(Source: Hart Energy)

Six months after exiting bankruptcy, Jones Energy II Inc. said it agreed Dec. 6 to sell its assets and merge with Revolution Resources, an affiliate of Mountain Capital Partners LP, for $201.5 million cash.

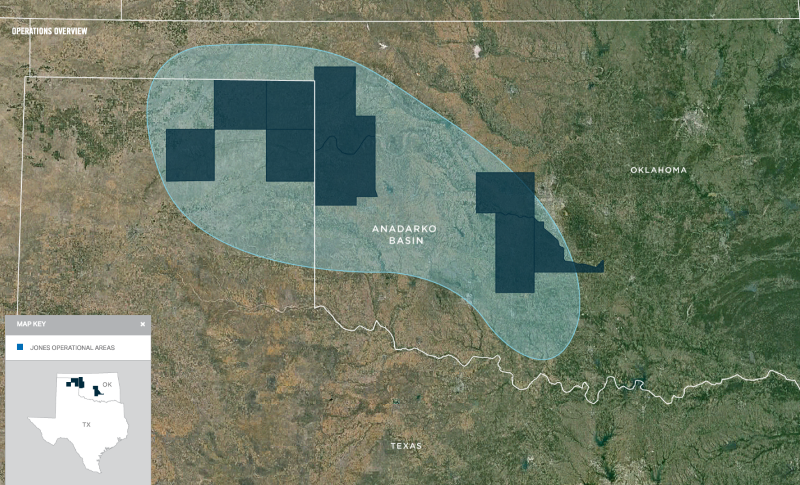

Jones Energy entered bankruptcy protection in April with secured and unsecured liabilities of more than $1 billion. The company, with assets in the Anadarko Basin in Oklahoma and Texas, emerged from reorganization 33 days later with a $225 million borrowing base agreement.

Jim Addison, Jones Energy’s chairman of the board, said the agreement marks the successful completion of its strategic alternatives process underway since earlier this year.

“Throughout the course of our exhaustive review, we engaged in meaningful strategic dialog with a significant number of potential counterparties,” he said. “Ultimately, the board unanimously determined that an all-cash transaction with Revolution is in the best interests of our shareholders and the company and will deliver the strongest economic value relative to the comprehensive range of alternatives we examined.”

Prior to bankruptcy, Jones Energy targeted the Eastern Anadarko Basin’s liquids-rich Woodford Shale and Meramec formation in the Merge area of the Stack/Scoop. In the Western Anadarko, the company targeted the Cleveland, Marmaton, Granite Wash and Tonkawa formations.

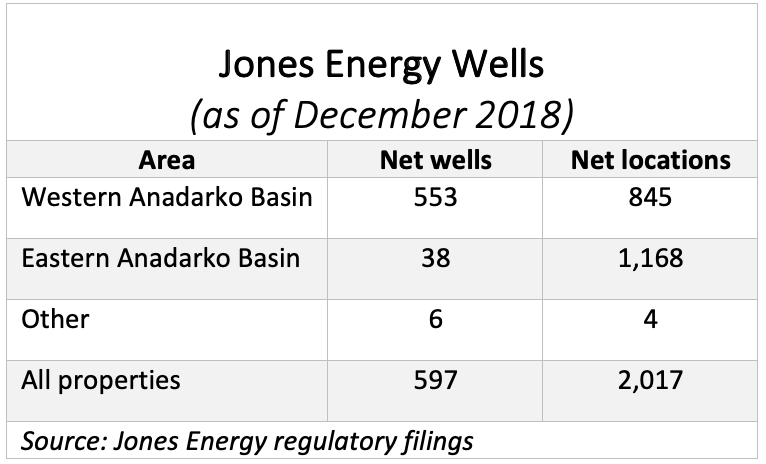

In the Midcontinent and other areas, Jones Energy held about 185,000 net acres as of year-end 2018, including 10,708 undeveloped acres. About 94% of its leasehold was HBP. Additionally, the company’s inventory included 597 net wells and 2,017 net locations.

Revolution Resources has previously taken advantage of distressed Midcontinent companies to make acquisitions. In January 2018, the company agreed to buy Gastar Exploration Inc.’s West Edmund Hunton Lime Unit (WEHLU) for $107.5 million.

Revolution II WI Holding Co. LLC is backed by Houston-based Mountain Capital private-equity fund, which has about $1 billion of assets under management.

Evercore and TD Securities (USA) LLC are serving as financial advisors to Jones Energy, and Baker Botts LLP is serving as its legal counsel. Kirkland & Ellis LLP is Revolution Resources’ legal counsel.

Recommended Reading

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

New US Rules Seek to Curb Leaks From Drilling on Public Lands

2024-03-27 - The U.S. Interior Department finalized rules aimed at limiting methane leaks from oil and gas drilling on public lands.