Genesis Energy LP (NYSE: GEL) said Aug. 29 it agreed to sell its Powder River Basin midstream assets to private-equity-backed Silver Creek Midstream LLC as Wyoming oil deals continue to be on the rise.

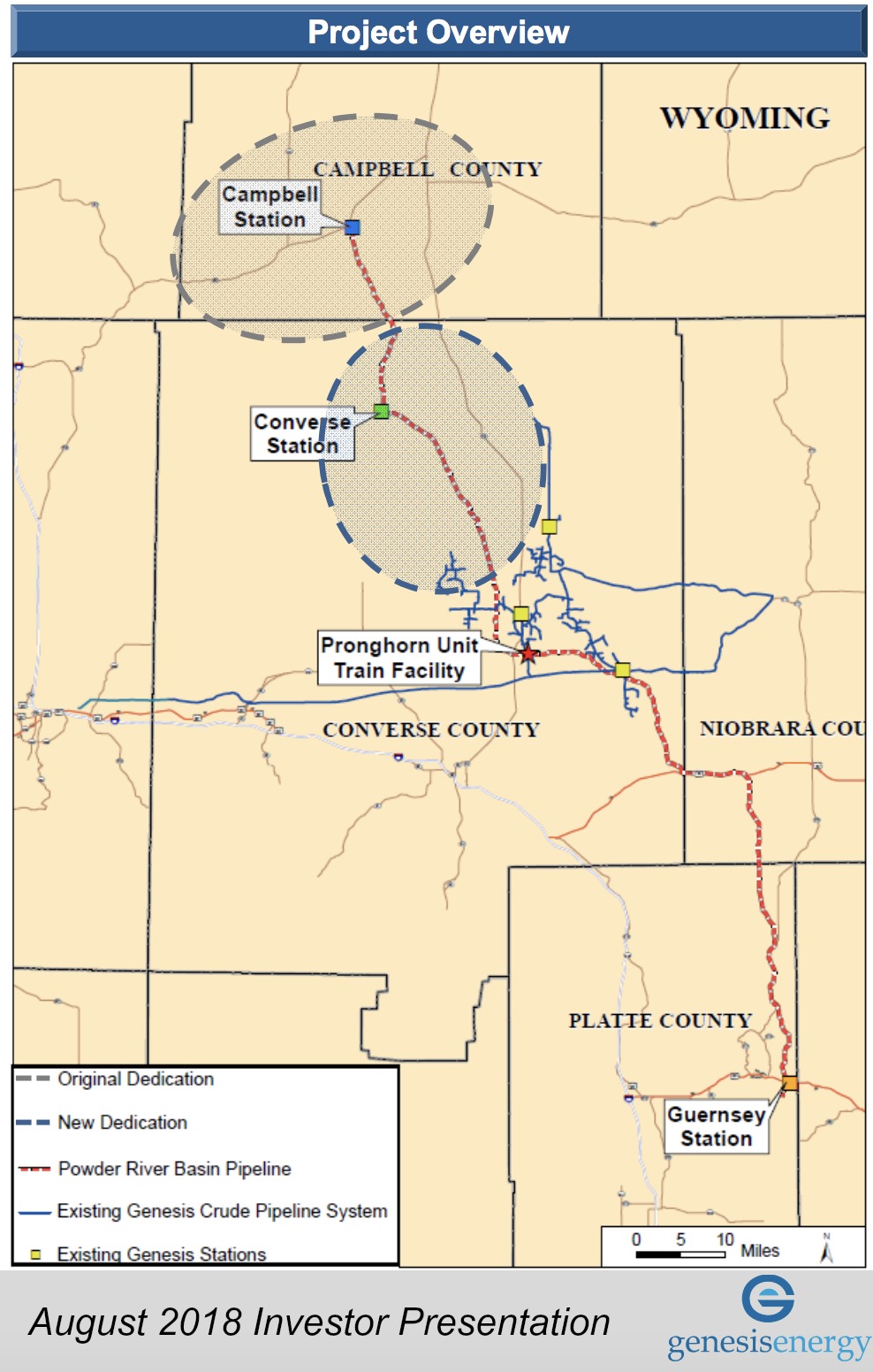

Genesis’ Powder River assets consist of a pipeline, associated crude oil gathering system and rail facility and are anchored by a 10-year, roughly 300,000 acreage dedication from Devon Energy Corp. (NYSE: DVN). An affiliate of Silver Creek exercised its option to acquire the assets for about $300 million in net cash proceeds, which Genesis plans to use to pay down debt.

Silver Creek was formed in August 2017 by CEO Patrick Barley to acquire and develop midstream assets in Wyoming and Texas. The company is backed by Dallas-based Tailwater Capital, which recently closed its latest fund that raised $1 billion to invest in oil pipelines.

In May, Silver Creek’s initial $150 million equity commitment from Tailwater Capital was upsized to $300 million. The additional equity was earmarked for the buildout of a 100%-owned crude gathering system in the Powder River Basin.

The company also formed a joint venture with Tallgrass Energy Partners LP (NYSE: TEP) in February to construct the Iron Horse Pipeline to transport crude from Silver Creek’s terminal to the Guernsey, Wyo., oil hub. The companies launched an open season for the pipeline in July and expect to start commercial operations first-quarter 2019.

Silver Creek also owns a gathering system that transports crude oil out of the Big Horn and Wind River Basins to Casper, Wyo. The company bought the system from Merit Energy Co. for an undisclosed amount late last year.

The transaction between Genesis and Silver Creek is expected to close third-quarter 2018.

In conjunction with the transaction, Genesis said it executed an amendment to its existing revolving credit facility, which among other things, sets the bank leverage ratio to 5.5x throughout the remaining term of the facility, currently May 2022.

Recommended Reading

Baker Hughes Defies Nature with an Upgrade to Ol’ Fashioned Cement

2024-10-15 - Baker Hughes’ InvictaSet uses regenerative capabilities to provide operators with a sustainable cement solution that can last for years.

E&P Highlights: Sept. 23, 2024

2024-09-23 - Here's a roundup of the latest E&P headlines, including Turkey receiving its first floating LNG platform and a partnership between SLB and Aramco.

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.