

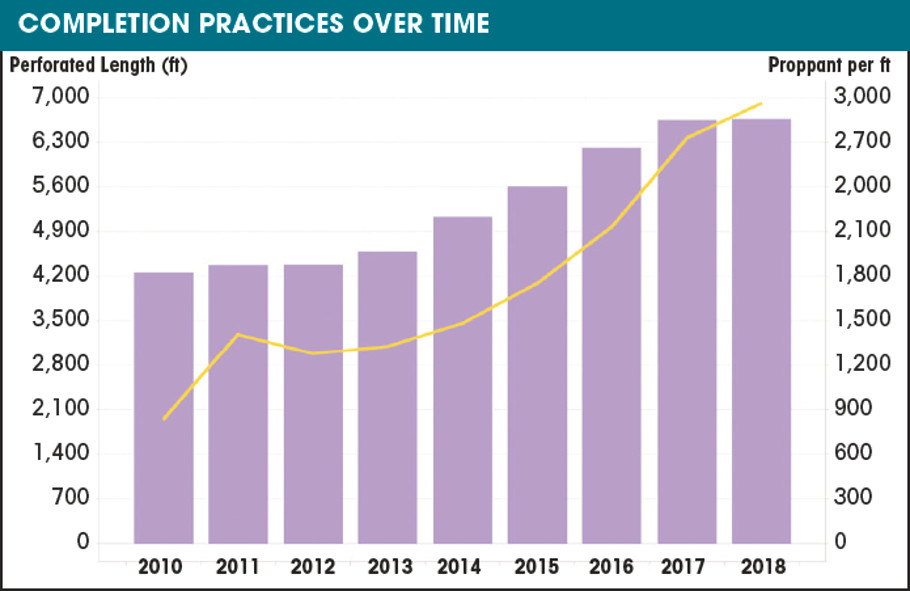

Drastic improvements in well performance have helped grow production since the start of 2017. Renewed interest and improved designs in completions in 2016 are cited in the report as having brought about the step change in well performance and consistent growth. Proppant intensity has greatly increased in the Cotton Valley Sands and Haynesville and Bossier shales, the report noted, with lateral lengths reaching about 2.4 km (1.5 miles) long.

Operators in the region have time to continue making improvements in well performance as the proposed Haynesville Global Access Pipeline (HGAP) is set for in-service beginning in 2023. “HGAP will connect the Haynesville Shale with growing markets in Southwest Louisiana, where natural gas demand is expected to triple, reaching approximately 12 Bcf/d [340 MMcm/d] by 2025,” said Tellurian President and CEO Meg Gentle in a press release. “HGAP will improve the connection between North and Southwest Louisiana, debottlenecking existing pipeline routes and providing shippers access to expanding markets.”

News of the construction, ownership and operatorship of the $1.4 billion 42-in. diameter pipeline was announced by HGAP LLC, a subsidiary of Tellurian Inc., in early 2018. The pipeline will stretch about 322 km (200 miles) from northern Louisiana south toward Gillis, La., and will have a delivery capacity of about 105 MMcm/d (3.7 Bcf/d) of natural gas from the Haynesville/Bossier shale area, according to HGAP.

Gas production in the Haynesville peaked in the fourth quarter of 2011 with an all-time high of about 292 MMcm/d (10 Bcf/d) and reached its low at about 164 MMcm/d in the fourth quarter of 2016. (Source: Drillinginfo)

Increased proppant intensity and longer laterals are helping modern wells (2017 and 2018) outperform wells completed prior to 2016. (Source: Drillinginfo)

A consistent improvement in the region’s gas type curves demonstrates the application of new well completion designs impact on production. (Source: Drillinginfo)

Recommended Reading

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

Avant Natural Resources Steps Out with North Delaware Avalon Tests

2024-08-21 - With the core of the Delaware Basin in full manufacturing mode, Avant Natural Resources is pushing an operated portfolio into the northern reaches of the New Mexico Delaware.

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

2024-07-08 - Oklahoma City-based Devon Energy is growing its Williston Basin footprint with a $5 billion cash-and-stock acquisition from Grayson Mill Energy, an EnCap portfolio company.

The OGInterview: BPX E-fracs Push ‘Values Up, Emissions Down,’ CEO Says

2024-07-02 - BPX Energy CEO Kyle Koontz discusses the company’s role as the “nimble entrepreneurial” arm of supermajor BP in the Permian Basin and Haynesville and Eagle Ford shales.

Devon Capitalizing on Bakken, Eagle Ford Refracs

2024-08-07 - Devon Energy’s Delaware Basin production dominated the quarter for the multi-basin E&P, but the company is tapping into recompletion opportunities to supplement production, executives said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.