The following information is provided by Energy Advisors Group Inc. (EAG), formerly PLS Divestment Services. All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

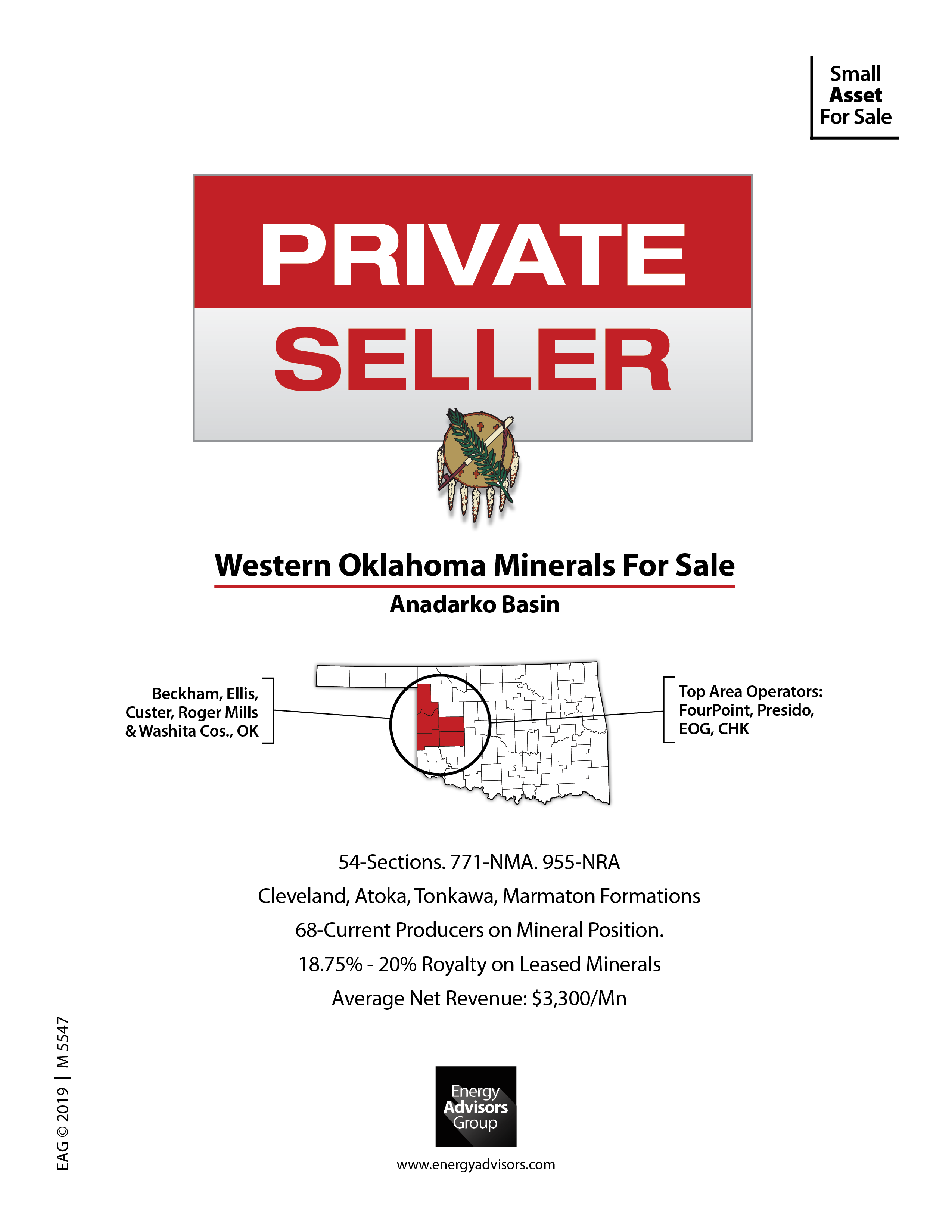

Energy Advisors Group Inc. (EAG) has been retained by a private seller to market a package of Western Anadarko Basin minerals located in Beckham, Ellis, Roger Mills, Custer and Washita counties, Okla. The package consists of 771 net mineral acres (99% leased) and 955 net royalty acres spanning 54 sections and royalties are between 12.5%-18.75%.

Package includes exposure to 68 producers including FourPoint Energy LLC, EOG Resources Inc., Chesapeake Energy Corp., Devon Energy Corp., Mewbourne Oil Co., Crawley Petroleum Corp. and Apache Corp., which recently sold these assets to Presidio Petroleum LLC. Four rigs are currently operating in the package locations: Mewbourne (2), FourPoint (1) and Rhino (1). The three month average net revenue is about $3,300.

Key Operators Activity Offsetting Minerals

FourPoint Energy is a key operator in the area and completed 30 Oklahoma wells in 2019 year-to-date and have a rig currently operating in Ellis County. FourPoint has shifted 70% of their new operated wells towards long laterals and have a 60% multiwell development strategy.

EOG expected to see a 44% increase in gross production from their Western Anadarko assets in third-quarter 2019. EOG is reportedly exceeding their high-end oil production target by 20% with 53 Oklahoma well completions in 2019 while also cutting per well drilling and completion costs by $400,000.

Atalaya Resources LLC operates three wells offsetting the seller's minerals in Beckham County, and recently completed a one-mile Strawn well in June 2019 with an IP-30 of 1,200 barrels of oil equivalent (5% above previous IPs)

Additional Notes

EAG said operators are receiving great results from one-mile laterals in comparison to extended laterals implying a shift toward lower costs and higher near-term returns. Also, 21 stacked pay targets allow more flexibility in drilling operations and enables the utilization of cost-effective multiwell pad drilling to maximize near-term cash flows.

Highlights:

- Oklahoma Minerals For Sale

- 54-Sections. 771 Net Mineral Acres. 955 Net Royalty Acres.

- Western Anadarko Basin

- Beckham, Custer, Ellis, Roger Mills and Washita Counties.

- Cleveland, Atoka, Tonkawa, Marmaton

- 68 Current Producers on Mineral Position.

- Mineral Interest For Sale

- Offset Several IPs greater than 1,500 barrels of oil equivalent per day

Click here to view the online data room or visit energyadvisors.com/deals to view our other 30-plus assignments.

For more information, contact Richard Martin, director with EAG, at rmartin@energyadvisors.com or 214-774-2150.

Recommended Reading

E&P Highlights: Sept. 9, 2024

2024-09-09 - Here’s a roundup of the latest E&P headlines, with Talos Energy announcing a new discovery and Trillion Energy achieving gas production from a revitalized field.

IOCs See Opportunity in Offshore Mexico, Despite Potential for Policy Changes

2024-08-14 - Five IOCs with offshore experience and capital—Eni, Harbour, Talos, Wintershall Dea and Woodside—continue to pursue promising opportunities offshore Mexico despite the country’s energy sovereignty push in favor of state-owned entities Pemex and CFE.

NSTA Opens Investigations into UK North Sea Decommissioning Delays

2024-07-16 - The North Sea Transition Authority is investigating missed deadlines for well decommissioning projects on the U.K. Continental Shelf that have already increased forecast P&A costs to $31 billion between 2023 and 2032.

Shell Offshore Takes FID on Waterflood Project in GoM

2024-08-14 - Shell Offshore’s waterflood secondary recovery process involves injecting water into the reservoir formation to extract oil.

Chevron’s Gulf of Mexico Anchor Project Begins Production

2024-08-12 - Chevron and TotalEnergies’ $5.7 billion floating production unit has a gross capacity of 75,000 bbl/d and 28 MMcf/d.