On Feb. 1, Civitas Resources added to its list of D-J Basin takeovers with the acquisition of privately held operator Bison Oil & Gas II LLC. (Source: Hart Energy)

Fresh off a transformative year, Civitas Resources Inc. said President and CEO Eric Greager has stepped down concurrent with a $346 million acquisition of a privately held Denver-Julesburg (D-J) Basin operator.

“It has been an honor and privilege serving as CEO of Civitas,” Greager said in a statement on Feb. 1. “I want to thank the Civitas board and our entire team for their exceptional efforts in successfully shaping the company’s founding principles and positioning the platform for long-term success.”

Formerly known as Bonanza Creek Energy, the company rebranded as Civitas Resources last November following a slew of acquisitions, which Greager helped oversee.

Greager has served as CEO of Civitas and its predecessor Bonanza Creek since 2018. During his tenure as CEO, Civitas acquired HighPoint Resources Inc., Extraction Oil & Gas Inc. and Crestone Peak Resources LLC. On Feb. 1, the company added to the list with the acquisition of Bison Oil & Gas II LLC, marking its fourth takeover within the past year.

Ultimately, the steady string of M&A activity helped to establish Civitas as the largest pure play E&P in the D-J Basin. Based in Denver, Civitas also claims to be Colorado’s first carbon neutral oil and gas producer.

“On behalf of the board and the entire Civitas organization, we thank Eric for all of his efforts in helping to establish Civitas as the largest pure play E&P in the D-J Basin,” Civitas Chairman Ben Dell commented in the release. “Eric realized much success in his time as CEO, and we wish him all the best with his future endeavors.”

Effective Jan. 31, Dell assumed the role as interim CEO. Civitas formed a search committee comprised of members of its board of directors to identify a new CEO. Greager also agreed to serve as a technical consultant to Civitas for the next 12 months “in order to help ensure its continued success,” a company release said.

Concurrent with the CEO transition, Civitas announced it had signed definitive agreements to acquire Bison Oil & Gas II LLC. Consideration consists of 2.3 million of Civitas Resources shares and $45 million in cash plus the assumption of approximately $176 million in debt and other liabilities.

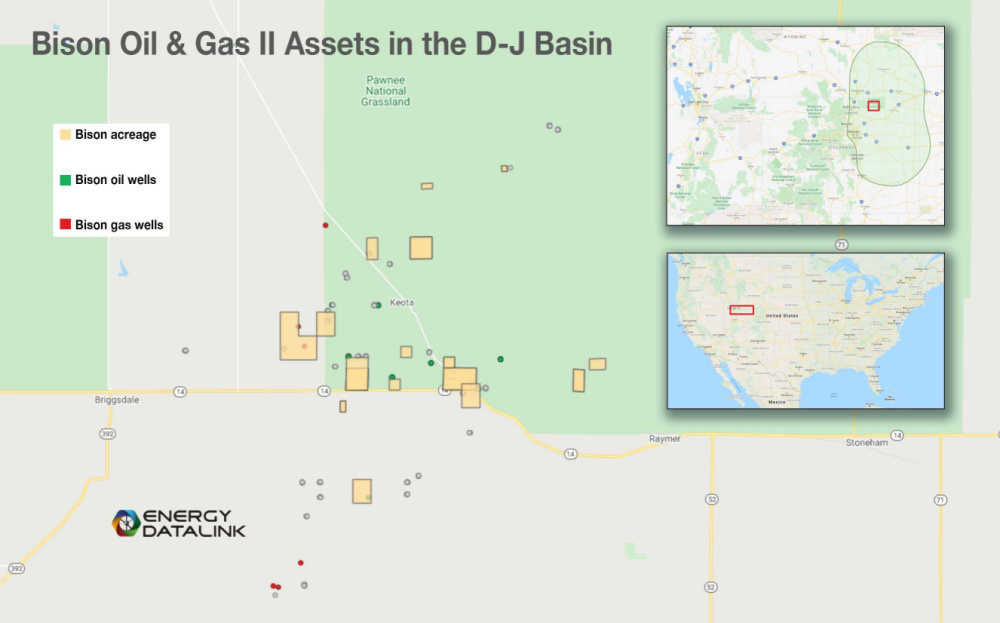

Bison II was founded in December 2016 with capital commitments from Carnelian Energy Capital and management. The company holds leases covering roughly 40,000 net acres and to-date has drilled 30 horizontal wells across its core D-J position, according to the Bison website.

Civitas said the acquisition of Bison II margins with a 2022E pro forma production increase of approximately 9,000 boe/d, composed of 75% oil and 90% liquids, without incremental G&A expense.

The Bison transaction will also add 102 gross “high-quality” locations, of which 38 are fully permitted, and be accretive to free cash flow beginning in 2023 with pro format net leverage of 0.2x, the company release added.

Kimmeridge Energy, Civitas’ second largest shareholder, commented in the release: “In just a short period of time, Civitas has established itself as a leading platform in the D-J Basin, with scale, resources and a demonstrated commitment to delivering unprecedented value to all of its stakeholders. We are very pleased with the integration progress of Civitas’ legacy companies and firmly believe that the Company is well positioned to continue successfully executing its business plan, with a clear objective of identifying value-accretive opportunities.”

Civitas operates wells across its roughly 525,000 net-acre position in the D-J Basin producing about 160,000 bbl/d, according to its website. The company exited 2021 with a cash balance of approximately $250 million and an undrawn revolving credit facility, yielding over $1 billion in liquidity, not pro forma for the Bison transaction. Civitas is expected to release its fourth-quarter results after market close on Feb. 28.

The Bison transaction is expected to close in first-quarter 2022. RBC Capital Markets LLC and Petrie Partners LLC are serving as financial advisers and Kirkland & Ellis LLP as legal adviser to Civitas. CIBC Capital Markets is financial adviser and Bracewell LLP is legal adviser to Bison.

Recommended Reading

How Liberty Rolls: Making Electricity, Using NatGas to Fuel the Oilfield

2024-08-22 - Liberty Energy CEO Chris Wright said the company is investing in keeping its frac fleet steady as most competitors weather a downturn in oil and gas activity.

Wood Mackenzie: OFS Costs Expected to Decline 10% in 2024

2024-07-30 - As service companies anticipate a slowdown in Lower 48 activity, analysts at Wood Mackenzie say efficiency gains, not price reductions, will drive down well costs and equipment demand.

Where, When and How to Refrac—Weighing All the Options

2024-07-12 - Experts weigh in on strategic considerations when deciding how to rejuvenate production from a tired well.

Patterson-UTI Boosts Bottom Line with OFS Acquisitions

2024-08-06 - Less than a year out from the closing of its merger with NexTier and its acquisition of Ulterra Drilling Technologies, Patterson-UTI is taking strides not to be the latest has-been.

Devon Capitalizing on Bakken, Eagle Ford Refracs

2024-08-07 - Devon Energy’s Delaware Basin production dominated the quarter for the multi-basin E&P, but the company is tapping into recompletion opportunities to supplement production, executives said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.