As the number of planned floating wind projects grows globally, industry experts anticipate supply chain challenges. (Source: Shutterstock)

HOUSTON—Ambitions are high for floating wind and its potential to provide the world with renewable energy, but supply chain issues could wreak havoc on lofty goals if they aren’t addressed, according to wind energy experts.

Ignacio Pantojo, floating offshore wind department manager for Iberdrola, used a hypothetical project to get this point across when delivering a presentation at the Floating Wind Solutions conference on Jan. 30.

A 1-gigawatt (GW) floating project, about 40 km from shore in a water depth of 120 m and comprised of 50 units that are 20 megawatts (MW) each, would require more than 243,000 tons of steel. “The biggest yard in Europe is able to produce 100,000 tonnes,” Pantojo said. Most of the capacity of steel manufacturers is already booked for vessels, fixed-bottom wind turbines and the oil and gas sector.

The story is similar for anchors and moorings, which stabilize floating structures holding the wind turbines. Nearly 59,000 tons of anchors and moorings would be required for the floating project; however, the biggest supplier in Europe makes only about 50,000 tons per year, he said.

Adding to these challenges: limited availability of suitable ports and few suppliers of dynamic cables and mooring.

“Bottlenecks are one of the major concerns for making floating projects viable,” Pantojo said.

RELATED

What to Watch in 2023 for Offshore Wind

Note, again, these are estimates for only one 1-GW hypothetical project.

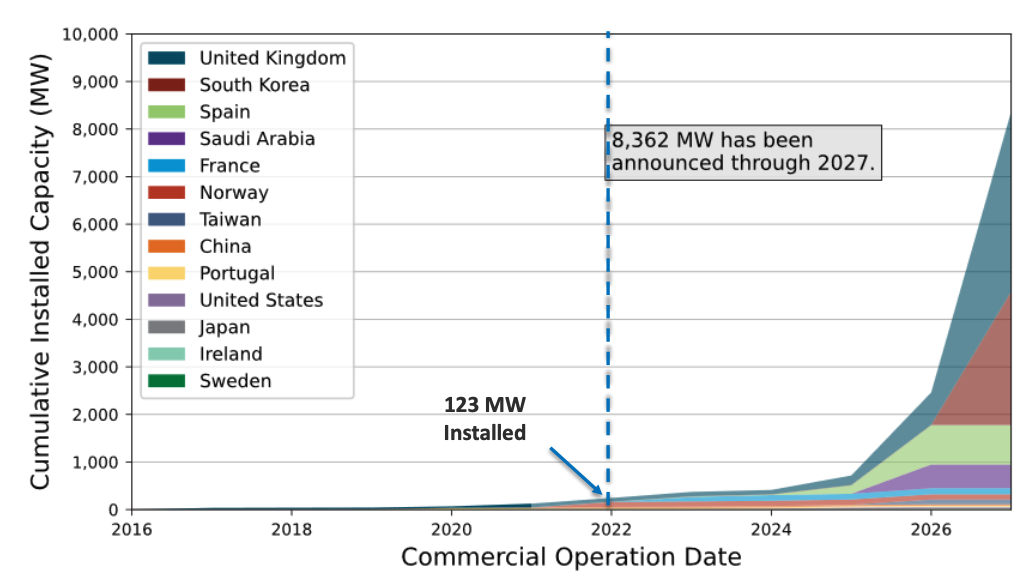

“There’s about 8,000 megawatts in the developer announced pipeline,” Walt Musial, principal engineer for the National Renewable Energy Laboratory (NREL), said of global floating projects. “[That’s] not the whole pipeline, but it’s the early stage pipeline. By 2027, we may see up to 8 gigawatts installed.”

The floating offshore wind project pipeline has grown 20x since 2017 as global commercial development has expanded, he said.

As growth continues, domestic supply chains will be crucial to helping companies, states and countries hit offshore wind installation targets. Additional solutions included communicating and early engagement among various stakeholders, constructing major supply chain facilities, expanding existing infrastructure and learning from others.

Challenges ahead

More than 380 GW-worth of floating and fixed-bottom projects combined were announced by developers in 2022, according to Jorge Porres, technology and supply chain director for BlueFloat Energy, the Madrid-based offshore wind developer owned by Quantum Energy Partners. This included about 107 GW in floating wind projects for Europe, he said.

“Developers, we celebrate when we are awarding projects, but if we don’t build them, it doesn't count,” Porres said, turning attention to final investment decisions (FID) and commercial operating dates (COD).

If developers were successful in bringing to FID only about 10% of Europe’s projects, for example, Porres estimated that 10 floaters must be fabricated per month to hit COD targets in 2035. That’s assuming it takes about six years for construction with FIDs in 2029. His figures were based on 15-MW turbines which are available today.

“So, there would be a massive bottleneck in the supply chain to fabricate the floaters just if we are only 10% successful on what we have now in development,” Porres said, “and that bottleneck applies as well for the turbines and for the cables and for the mooring system and for the vessels that we will need.”

It is not guaranteed that developers of floating wind projects in one country will be able fulfill equipment needs in other countries, which may have their own floating wind goals to meet.

Ports can make a difference.

“Ports are the enablers of that supply chain development,” Porres said.

Improving ports

Serving as the site of the fabrication, construction and assembly of floating wind system components too big to travel via roads and railways, ports are seen as one of the few places suitable for building major offshore wind manufacturing facilities.

However, port upgrades are needed to meet floating wind’s demands.

“The facilities also need sufficient acreage, quayside length, quayside bearing capacity and navigation channel depth to safely fabricate, maneuver and load out components,” NREL said in its U.S. offshore wind supply chain roadmap report. “Some offshore wind energy components, such as jackets or transition pieces, are transported vertically, which means that there can be no low bridges along the navigation channel.”

Upgrades could run into the hundreds of millions of dollars and take years to complete, NREL said.

Adding to uncertainty, said NREL, is the rapid growth in wind turbine sizes and how manufacturing facilities must be designed to handle larger components.

Suitable ports exist today in the U.S., but they are limited. The Biden administration’s Bipartisan Infrastructure Law will make billions of dollars to modernize ports in other regions.

Port expansion plans are underway, including in California where the Bureau of Ocean Energy Management awarded five Pacific Ocean floating wind leases in December. The leases include the Humboldt Bay area, where the California Energy Commission approved in 2022 a $10.5 million grant for renovations at the Port of Humboldt Bay to support offshore wind activities in the area.

Andrew Kyriakides, project manager for MODEC, recalled reading about a proposed floating wind port on Humboldt Bay that he said would resemble a factory, allowing for the fabrication of foundations, fabrication and storage of blades and towers, large storage areas for turbines and anchors plus crew and marshaling services across an area of about 120 football fields.

“This, to me, would be the floating wind factory utopia,” Kyriakides said, later adding “floating wind factories may be the way of the future.”

Finding solutions

Kyriakides also had suggestions on ways to improve the supply chain. These included considering letters of intent prior to FID.

“At FID, it would be preferable that engineering is substantially complete,” he said in his presentation. “Striking steel at FID would reduce risk to [the] overall schedule.”

To eliminate land space constraints, Kyriakides said all turbine units could be installed in a single season. “It is probably feasible to install up to about half a gigawatt in a single season without any major reinforcements, provided these units are anywhere between 18 to 20 megawatts,” he said.

Kyriakides also pointed out that multiple shipyards would be needed for hull construction to stay on schedule. Plans should include wet park space for at least six units per shipyard or port, he said.

“In the absence of local shipyards/ports, Asia fabrication can offer complete fabrication of foundations or block fabrication that can be transported and integrated in a local shipyard/port,” according to Kyriakides’ presentation.

Engaging suppliers during the concept design phase and including them in early engineering stages could also prove beneficial, according to Nick Zenkin, lead offshore wind consultant for Xodus.

“They could actually have time to train a workforce and actually integrate into the area,” Zenkin said during the conference. “I think we have a really good opportunity here in California and the West Coast in general.”

He highlighted Ørsted and Simply Blue Group’s proposed 100-MW Salamander floating wind project offshore Scotland, saying the industry can learn from the duo’s approach. The project has a strong focus on supply chain development. The companies are taking what they call a precommercial “stepping-stone approach,” starting with small projects before moving to bigger ones to reduce the technology risk, lower costs for commercial projects and give the local supply chain time to prepare for commercial opportunities.

Zenkin pointed out the concept involves working with local suppliers early, way before design work begins, “so everyone kind of has a heads up about what’s going on. I think it’s a pretty good idea.”

The Biden administration aims to have 30 GW of offshore wind energy capacity by 2030 and 15 GW of floating offshore wind by 2035.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.