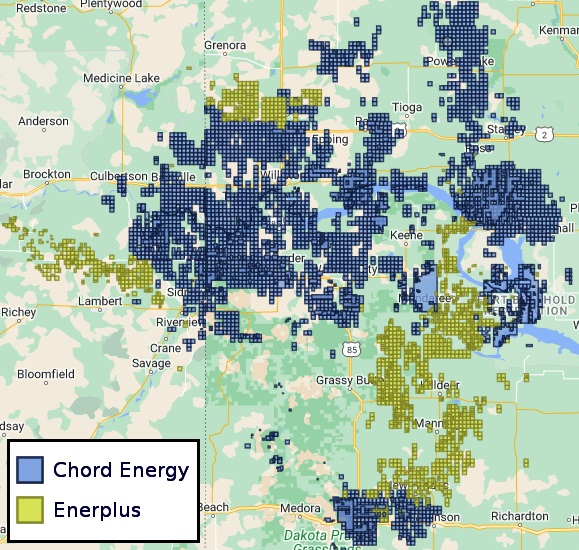

Chord has previously said the combined company would become a premier operator in the Williston with 1.3 million net acres and combined production of 287,000 boe/d, including about 100,000 boe/d from Enerplus. (Source: Shutterstock/Chord Energy/ Enerplus Corp.)

Chord Energy appears to be pulling off one heck of a balancing act. The company is looking to close a $4 billion deal to acquire fellow Williston Basin operator Enerplus Corp. on May 31, with integration efforts already underway.

At the same time, the company is focused on fine-tuning its three-mile lateral program—they’re costlier but recover more resources—as it preps for four-mile horizontals late in 2024. And, the company overcame some nasty weather earlier this year to exceed some production expectations.

Chord’s President and CEO Danny Brown addressed the Enerplus deal in opening remarks during a May 8 earnings call, saying the company has long believed in the “industrial logic” of a combination of these two Williston E&Ps.

At close, Brown said that the company will provide some preliminary guidance and then a more extensive outlook for the pro forma company during its second-quarter earnings report in August.

Chord has previously said the combined company would become a premier operator in the Williston with 1.3 million net acres and combined production of 287,000 boe/d, including about 100,000 boe/d from Enerplus. Crude oil is expected to be 56% of the combined company's production.

Neal Dingmann, managing director at Truist Securities, forecasts an immediate step up in free cash flow with “several other positive potential results to come.”

“The combined larger asset base of older and newer wells along with [Chord’s] operational efficiencies could result in notable total well productivity,” Dingmann wrote in a May 8 commentary. “As such, we believe there is upside to our/consensus estimates as the combined operations continues to improve. Further, we anticipate [Chord] remaining active in the M&A arena. We are raising our [price target] to $228/share from $224/share.”

Shareholder approval remains, with votes on the deal scheduled on May 14 for Chord stakeholders and on May 24 for Enerplus.

Brown expressed confidence in integrating Enerplus’ assets, noting that the company has successfully folded in multiple transactions in the past few years, including an acquisition of XTO Energy assets, as well as the Oasis and Whiting merger.

“The team keeps getting better, and applying the learnings from these integration efforts is expected to help ensure we realize and even exceed our announced synergies while maintaining strong operational performance of the underlying business,” Brown said.

Chord said it expects to generate $150 million or more per year in synergies and accretive key metrics. The company has also touted Enerplus’ “best-in-class” core Williston inventory, which will support about 10 years of development.

The company said its leverage will be 0.2x pro forma at the close of the Enerplus merger. Chord has standalone liquidity of $1.3 billion, consisting of an undrawn $1 billion elected commitment, $296 million in cash and $9 million in letters of credit.

“To put it plainly, we believe that Enerplus has some of the best inventory and acreage in the basin,” Brown said.

He added that both organizations share similar cultures.

“Integration efforts are going very well, with both organizations working together to drive incremental value from the transaction,” Brown said.

The combination will drive accretion across all key per-share metrics, including EBITDA, cash flow and free cash flow, Brown said.

“In addition, the structure of the deal allows us to maintain a peer-leading return of capital program and preserves a fortress balance sheet, giving the pro forma organization tremendous optionality as we move forward,” he said. “The combination with Enerplus significantly accelerates Chord's beneficial rate of change as it relates to improving economic returns and value creation, and it is a very exciting time for our organization.”

Brown also congratulated his team for continuing to operate at a high level, including dealing with winter weather and continuing to explore longer laterals.

Dingmann noted Chord was able to minimize downtime activity and exceed oil production expectations for the quarter.

“Much of the upside was a result of solid continued well performance and accelerated activity driven by cycle time improvement,” he said. “We believe post Enerplus close, production will immediately increase though the go forward plan/strategy of stable production to maximize FCF.”

Enerplus, however, reported weaker first-quarter production results relative to consensus, Gabriele Sorbara, managing director at Siebert Williams Shank & Co., wrote in a May 9 report.

“The miss was attributed to timing and weather impacts, with the capex coming in 11.3% lower than consensus,” Sorbara said.

The fourth mile

Operationally, COO Darren Henke said Chord continues to be encouraged by the progress it’s making on three-mile laterals. To date, the company has executed on about 80 such wells.

“While it's still early days, on average, performance is meeting or exceeding our expectations, and one can clearly observe contribution from the furthest portions of the lateral,” Henke said.

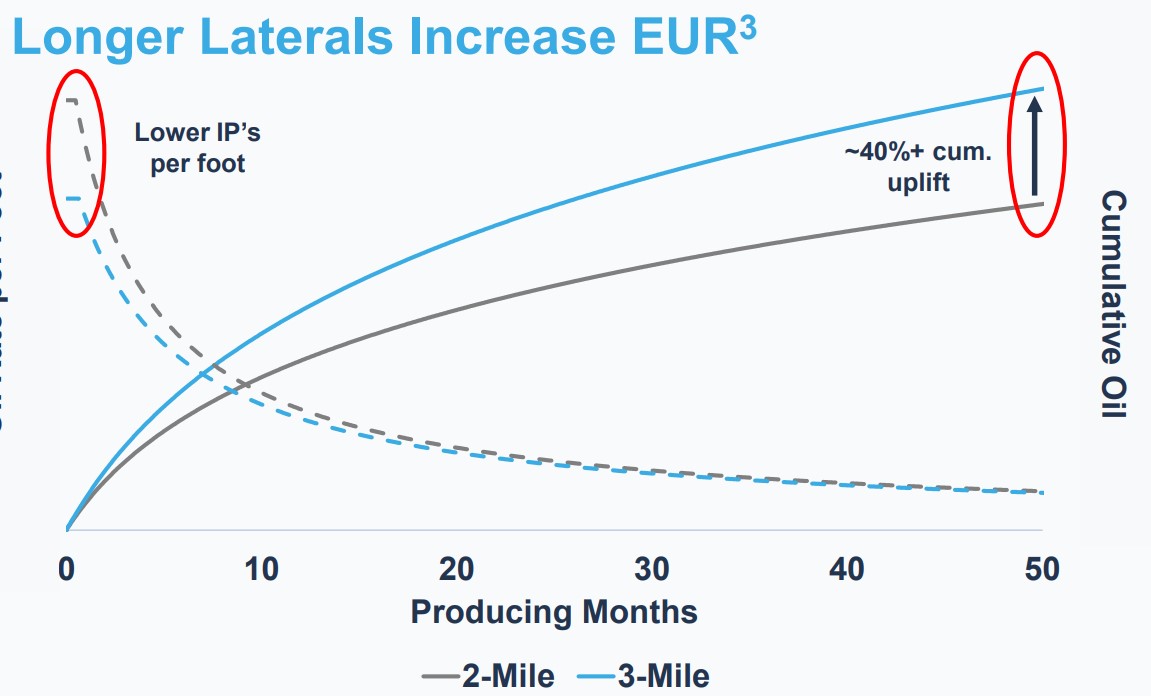

The company reported 40% higher EURs at a 20% increase in wells costs. The economics in Chord’s western acreage is comparable to two-mile laterals in the core of the Williston.

“We're also seeing an uplift compared to the two-mile analog wells in each prospect area, which is increasing over time,” Henke said.

Henke said it was important to acknowledge that production per lateral foot from three-mile wells is initially below two-mile analogs. He said that lower production reflects facility constraints and managed flowback, which generally keep volumes in a certain band for the initial productivity period.

“However, over time, the three-mile well production per lateral foot catches up with 2-mile wells, given shallower declines, which ultimately leads to higher recovery,” he said.

Chord has also made progress on drilling and completing times, cutting the duration by 25% compared to 2023. Three-mile wells now take about 10 days to 11 days, on average.

“I should note, in the first quarter, Chord drilled a three-mile well in 8.7 days, spud to rig release, which set a new basin record,” Henke said.

Asked by an analyst about future four-mile laterals, which Chord plans to spud near the end of 2024, Brown said it’s early days for the program. Brown anticipates some incremental degradation on the fourth-mile delivery, just as the company has experienced in the third mile on three-mile laterals.

“We're encouraged that maybe we've been a little too conservative on that from a two- to three-mile standpoint,” Brown said, adding more clarity will be provided near the end of the year. “But as we increase our learnings through the three-mile process, we’ll plow that into four mile.”

From a drilling perspective, Brown said he’s confident that a four-mile lateral won’t be too much of a technical challenge.

“I think the clean out is probably the technical challenge that we have most just with existing coil,” he said. “Certainly, coil tubing clean out will be a big challenge for us in a lateral that's long, and probably will require some stick pipe.”

However, Brown said he’s not sure how much Chord is envisioning four-mile wells replacing three-mile wells. Some of those decisions will be based on the geometry of where the company is drilling.

“Certainly a four-mile well instead of a two-mile well could be a big uplift for us. And so that's … really what we're excited about,” Brown said.

Recommended Reading

Battling the Secret Army of Leakers in the Oil and Gas Field

2024-08-20 - When it comes to emissions reductions, AI and machine learning can help, but actually collecting and interpreting emissions data has often proven a daunting task.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.