As the industry braces for the future, operators are cautiously optimistic about the global rig market. Even with persisting uncertainties, the industry expects a robust and sustainable future. (Source: Shutterstock)

Despite a lower rig count than the previous year, extended durations of contracts awarded globally were a defining feature of 2023, with operators strategically securing rigs well in advance — some with contracts spanning up to 15 years.

But while the future looks bright for most regions, the Gulf of Mexico (GoM) can’t say the same.

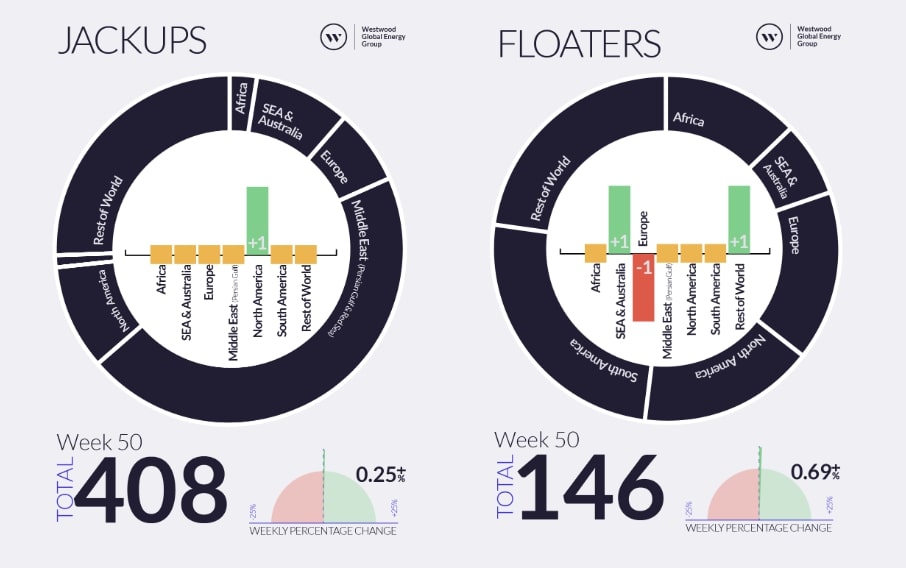

“So there's several markets that still have really good outlooks for 2024 and beyond. The Gulf of Mexico right now is not one of those,” Terry Childs, head of Riglogix at Westwood Global Energy, told Hart Energy.

Even though the 2024 Gulf outlook is not as strong as some other regions, 2023 was still a good year for the region. The GoM has been the worldwide leader in terms of floating rig day rate increases the past few years because of the tight market. Utilization reached 100%, leaving no available rigs left in the Gulf.

“The U.S. Gulf of Mexico was by far the leader in terms of day rate increases in recent years and has been a really tight market. There was quite literally no supply for a while,” Childs said.

The slowdown in demand led to the rare situation of two idle drillships, both owned by Transocean, left in the area without work, he said.

In the GoM, the limited amount of available rigs caused day rates to soar before they plateaued as rig utilization reached 100%. Contractors had to look elsewhere for work, causing both rig counts and rig utilization in other markets to grow. Day rates in other regions have now “risen and essentially caught up to the Gulf,” Childs said.

Other regions catching up in terms of contract awards contributed to a global shortage of rigs, causing operators to secure contracts earlier to avoid potential shortages. The anticipation of rising day rates also motivated operators to act swiftly, resulting in increases in day rates across the world. Regions such as Eastern Canada were able to reach day rates as high as $500,000 per day for a semi-submersible rig, with other areas seeing day rates vary based on demand and bidding competition, Childs said.

In the Middle East, most jackup contracts awarded were multi-year, ranging from three years all the way to fifteen, Childs said. Operators such as Saudi Aramco and ADNOC Offshore made efforts to add rigs to their fleets, he said.

In Brazil, Petrobras played a crucial role in the region’s growth, adding rigs to its fleet, with numerous outstanding tenders indicating sustained activity. Southeast Asia faced a jackup shortage, due to rigs moving to the Middle East, resulting in an upswing in day rates. Increased drilling activity was also observed in Western and Southern Africa, particularly around recent discoveries in Namibia, prompting operators to plan additional drilling in those regions.

In 2024, Childs doesn’t expect to see as many contracts awarded in Middle East as result of the sheer number of rigs, but he does expect to see some tendering during the year. In India, ONGC is said to be looking to contract as many as six jackups, a few of which are likely to be added incrementally.

“Typically, the way that the jackup market works [in India] is that they award three-year contracts at a time. So some of those six jackups will just be new contracts for incumbent units that are already working there... they may also draw a unit or two out of the Middle East, because there are some idle rigs there that could go to India,” Childs said.

On the other side of the world, Petrobras — and Brazil as a whole — will continue to be busy, with several tenders that haven’t been awarded contracts and a plethora of rigs to add to the market. Other South American countries such as Colombia and Argentina are also expected to add a few rigs to the market as well. Trinidad and Suriname have had some discoveries as well, although the full development is some years away.

“Trinidad has seen a little bit of activity. In Suriname, Total and APA Corp.’s Apache made their discoveries [in] Block 58 and they intend on developing that block,” Childs said. “I think ultimately in Suriname you could see situations similar to Guyana where they have six drill ships working there now. And I don't know that you'll get to six, but you likely will see multiple rigs there, it's just not going to happen before 2025 at the earliest.”

As the industry braces for the future, operators are cautiously optimistic about the global rig market. Even with persisting uncertainties, the industry expects a robust and sustainable future.

Recommended Reading

Industry Warns Ruling Could Disrupt GoM Oil, Gas Production

2024-09-12 - The energy industry slammed a reversal on a 2020 biological opinion that may potentially put an indefinite stop to oil and gas operations in the Gulf of Mexico—by December.

New FERC Commissioner Calls Slow Permitting Process ‘Huge Problem’

2024-09-17 - FERC Commissioner David Rosner said the commission is aware that the permitting process is too slow overall at Gastech Houston 2024.

Supreme Court’s Uinta Basin Rail Case Raises Stakes for LNG, Pipelines

2024-07-10 - The lawsuit, involving crude transport via railway in the Uinta Basin, is part of a larger intragovernmental fight that could have implications for how FERC decides pipeline and LNG plant permitting.

FTC Requests More Info on $17.1B ConocoPhillips, Marathon Oil Deal

2024-07-12 - The U.S. Federal Trade Commission’s request for additional information regarding ConocoPhillips’ $17.1 billion acquisition of rival Marathon Oil is likely to delay the transaction. Other recent energy M&A deals have faced similar “second requests” from the FTC.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.