The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Caddo Minerals Inc. retained EnergyNet for the sale of producing Eagle Ford Shale minerals in Dimmit County, Texas, operated by an affiliate of Chesapeake Energy Inc. through two sealed-bid offerings.

For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

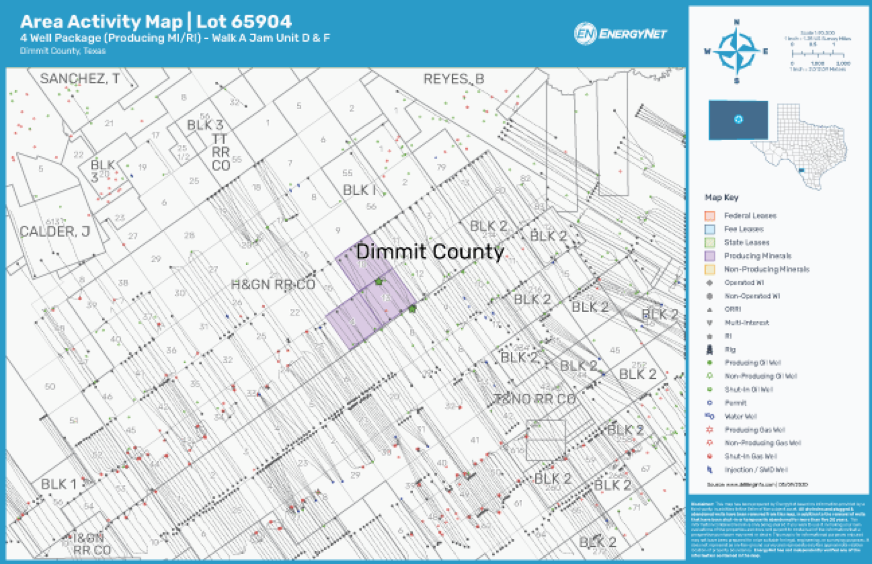

Lot 65904

Highlights:

- Royalty Interest (Producing Minerals) in Four Producing Wells:

- 1.056493% Royalty Interest in the Walk A Jam Unit F DIM 3H Well

- 0.744509% Royalty Interest in the Walk A Jam D-F HC2 2H Well

- 0.701712% Royalty Interest in the Walk A Jam D-F HC1 1H Well

- 0.42227% Royalty Interest in the Walk A Jam Unit D DIM 5H Well

- Current Average 8/8ths Production: 807 barrels per day (bbl/d) of Oil and 1.392 million cubic feet per day (MMcf/d) of Gas

- Three-Month Average Net Income: $17,899 per Month

- Operator: Chesapeake Operating LLC

Bids are due at 4 p.m. CT April 2.

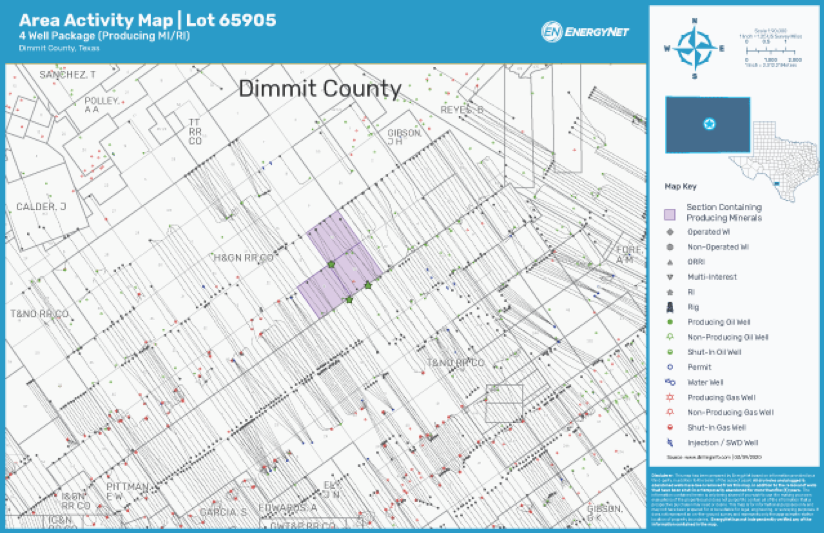

Lot 65905

Highlights:

- Royalty Interest (Producing Minerals) in Four Producing Wells:

- 0.565577% Royalty Interest in the Walk A Jam C-E HC2 2H Well

- 0.565539% Royalty Interest in the Walk A Jam C-E HC1 1H Well

- 0.564676% Royalty Interest in the Walk A Jam Unit E DIM 4H Well

- 0.540652% Royalty Interest in the Walk A Jam Unit C DIM 1H Well

- Current Average 8/8ths Production: 1,173 bbl/d of Oil and 1.391 MMcf/d of Gas

- Three-Month Average Net Income: $17,128 per Month

- Operator: Chesapeake Operating LLC

Bids are due by 4 p.m. CT April 9.

Recommended Reading

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Exclusive: How E&Ps Yearning Capital can Stand Out to Family Offices

2024-10-15 - 3P Energy Capital’s Founder and Managing Partner Christina Kitchens shares insight on the “educational process” of operators looking at opportunities in the U.S. and how E&Ps looking for capital can interest family offices, in this Hart Energy Exclusive interview.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.