The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Pintail Oil and Gas LLC retained TenOaks Energy Advisors for the sale of its producing properties in South Texas and Louisiana through an offering closing Oct. 18.

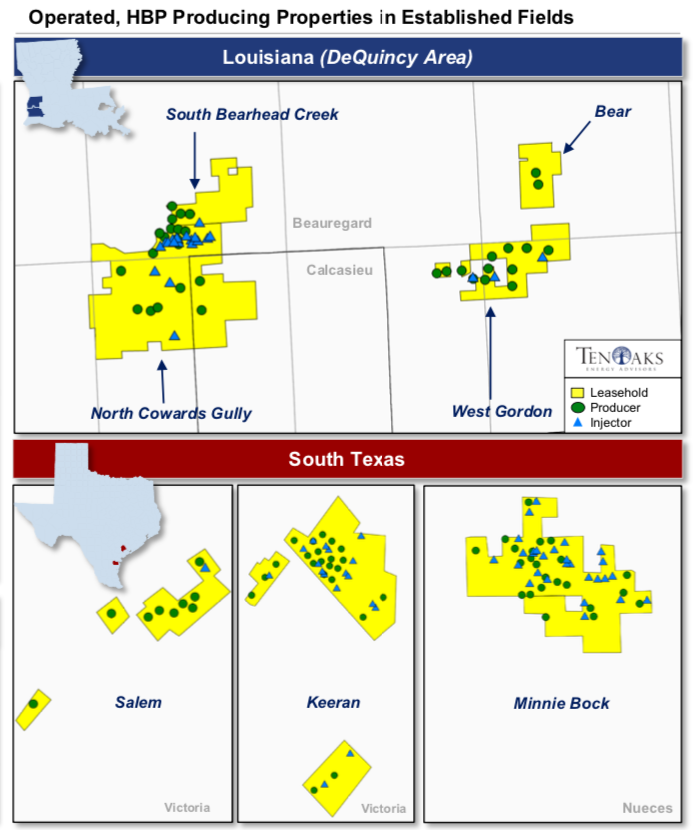

The offering includes operated, HBP producing properties in established fields located in Nueces and Victoria counties, Texas, and Beauregard and Calcasieu parishes, La.

Highlights:

- Oil-weighted, HBP asset in legacy fields with operational control

- High ownership interests (98% Working Interest / 74% Net Revenue Interest)

- 614 net barrels of oil equivalent per day (99% liquids)

- $5.2 million annualized net cash flow

- Undercapitalized asset with behind-pipe, operational and production enhancement projects

- Option to acquire all assets or by state:

- Louisiana: DeQuincy Area (Beauregard and Calcasieu Parishes)

- Texas: Salem, Karen, Minnie Bock Fields (Victoria and Nueces Counties)

Bids are due by noon CST Oct. 18. The virtual data room will be available beginning Sept. 20.

For information visit tenoaksenergyadvisors.com or contact Trey Bonvino, TenOaks associate, at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Entergy Picks Cresent Midstream to Develop $1B CCS for Gas-fired Power Plant

2024-09-20 - Crescent will work with SAMSUNG E&A and Honeywell on the project.

FERC Chair: DC Court ‘Erred’ by Vacating LNG Permits

2024-09-20 - Throwing out the permit for Williams’ operational REA project in the mid-Atlantic region was a mistake that could cost people “desperately” reliant on it, Chairman Willie Phillips said.

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.