The Buckeye Texas Hub, pictured, is located along the ship channel in the Port of Corpus Christi and has 2.6 million barrels of crude, condensate, naphtha and fuel oil storage. (Source: Buckeye Partners LP)

[Editor's note: This story was updated at 9:30 a.m. CDT May 10.]

Buckeye Partners LP said May 10 it agreed to be acquired by IFM Investors in an all-cash transaction valuing the Houston-based company, which roots trace back over a century, at $10.3 billion.

Under the agreement, the IFM Global Infrastructure Fund will acquire all of the outstanding public common units of Buckeye for $41.50 per unit. The equity value of the transaction is about $6.5 billion.

Additionally, the acquisition price represents a 31.9% premium to Buckeye’s volume-weighted average unit price prior to the company’s announcement of certain strategic actions made in early November 2018.

“Buckeye’s board of directors recently reviewed strategic options for the business and determined that IFM’s proposal to acquire Buckeye is in the best interest of Buckeye,” Clark C. Smith, chairman, president and CEO of Buckeye, said in a statement.

Buckeye Partners traces its roots to 1886 when The Buckeye Pipe Line Co. was incorporated as a subsidiary of Standard Oil Co. Buckeye became an independent publicly owned company after Standard Oil’s dissolution in 1911.

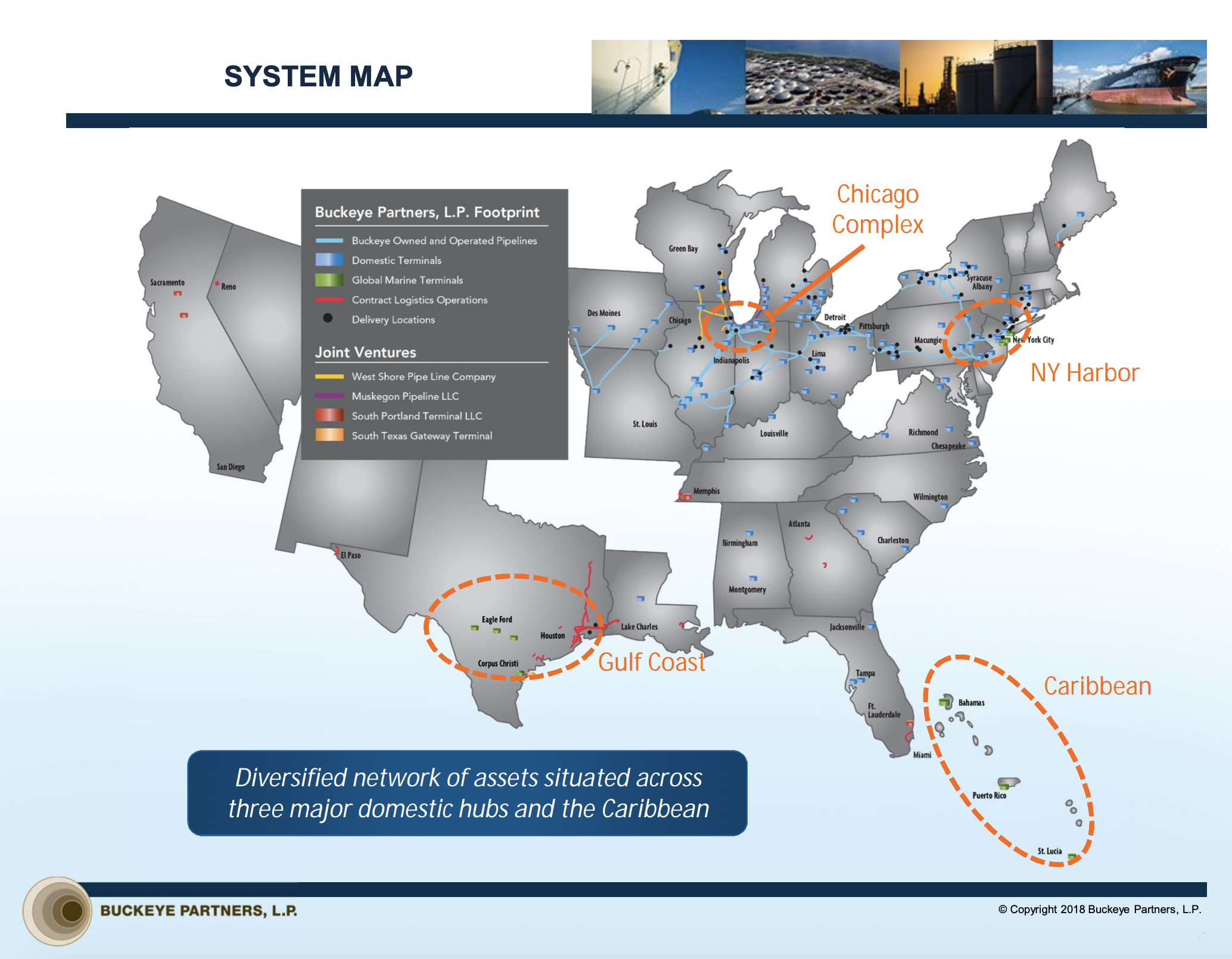

Today, Buckeye owns and operates one of the largest diversified networks of integrated midstream assets, including a network of marine terminals located primarily in the East Coast and Gulf Coast regions of the U.S., as well as in the Caribbean.

Smith said the proposed transaction with IFM will accelerate long-term returns for Buckeye unitholders as well as providing access to capital to execute on its long-term business strategy.

“We look forward to this next chapter in Buckeye’s 133-year story,” he added.

Among MLPs, Buckeye has a notable history having gone public in 1986, said Stacey Morris, director of research at Alerian.

Alerian is a Dallas-based advisory firm focused on providing research on the MLP market. Morris noted the proposed transaction highlights the disconnect between how public markets vs. private-equity companies are valuing midstream companies, particularly MLPs.

“For months, we have viewed a major private equity transaction as a potential catalyst for the MLP and midstream space,” she said in an emailed statement. “Today’s transaction could serve as a potential catalyst for the MLP and midstream space more broadly.”

She estimates the transaction value represents a 27.5% premium to yesterday’s closing of Buckeye share price.

RELATED: Re-Evaluating MLP Valuations

The acquisition of Buckeye for IFM—a pioneer and leader in infrastructure investing on behalf of institutional investors globally—expands the Australian firm’s midstream energy infrastructure portfolio.

Pro forma the transaction, IFM has $90 billion of assets under management, including $39.1 billion in infrastructure, which it manages on behalf of more than 370 institutional investors. The firm takes a long-term approach to investing, with no pre-determined time divestiture horizon.

In total, Buckeye operates 6,000 miles of pipeline with over 100 delivery locations and 115 liquid petroleum products terminals with aggregate tank capacity of over 118 million barrels.

Pending the transaction’s close, expected fourth-quarter 2019, the companies will continue to operate independently. The closing of the merger will be subject to approval of a majority of the Buckeye unitholders, certain regulatory approvals and other customary closing conditions.

Financial advisers to IFM for the transaction include Credit Suisse, Goldman, Sachs & Co. LLC and BofA Merrill Lynch with Evercore Group LLC acting as lead financial adviser. White & Case LLP and Baker Botts LLP are the firm’s legal advisers. Intrepid Partners LLC and Wells Fargo Securities LLC are financial advisers to Buckeye and Cravath, Swaine & Moore LLP is the company’s legal adviser.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

How Chevron’s Anchor Took on the ‘Elephant’ in the GoM’s Deepwater

2024-08-22 - First oil at Chevron's deepwater Anchor project is a major technological milestone in a wider industry effort to tap giant, ultra-high-pressure, high-temperature reservoirs in the Gulf of Mexico.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

E&P Highlights: Nov. 4, 2024

2024-11-05 - Here’s a roundup of the latest E&P headlines, including a major development in Brazil coming online and a large contract in Saudi Arabia.

E&P Highlights: Oct. 14, 2024

2024-10-14 - Here’s a roundup of the latest E&P headlines, including another delay at one of the largest gas fields in the world and two major contracts in West Africa.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.