DENVER—It was 20 years ago when Big Sky Country started its journey into Big Oil country. It was a small group of determined dreamers who applied an entrepreneurial spirit to horizontally drill Burning Tree State 36-2H in Richland County, Mont. The Bakken was suddenly at the center of the American oil revolution.

Among them was a prospector, who told Hart Energy he was asking for just one more chance in the Middle Bakken, a young Halliburton engineer with a lot of creativity, and two partner operators with a lot of patience. Two of those men, and the son of another, were on hand to tell their story and receive commemorative awards at Hart Energy’s DUG Bakken and Rockies Conference and Exhibition at the Colorado Convention Center on Feb. 19.

Two decades later, nearly 800 oil and gas professionals gathered to look at the future of the Bakken Shale in Montana and North Dakota as well as Wyoming’s Powder River Basin and Colorado’s Niobrara. It’s hard to say if they’d all have been here without the efforts of Dick Findley, Kumar Ramurthy and Bob Robinson, among others, but the frack job they did on May 26, 2000, showed that oil molecules weren’t too big to flow through a horizontal well. The rest, as they say, is history. History, that is, still in the making.

(Source: Len Vermillion, Hart Energy)

The celebration was only part of the activities. Despite post-Senate Bill 19-181 (SB19-181) life in Colorado, low commodity prices everywhere, poor investor sentiment about shale and the specter of political battles over climate change causing the industry sleepless nights, many of the attendees remained upbeat about the future of the region.

“What I have seen that has been unusual is that people have been very creative and willing to collaborate more than in the past,” said Samantha McPheter, president and CEO of data software provider eLynx Technologies LLC, at the company’s booth on the exhibit floor. “Everyone is looking for new and unique ways to do business development so they are more open to some partnerships.

“It works for us because we are also strategically looking at what we need to do differently. It’s just a different time and industry is in a different place,” she continued. “You can’t do the same things and expect different results.”

Click here for more information like this.

One of those innovations making its way into the Bakken is enhanced oil recovery (EOR). Liberty Resources II LLC’s vice president of business development, Gordon Pospisil, took the stage at the conference to offer results of a Bakken pilot well using EOR. He showed how gas injection “huff ’n puff” EOR can work for tight oil. He said produced gas works like CO₂ in light, tight oil.

In addition, he said capital efficiency can be dramatically improved and that EOR is a driver for M&A activity. Pospisil said it creates new business opportunities like rental compression and gas injection services.

Another company using innovative drilling technology in the Bakken is Hess Corp. Dougie McMichael, director, Bakken Well Factory for Hess Corp., told Hart Energy the company is having great success iwith its plug-and-perf completion design. “We’ve increased IP180 production rates by 15% by doing that,” he said.

Another operator on hand to talk about the Williston Basin was Jay Knaebal, vice president of Oasis Petroleum, who said his company is focused on moderate growth, significant cash flow and a strong balance sheet in the play.

Meanwhile, back in the exhibit hall service companies with interests in both the Bakken and the Rockies were still getting business done despite the tough market conditions.

“The show’s been great. All of our customers and prospects are speaking. We’re getting a few leads out of our poly-pipe offering,” said Jeff Jumonville, vice president of sales for production equipment at Dragon Products PES Inc., a Beaumont, Texas-based maker of production equipment with a significant footprint in the Rockies due to its 2018 acquisition of Casper, Wyo.-based FabTech from Nalco Champion.

Jumonville said business has been good in the Rockies and Bakken. The company maintains three of its six facilities in the region. “Maybe Wyoming’s been a brighter spot over the last couple of years,” he said. “We’re getting more business on the midstream side in the Bakken.”

With the Powder River Basin seeing a surge in interest and the buildout of infrastructure in the Bakken, the better business environment in those two areas stands to reason.

RELATED: Oil And Gas Experts On Regs: Resist The Rocky Mountain Sigh

What doesn’t necessarily stand to reason is the tendency of the industry to dismiss anti-fossil fuel activists in a state that less than a year ago pushed through SB19-181, which put surface rights for drillers in the hands of local authorities. For the record, no anti-fossil fuel protestors showed up at DUG Bakken & Rockies.

And while operators in the region work with anti-fracking activists and state and local governments during the rulemaking phase in Colorado to implement SB19-181, Tisha Schuller, former Colorado Oil and Gas Association (COGA) president and CEO turned energy thought leader, issued a warning to the audience.

“There is clearly an anti-fossil fuel mindset out there and as much as we want to dismiss it, it’s important to understand it. It is an existential threat,” she said.

In a lighthearted moment, she told the oil and gas industry crowd, “It’s nice to talk to a group of people who don’t have ‘frack off’ taped to their heads.”

She urged industry leaders in the audience to understand the aspirations of the opposition and focus on listening to build trust. “There is a time for education but that’s after building trust and relationships,” she said, urging the industry to “reframe the opposition as an opportunity.”

Earlier, PetroNerds’ founder Trisha Curtis said, “We’re not doing the industry any favors by simply saying Colorado is an unfavorable regulatory environment.” She pointed to a lot of advantages in the geology of the state, among them its known rock.

Curtis used her time to focus on what the industry can do to try to figure out what will actually increase share prices for its companies.

Fellow analyst Welles Fitzpatrick of SunTrust Robinson Humphrey agreed there’s plenty to be optimistic about when it comes to the future of shale in general. “When sentiment shifts, there is a lot of value set to come online. It looks depressing but it’s actually set up for a nice bounce back,” he said.

Click here for more information like this.

One company that is embracing the still-existing opportunities in Colorado’s rock is Denver-based HighPoint Resources Corp. Paul Geiger, COO and the opening keynote speaker, acknowledged that state regulations and ESG (environmental, safety and governance) documentation have made for longer permitting and planning. However, Geiger said HighPoint has been able to accomplish what it wants to get done and that Colorado is still viable.

There was also plenty of talk about the Rockies’ new star, the Powder River Basin. Aaron Ketter, vice president of the Rockies Business Unit for Devon Energy, said multiple horizons have created a diversified drilling program for the company in the Rockies. It now has 320,000 net acres in the Powder River Basin in Wyoming, where much of the competition for leaseholds has shifted given the scarcity of options in the better established Denver-Julesburg Basin in Colorado. He added that Devon’s Powder River margins reached 50%.

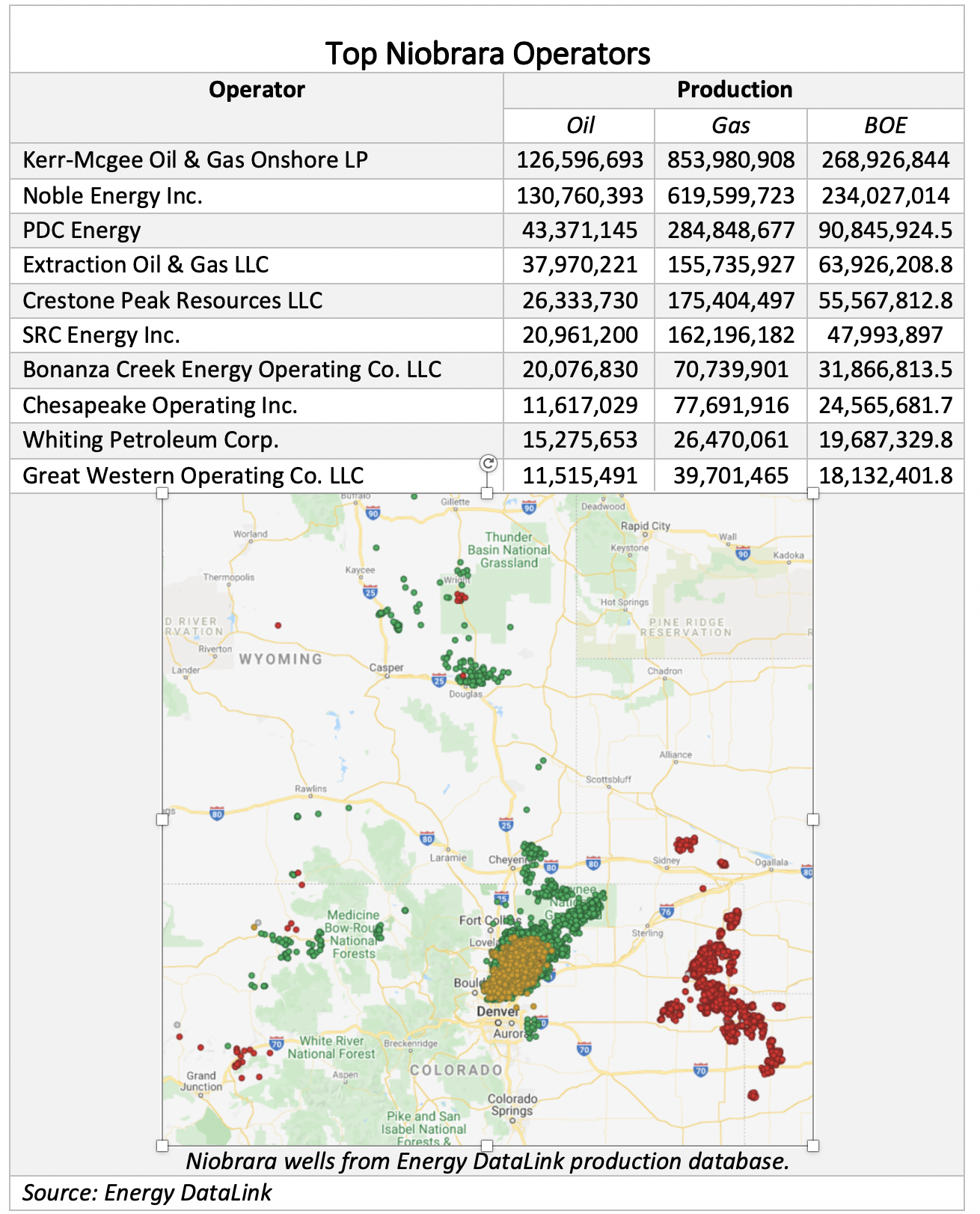

It’s no surprise then that Devon Energy is planning to double its activity levels to 15 wells in the emerging Niobrara Formation of the Powder River Basin.

Next year’s DUG Bakken and Rockies will be back in Denver on March 25-26, 2021.

You can find more features and coverage from the conference in the coming weeks on HartEnergy.com.

Recommended Reading

TGS Releases Illinois Basin Carbon Storage Assessment

2024-09-03 - TGS’ assessment is intended to help energy companies and environmental stakeholders make informed, data-driven decisions for carbon storage projects.

STRYDE Awarded Seismic Supply Contracts in Mexico

2024-09-03 - STRYDE was awarded two seismic node supply contracts in Mexico, the company’s first projects in the country.

PakEnergy Plows Ahead with New SCADA Solution

2024-09-17 - After acquiring Plow Technologies, home of the OnPing SCADA platform, PakEnergy looks to enhance its remote monitoring solutions.

SLB Launches New GenAI Platform Lumi

2024-09-17 - Lumi’s machine learning capabilities will be used to enhance SLB’s Delfi digital platform offering for better automation and operational efficiencies.

Honeywell Bags Air Products’ LNG Process, Equipment Business for $1.8B

2024-07-10 - Honeywell is growing its energy transition services offerings with the acquisition of Air Products’ LNG process technology and equipment business for $1.81 billion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.