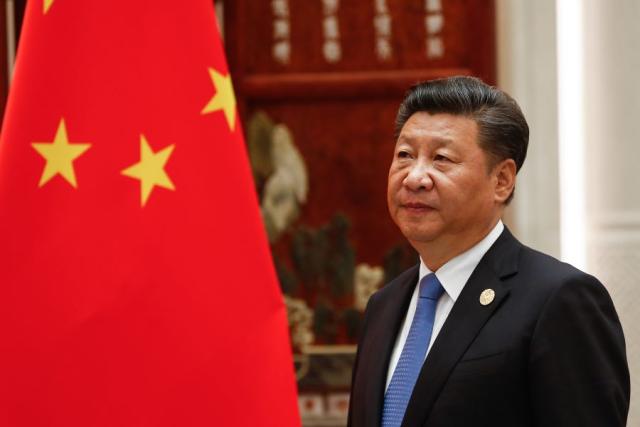

A file photo of China’s President Xi Jinping during a summit in Hangzhou, China. (Source: Shutterstock.com)

The decision by China’s President Xi Jinping to walk back decisions around his zero-COVID policy will lead to higher domestic demand for oil and gas, according to Dr. Michal Meidan, director of the gas program and of the China energy program at the Oxford Institute for Energy Studies.

Protests and weak economic data were key elements behind the leader’s decision, she said Jan. 10 during a webinar hosted by Jefferies.

As such, China will spring back to life after being under a strict lockdown system aimed at stopping the spread of COVID cases. Increased mobility inside and outside the country of some 1.5 billion citizens, based on data compiled by Worldometer, will anchor rising industrial activities.

The pace of China’s economic recovery will depend on COVID infections, which are expected to peak sometime in the first half of 2023 followed by a stronger recovery in the second half of the year, according to the Oxford director.

The abrupt policy change, which favors stability but raises doubts about policy volatility moving forward, could see China contributing approximately 600,000 bbl/d to global oil demand growth in 2023, she said.

China’s demand for gasoline and jet fuel is expected to rise with the economic reopening after declining due to mobility restrictions.

On the refining side, China will also walk back limits on throughputs and export quotas. These quotas will be important to track to see if the government adopts a more liberal approach toward product exports.

“China’s reopening is also likely to benefit export economies in the European Union like Germany,” said Megan Greene, Kroll Global chief economist and senior fellow at Brown University, during a Jan. 11 webinar hosted by the Atlantic Council.

China’s rising gas demand

China’s reopening not only impacts oil but also gas and LNG, said Meidan, who has focused on all things Asia in the past for Energy Aspects, Eurasia Group and Chatham House.

LNG demand in China is expected to remain limited between 8 million tonnes per annum (mtpa) to 10 mtpa due to the expected rise in domestic production and pipeline imports. High gas prices haven’t negatively impacted import demand since they fall under long-term contracts priced at advantageous terms, she said.

Beijing has been hesitant about boosting its reliance on Russian imports, though there will likely be an increase in oil imports to Shandong refineries as Chinese majors remain wary of sanctioned barrels.

China already obtains 33% of its gas from Russia and imports through the Power of Siberia pipeline are expected to rise to its capacity to 38 Bcm in 2025 compared to 15 Bcm currently, Meidan said.

But she remains cautious about the future prospects of Power of Siberia 2, with its 50 Bcm capacity, noting encouraging comments recently made by Gazprom haven’t been matched by equally positive ones from Chinese counterparties.

Recommended Reading

CEO: Coterra Drops Last Marcellus Rig, May Halt Completions

2024-09-12 - Coterra halted Marcellus Shale drilling activity and may stop completions as Appalachia waits for stronger natural gas prices, CEO Tom Jorden said at an industry conference.

Vitol CEO: US Shale Gas Growing Source of Shipping, Trucking Fuel

2024-09-18 - International commodities trading house Vitol sees growing demand for U.S. shale gas to spur LNG exports to China, India and emerging economies in Asia.

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

2024-09-03 - The past decade has been difficult for the Midcontinent, where E&Ps went bankrupt and pulled back drilling activity. But bountiful oil, gas and NGL resources remain untapped across the Anadarko, the SCOOP/STACK plays and emerging zones around the region.

Non-op Rising: NOG’s O’Grady, Dirlam See Momentum in Co-purchase M&A

2024-09-05 - Non-operated specialist Northern Oil & Gas is going after larger acquisitions by teaming up with adept operating partners like SM Energy and Vital Energy. It’s helping bridge a capital gap in the upstream sector, say NOG executives Nick O’Grady and Adam Dirlam.

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

2024-09-25 - Falling oil prices, recession fears and the U.S. election cycle are weighing on an increasingly pessimistic energy industry, according to a new survey of oil and gas executives by the Federal Reserve Bank of Dallas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.