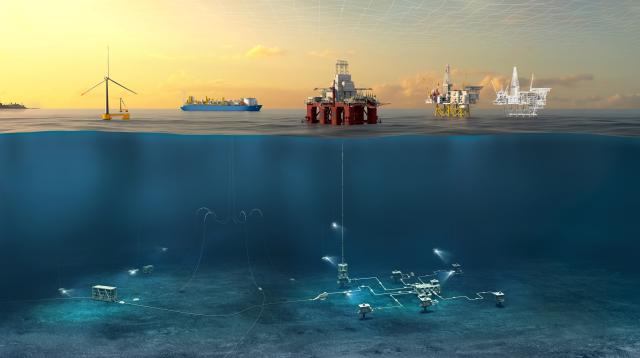

(Source: Aker Solutions)

Presented by:

Editor's note: This article originally appeared in the March issue of E&P Plus.

Subscribe to the digital publication here.

Despite turbulent pricing for oil and gas and a strong social pivot toward the energy transition and decarbonization, determination and cautious optimism prevails to make a success of the remaining life in the U.K. Continental Shelf (UKCS).

In its 2019 economic report, Oil & Gas UK (OGUK) asserted that North Sea firms were on track to produce roughly the same amount of oil and gas in 2020 as they did the previous year, regardless of the unforeseen challenges thrown up by the COVID-19 pandemic. However, with more than GBP35 billion of investment opportunities over the next 10 years included in companies’ plans at the outset of 2020, the annual study concedes there is “real uncertainty” about the viability of many of these initiatives going forward.

As a mature basin, dealing with aging infrastructure and challenging recovery costs, those in the local market are competing with easy and more profitable projects in other locations. However, it continues to be viewed as a resilient role model for burgeoning regions to concurrently reduce lifting costs and improve production in deeper, harsher and more demanding environments. Conversely, its fortune and fate also can act as a portent to oil and gas hubs reaching the dusk of life but where the sun still shines brightly.

Making hay

According to research by McKinsey & Co., aggregate fossil fuel demand is set to peak in 2027 with oil peaking in 2029 and gas in 2037, partially due to the impacts of COVID-19. The study surmises that while hydrocarbon consumption will plateau, more than half of all global energy demand will continue to be met by oil and gas up to 2050.

There seems no doubt that standing still is not the answer. A different approach will be required to secure and sustain success in this new era for the energy mix.

In less than a decade, the playing field of the North Sea has undergone dramatic change with many of the supermajors departing and making way for a new generation of smaller, more nimble, independent operators. There has also been a significant shift in the size and type of field development being progressed to extend life in the basin. This renovation looks likely to continue for another decade as renewables, such as offshore wind, hydrogen and greater electrification, take time to upscale.

As one of the most mature provinces for oil and gas, the UKCS has continually evolved technologies to satisfy its specific requirements—many times ahead of other regions—which affords great opportunity. However, the counter point is now a very cost-focused culture where commoditization of the supply chain has ramped up, potentially hindering further investment in technology.

Though the reputational and financial gains to be made from the renewables sector are now more attractive and attainable for investors, oil and gas retains a crucial role in the energy mix going forward. As the transition starts to pick up pace, oil and gas production is still considered the cash cow for investors.

From a supply chain perspective, the ideal investment is one in which the technology being used to drive down the costs of remaining reserves can also build in efficiencies to lower carbon footprint and increase sustainability. Likewise, key to any kind of business, regardless of size or market, is learning to adapt to the conditions, adopt digital technologies and be agile in that change. Diversification into renewables also becomes increasingly important to spread the risk and increase the gains.

Opportunity knocks

It need not be doom and gloom for the sector. In fact, the cyclical nature of the oil and gas industry makes it inherently more flexible to ride through the lows and take the prize with the highs. It’s a myth to think of monolith organizations as dinosaurs seeking fossils. Adaptability whilst maintaining productivity has always been a necessary trait. Commercial prospects do exist in this sector, particularly as the U.K. boasts a fast-moving net-zero agenda and a highly qualified and highly skilled workforce with easily transferrable talent ready to expedite it.

For example, knowledge and experience gleaned from decades working with natural gas enhance the safe and sustainable adoption and implementation of hydrogen management, processing and transportation. A strong skills base in the North Sea today is vital or our future role will be limited.

As traditional oil and gas companies such as bp, Shell and Equinor evolve into international energy companies, the supply chain is pivoting toward those with strong provenance already in place.

The issue is one of 10 keynote program sessions at SPE Offshore Europe 2021 being held Sept. 7-10 in Aberdeen, Scotland. It will bring together the regulator and a selection of operators at different stages of evolution to share experience and insight and discuss what is needed to survive and thrive in this period of extraordinary change and pressure.

The sessions, which include transitioning to lower carbon solutions, oil and gas security of supply, lowering carbon footprint and emissions, and future collaboration models, are aligned to the overall theme and direction of the event: “Oil & Gas: Working Together for a Net Zero Future.”

Recipe for success in E&P

With the continuing need for the provision of oil and gas to satisfy energy demand, alongside new and broader sources of energy provision, there is a market for many types of energy providers. Like an elaborate quilt, the industry is a patchwork of diverse companies each approaching the marketplace on a range of routes. Some of the larger internationals are using technology to drive it while smaller businesses are using varying work processes and practices. The winners will be those that can balance and take into consideration the agenda for decarbonization as well as continuing safe and sustainable production.

For the future of E&P, which will be a major talking point at SPE Offshore Europe 2021, companies that can approach the marketplace with the right cost base and approach for managing and developing commercial deals and models, which may not be so heavily burdened with their own resources to keep costs lean, will make money.

Essentially, if the recovery continues and lifting costs can be kept at or below $20/bbl, then there’s still a profit to be made, even between US$40 to US$50/bbl. Anything is possible with the right combination of field, development plans and financial acumen.

This also affords the industry opportunities to work together and develop solutions to reduce flaring and venting, for example, and legitimize their social license to operate.

United we stand and deliver

For the U.K., there has been a huge jump forward in terms of government investment in the low carbon agenda. Over the past year, the Energy Whitepaper and the 10-point plan for a green recovery have been showcased. The outcome of negotiations on the North Sea transition deal also is expected over the next six months. This will map out long-term action for transforming the sector, delivering the energy transition and act as a vehicle for creating new jobs as well as trade and investment opportunities.

All these are at a particular point in time where it makes sense for those working in the mature North Sea to look at the transition more strategically, whilst continuing the day-to-day delivery of oil and gas, now and for future energy requirements. It’s a time when our industry must pull together and show its broad capability and focus.

About the authors:

Sian Lloyd-Rees and Jim Lenton are both SPE Offshore Europe 2021 Executive Committee members.

Lloyd-Rees is U.K. country manager with Aker Solutions. In a career spanning more than 25 years, she has extensive business experience as a senior leader in both energy and IT industries, having held a number of leadership roles in both blue chip and startup companies. She is the head of U.K. and a senior vice president with Aker Solutions. She is also co-chair on the board of OGUK.

Lenton is senior vice president of integrated solutions with Worley. With a background in chemical and process engineering, Lenton has built his career in oil and gas globally over 25 years. He is a fellow of the IChemE. Prior to being acquired by WorleyParsons in 2017, he ran the European operations for Amec Foster Wheeler in Northern Europe and CIS, and then the global asset support product line in the Oil, Gas and Chemicals division.

References available.

This story was originally published March 19, 2021.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.