(Source: Shutterstock, HartEnergy.com)

And … we’re back to China trade talks as the arbiter of optimism concerning commodity prices.

On Jan. 8, President Donald Trump assured the nation that the most recent Middle East crisis concerning Iran was under control.

“Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world,” the president said in a televised speech.

Swiftly after, the price of West Texas Intermediate (WTI) fell 4%, giving up essentially all of the gains built up since missiles fired from a U.S. drone killed Iranian Maj. Gen. Qassem Soleimani in Baghdad on Jan. 3. The price peaked on Jan. 7 following news of Iranian missile strikes on two military bases in Iraq. Those attacks appeared designed to avoid casualties and the focus on fundamentals returned.

“Before the U.S. energy revolution took off, American consumers were generally vulnerable to price shocks due to instability in the Middle East,” said Dean Foreman, chief economist of the American Petroleum Institute in an email to HartEnergy.com. “However, the rise of U.S. energy leadership has helped to reduce market volatility by about half since 2014. Consequently, recent geopolitical events have had relatively small effects on energy prices and provide a consistent reminder of how vital it is to have a strong domestic U.S. oil and gas industry.”

The outlook for global trade appears somewhat brighter, at least early in the New Year. Akin Gump described the international trade landscape as “poised for change.”

“President Donald Trump’s trade initiatives—including those dealing with the North American Free Trade Agreement (NAFTA), China, Japan and the World Trade Organization (WTO)—will likely come to fruition, essentially remaking bilateral trading relationships in the New Year,” the law firm said in an email newsletter. “At the same time, the United States and United Kingdom are preparing to navigate a post-Brexit world as of Jan. 31, 2020. We expect trade policy to become a defining issue for the 2020 presidential campaign.”

Stronger trade leads to a stronger global economy which leads to faster growth for energy. What’s not to like?

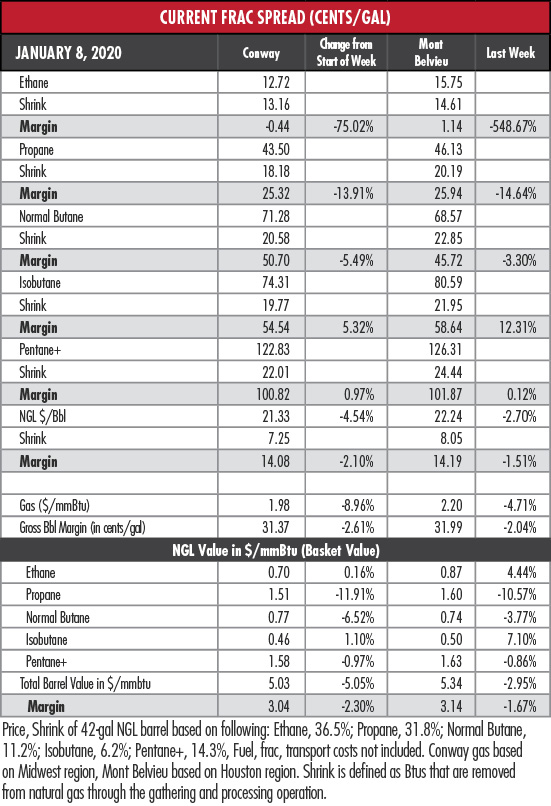

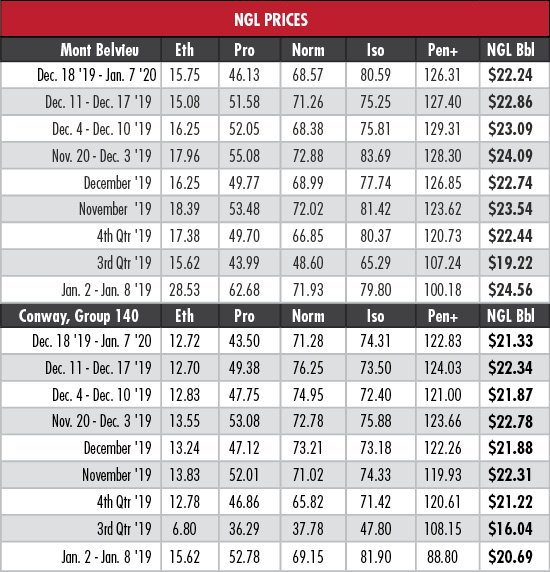

Since you asked: the recent travails of propane’s price. The average Mont Belvieu, Texas, price during the long 13-day break was the lowest since mid-October.

That puts the Mont Belvieu price of Jan. 7 at 32% of WTI. The Jan. 7, 2019 price, by comparison, was 58.6% of WTI.

Compared to the most recent Frac Spread of Dec. 19, Mont Belvieu propane’s margin shrunk by 14.6%. The relatively robust margin of 35.46 cents per gallon (gal) of a year ago contrasts with the 25.94 cents/gal in this report, or a reduction of about 27%.

Ethane rose about 1.8 cents/gal on average in fourth-quarter 2019 from the third quarter, but the Mont Belvieu December price tumbled by more than 2 cents/gal compared to November. And while the most recent price was about 4.4% higher than it was for the period ending Dec. 19, the Mont Belvieu price has trended lower since the start of the year. On the plus side, the Mont Belvieu margin returned to positive territory and the margin at Conway, Kan., improved as natural gas prices slumped.

In the week ended Jan. 3, storage of natural gas in the Lower 48 experienced a decrease of 44 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. The EIA figure resulted in a total of 3.148 trillion cubic feet (Tcf). That is 19.8% above the 2.627 Tcf figure at the same time in 2019 and 2.4% above the five-year average of 3.42 Tcf.

Recommended Reading

New Mexican President, Same Reliance on Permian Gas

2024-08-13 - While Sheinbaum leans toward a stronger Pemex, U.S. producers are likely to maintain their relevance in Mexico.

Mexico’s Nearshoring Attracts $36B in Investment as US Energy Benefits

2024-07-07 - Mexico saw the highest level of foreign investment in 18 years as companies were attracted to low wage workers, but U.S. energy producers, among others, continue to fuel power for the country’s new factories and projects.

Belcher: How Overturning the Chevron Deference Will Impact Energy Regs

2024-08-20 - The decision will enable the industry to challenge an array of federal regulatory actions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.