From Petrobras planning FPSOs for its Sergipe project to a Neptune ordering digital twins, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Hibiscus flows for BW Energy

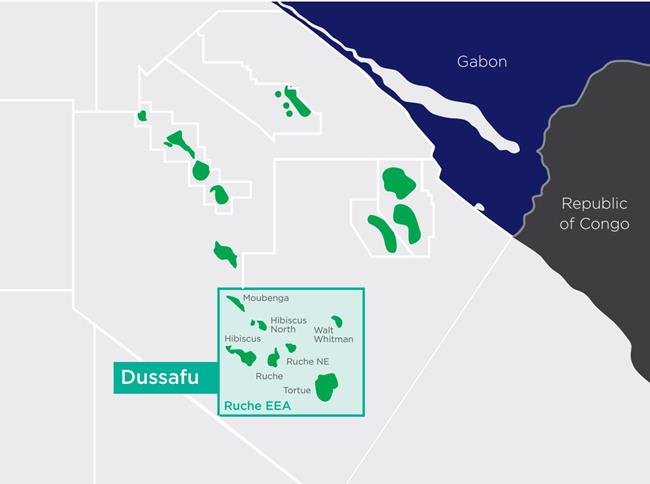

First oil has flowed from BW Energy’s Hibiscus / Ruche Phase 1 shallow water development in the Dussafu license offshore Gabon, the operator announced on April 10.

The BW MaBoMo production facility drilled the DHIBM-3H well to a depth of 3,883 m into Gamba sandstone reservoir on the Hibiscus Field. Drilling followed the installation of the production facility, risers, and pipelines. A pipeline transports produced oil from Hibiscus / Ruche to the BW Adolo FPSO for processing and storage before offloading to oil tankers.

The Hibiscus / Ruche Phase 1 drilling campaign targets four Hibiscus Gamba and two Ruche Gamba wells, which are expected to add an average 30,000 barrels per day (bbl/d) of oil production when all wells are completed in early 2024. The wells will be drilled by the Borr Norve jackup rig.

"Our priority now is to complete start-up activities and stabilize production from the DHIBM-3H well,” BW Energy CEO Carl Krogh Arnet said in a press release. “In parallel, work progresses towards start-up of the new gas lift compressor to support production from the existing six Tortue wells while also moving ahead with drilling of the next Hibiscus / Ruche production wells as planned."

BW Energy Gabon SA operates the Dussafu license with 73.5% interest on behalf of partners Panoro Energy with 17.5% and Gabon Oil Co. with 9%.

FPSO sails for Baleine offshore Côte d'Ivoire

The FPSO for the Eni-operated Baleine Field left Dubai for Côte d'Ivoire, the operator announced on April 6.

The FPSO was refurbished and upgraded to be able to handle 15,000 bbl/d of oil and 25,000 cubic feet per day (cf/d) of associated gas.

On arrival in Côte d'Ivoire, the vessel will be renamed Baleine for the field it is serving. Eni SpA estimates the field holds 2.5 billion bbl and 3.3 trillion cubic feet of reserves in place. Gas production will be delivered onshore via a new export pipeline. The installation of the subsea production system and well completion campaign are underway, targeting accelerated start-up of production by June 2023.

The project is set to start production less than two years after the Baleine 1X discovery well and one and a half year after the final investment decision (FID). Eni is already progressing on the second phase of the project, forecasting a start-up of production by December 2024 after having taken the FID in December 2022.

The Baleine Field extends over blocks CI-101 and CI-802, which Eni operates on behalf of partner PetroCi Holding.

Petrobras chartering two FPSOs for Sergipe

Petrobras said on April 3 it will charter two FPSOs for its Sergipe deepwater project in the Sergipe-Alagoas Basin.

The FPSOs will each be able to process up to 120,000 bbl/d of 38- and 41-degree API oil. Together, they will be able to handle up to 18 million cubic meters per day (MMcm/d) of gas.

The project is in water depths of 2,500 m to 3,000 m.

The first FPSO will serve the Agulhinha, Agulhinha Oeste, Cavala, and Palombeta fields, located in the BM-SEAL-10 and BM-SEAL-11 concessions. Petrobras operates BM-SEAL-10 with 100% interest and BM-SEAL-11 with 60% interest. IBV Brasil Petróleo LTDA holds the remaining 40% interest.

The second FPSO will serve the Budião, Budião Noroeste, and Budião Sudeste fields, located in the BM-SEAL-4, BM-SEAL-4A, and BM-SEAL-10 concessions, respectively. Petrobras operates BM-SEAL-4 with 75% interest on behalf of ONGC Campos Limitada with 25%. Petrobras operates BM-SEAL-4A and BM-SEAL-10 with 100% interest.

Contracts and company news

Repsol implements DecisionSpace suite

Halliburton Co. announced on April 5 that Repsol had implemented the Halliburton Landmark DecisionSpace 365 Well Construction Suite to automate and streamline its well design process. The Well Construction Suite and Digital Well Program help Repsol standardize its well design process and automate routine work to increase efficiency and minimize down time, according to the service company. The SmartDigital co-innovation service delivers tailored workflows and new components to further reduce cycle time and provide greater data quality throughout the well workflow process, Halliburton said.

Neptune orders two new digital twins

Neptune Energy announced on April 6 an agreement with Eserv to create new “digital twins” of two offshore platforms in the Dutch sector of the North Sea.

The deal expands Neptune’s portfolio of digitized assets to 14. The twins enable engineers to carry out traditional offshore work from an onshore location, accelerating work schedules and reducing costs.

U.K.-based Eserv, which previously created digital versions of 12 platforms in the Dutch and U.K. sectors, will digitize the Neptune-operated D15-A and K12-C platforms.

Microseismic, ShowMyWell team up

MicroSeismic Inc. (MSI), has entered a strategic alliance with digital oilfield firm ShowMyWell to provide continuous subsurface and surface monitoring solutions for site assessment activities and the management of greenhouse-gas emissions, MSI said on March 28.

ShowMyWell’s Internet of Things (IoT) capabilities provide continuous monitoring solutions that respond to ongoing changes in field conditions or advancements in technology. The IoT adapts by adding or removing sensors, meters, probes or gateway devices.

The partnership will provide continuous monitoring solutions and deliver a rapid, cost-competitive and autonomous alert system. The systems notify stakeholders of changes in environmental conditions including anomalous and unplanned events. As an alert system, the monitoring solutions may trigger additional actions, including rapid deployment of repair personnel to minimize damage to the environment.

MicroSeismic and ShowMyWell plan to release their turnkey monitoring solution in the second quarter of 2023.

Seadrill completes Aquadrill acquisition

Seadrill Ltd. completed its acquisition of Aquadrill LLC, Seadrill announced on April 3.

The combined company owns 12 floaters, including seven seventh-generation drillships, three harsh environment rigs, four benign jack-ups, and three tender-assisted rigs. Additionally, seven rigs will be managed under strategic partnerships. Together, they have a combined backlog of $2.6 billion.

Recommended Reading

Chevron Moving HQ, CEO from California to Houston

2024-08-02 - Chevron Chairman and CEO Mike Wirth and Vice Chairman Mark Nelson will relocate to Houston, where much of Chevron’s other top leadership is already based.

ISS, Glass Lewis Push Crescent, SilverBow Shareholders to Vote for Merger

2024-07-19 - Proxy Advisory firms Institutional Shareholder Services and Glass Lewis also recommend that Crescent Energy shareholders vote for the approval of the issuance of shares on Crescent Class A common stock.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Permian Consolidation Piques Interest in Drill-to-earn Opportunities

2024-08-14 - Drill-to-earn arrangements have been utilized in the Permian for years in the forms of joint ventures, farm-outs and other customizable agreements.

Archrock Offers Common Stock to Help Pay for TOPS Transaction

2024-07-23 - Archrock, which agreed to buy Total Operations and Production Services (TOPS) in a cash-and-stock transaction, said it will offer 11 million shares of its common stock at $21 per share.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.