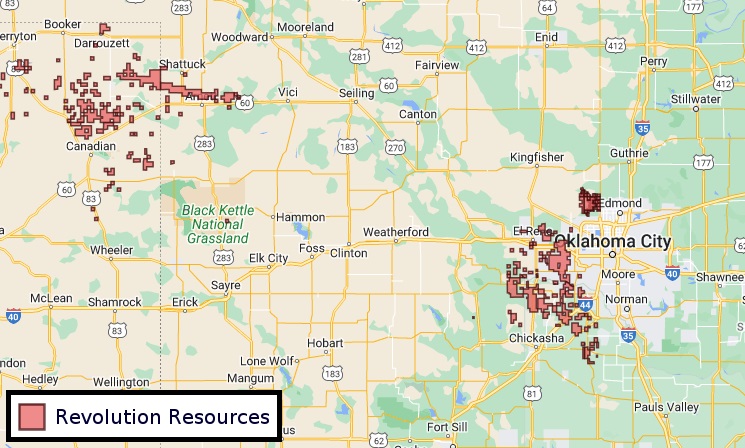

Benchmark Energy II is acquiring Revolution Resources’ assets in Oklahoma and the Texas Panhandle (Source: Shutterstock.com/ Benchmark)

Benchmark Energy II is acquiring upstream assets from Revolution Resources to expand the E&P’s portfolio in the Midcontinent.

The deal comes a little over four years after Revolution Resources acquired Jones Energy Inc.’s assets in Texas and Oklahoma.

Austin, Texas-based Benchmark Energy is adding approximately 140,000 net acres and 470 operated producing wells in the western Anadarko Basin through the acquisition, the company announced Feb. 20. The deal includes a low-decline, mature production base of around 6,000 net boe/d, the company said.

Benchmark—majority owned by publicly-traded Acacia Research Corp.—entered into a sale and purchase agreement with Revolution Resources II LLC, Jones Energy LLC and other related parties, according to regulatory filings.

Revolution, backed by private equity firm Mountain Capital Partners LP, completed a $201.5 million buyout of Jones Energy’s portfolio in Texas and Oklahoma in early 2020.

“After closing this acquisition, Benchmark will have a large, contiguous acreage position in the heart of the Midcontinent, and incremental scale to continue driving meaningful operational enhancements to create attractive returns for our stakeholders for many years to come,” Benchmark CEO Kirk Goehring said in a news release.

The aggregate consideration to Revolution will consist of $145 million in cash. Acacia is paying $57.5 million for its portion of the deal, which the company expects to fund from cash on hand.

McArron Partners, a minority Benchmark investor and the family investment office of Jones Energy founder Jonny Jones, will contribute approximately $15 million in cash.

The remaining consideration will be funded by borrowings by Benchmark under a new $72.5 million revolving credit facility, per regulatory filings.

“This transaction further expands the exciting partnership between Acacia and McArron in our support of Benchmark,” said Jonny Jones, who serves as McArron Partners’ CEO. “Kirk and his team have a deep familiarity with these high-quality assets, and they will bring Benchmark the required scale to drive meaningful value within the combined enterprise.”

Following the latest acquisition from Revolution, Acacia will own an approximately 73% interest in Benchmark. The Revolution deal is expected to close during the second quarter.

RELATED: Jones Energy Agrees To $201 Million Buyout By Revolution

Midcontinent madness

Jones Energy had a long history in the Anadarko and Arkoma basins in Texas and Oklahoma before entering bankruptcy protection in 2019. Jones Energy held about 185,000 net acres in the Midcontinent and other areas as of the end of 2018, including nearly 11,000 undeveloped acres.

The company exited bankruptcy as Jones Energy II Inc. In December 2019, Jones Energy II agreed to sell its assets and merge with Revolution Resources for $201.5 million cash.

Revolution was formed by CEO Scott Van Sickle in 2018 when the company made its first acquisition of Midcontinent assets from Gastar Exploration.

Acacia acquired a majority stake in Benchmark in November 2023. McArron Partners retained an investment in Benchmark after the Acacia deal late last year.

At that time, Benchmark’s existing assets included around 13,000 net acres primarily located in Roberts and Hemphill counties, Texas, and interests in more than 125 wells. Goehring, Benchmark’s CEO, previously served as COO of Jones Energy.

Through its Benchmark subsidiary, Acacia aims to develop a portfolio of oil and gas assets in mature resource plays in Texas and Oklahoma. Outside of energy, Acacia acquires and operates businesses in the industrial, healthcare and mature technology sectors.

RELATED: Forty Under 40: Scott Van Sickle, Revolution Resources

Recommended Reading

Beyond Energy: EnergyNet Expands Marketplace For Land, Real Assets

2024-09-03 - A pioneer in facilitating online oil and gas A&D transactions, EnergyNet is expanding its reach into surface land, renewables and other asset classes.

Diversified Energy Closes on 170,000-acre Deal in East Texas

2024-08-16 - Diversified will pay $106 million for the natural gas assets through the issuance of 2.24 million new shares and $71 million cash.

For Sale: Grandma’s Minerals

2024-08-16 - A younger generation more open to selling subsurface rights has increased supply for the minerals and royalties market, and Mesa Minerals III is buying up interests in the Permian and Haynesville.

Marketed: South Texas Assets in McMullen, Zapata Counties

2024-08-15 - The Trustee of El Dorado Gas & Oil and Hugoton Operating LLC has retained Energy Advisors Group for the sale of South Texas assets in the A.W.P (Olmos) field in McMullen County and in the Mecom Ranch lease (Lobo) in Zapata County, through a bankruptcy sale.

Strategic Minerals Buying: A Complex Game of 52 Card Pickup

2024-08-09 - Enverus’ minerals expert Phil Dunning pulls back the curtain on generational changes and seismic shifts in the U.S. minerals market that make it challenging to for aggregators to achieve scale.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.