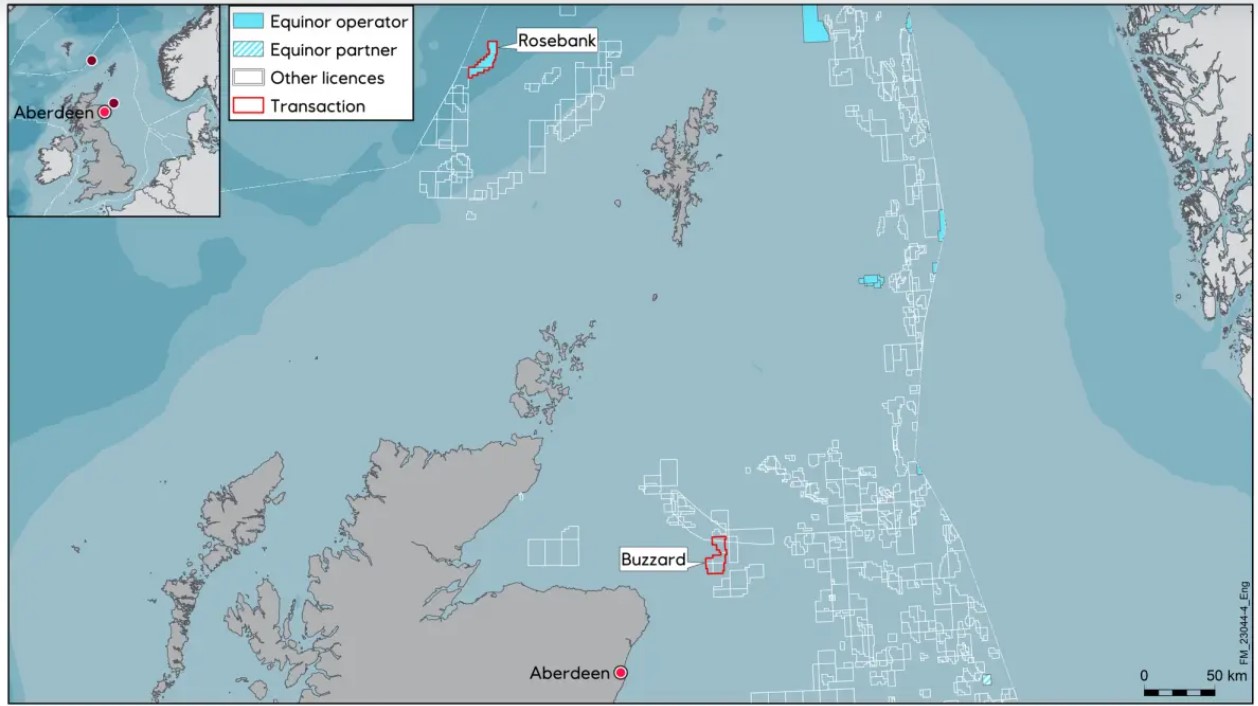

The Buzzard oil field. (Source Suncor Energy)

Suncor Energy received a better-than-expected deal from Equinor after the Norwegian company agreed March 3 to acquire the Canadian company’s U.K. business unit, analysts said.

Equinor agreed to pay $850 million to the British business, which will add or up the stakes Equinor in several key North Sea offshore projects.

Equinor said the deal includes a 29.9% stake in the Buzzard oilfield, an additional 40% stake in the Rosebank development and will also see the Norwegian firm taking on Suncor's U.K.-based employees who work with these assets.

"This transaction is in line with Equinor's strategy of optimising our oil & gas portfolio and deepening in our core countries," Philippe Mathieu, the company's head of international exploration and production, said in a statement.

Tudor, Pickering, Holt & Co. analysts viewed the deal as a positive for Suncor. Part of Equinor’s deal includes a $250 million (CA$340 million) contingency payment based on the submission of a Rosebank development plant.

The consideration is gives “slightly higher proceeds for the Buzzard project and limited proceeds previously anticipated for the as of yet unsanctioned Rosebank project,” TPH analyst Matt Murphy said in a March 3 note.

The deal, expected to close in mid-2023, also supports Suncor’s move to accelerate reduction of final net debt and shareholder returns targets (CA$9B and 100% of free cash flow) “following the step up to the 75% of free cash flow level at the end of the quarter,” Murphy said.

"The decision to sell our UK Exploration & Production (E&P) business is a clear example of our commitment to optimise our asset portfolio," Suncor's interim president and CEO, Kris Smith, said in a separate statement.

"Having the right 'fit and focus' in our portfolio enables us to both ensure effective capital allocation consistent with our strategic objectives and to focus our organisation on delivering value in the rest of our portfolio, including our E&P business in East Coast Canada," he said.

The transaction will add approximately 15,000 boe/d to Equinor's production in 2023, the Norwegian company said.

Equinor is already operator of the planned offshore Rosebank oil and gas project, some 130 km (80 miles) northwest of the Shetland Islands and one of the largest developments in the aging North Sea basin.

The deal doubles Equinor's stake in the development to 80%, while London-listed Ithaca Energy holds the remaining 20%.

Equinor and its partner later this year are expected to make a final investment decision on Rosebank's development, which the Norwegian group has said could involve a commitment of about 4.3 billion pounds (US$5.2 billion).

Equinor also gave updates on the two offshore projects its acquiring interests in.

The Buzzard Field

- Consists of four fixed platforms and three subsea manifolds;

- The field is currently producing at approximately 60,000 boe/d;

- Liquids are exported via the Forties Pipeline System to Hound Point Terminal where the crude is lifted and sold in the open market;

- The gas volumes are exported via the FUKA system;

- There is an electrification initiative to reduce the CO2 emissions on Buzzard; and

- Buzzard is operated by CNOOC International.

The Rosebank Field

- The Rosebank Field, operated by Equinor is located about 130 km west of the Shetland Islands on the U.K. Continental Shelf;

- The Rosebank development has been optimized to reduce carbon emissions and the FPSO will be prepared for future electrification;

- The expected recoverable resources are approximately 300 MMbbl of oil;

- Production from the field will be through subsea wells tied back to a redeployed FPSO for processing and offloading at the Rosebank Field; and

- The Rosebank partners are Equinor (40%), Suncor Energy (40%) and Ithaca Energy (20%).

This report includes reporting by Reuters.

Recommended Reading

Energy Transition in Motion (Week of March 21, 2025)

2025-03-21 - Here is a look at some of this week’s renewable energy news, including a move by U.S. President Donald Trump to boost domestic production of critical minerals.

Stryten Plans to Add 10 GW of Battery Manufacturing Capacity

2025-03-31 - As part of the plan, Stryten said it also will increase domestic processing capacity of recycled plastic from spent batteries.

Rocky Mountain Power Clears Torus as Commercial Battery Provider

2025-03-19 - The approval means Torus is certified to deploy up to 1.2 megawatts for grid-scale energy storage systems across the PacifiCorp service territory, Torus says.

Copenhagen Infrastructure Partners Selects Canadian Solar for Energy Storage Systems

2025-02-10 - Construction on the 240-megawatt battery energy storage system in South Australia is expected to start in 2025, Canadian Solar says.

International Battery Metals CEO Talks Direct Lithium Extraction

2025-03-18 - IBAT CEO Iris Jancik, who stepped into the role in August, shared her insight on market conditions, lessons learned and China.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.