The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

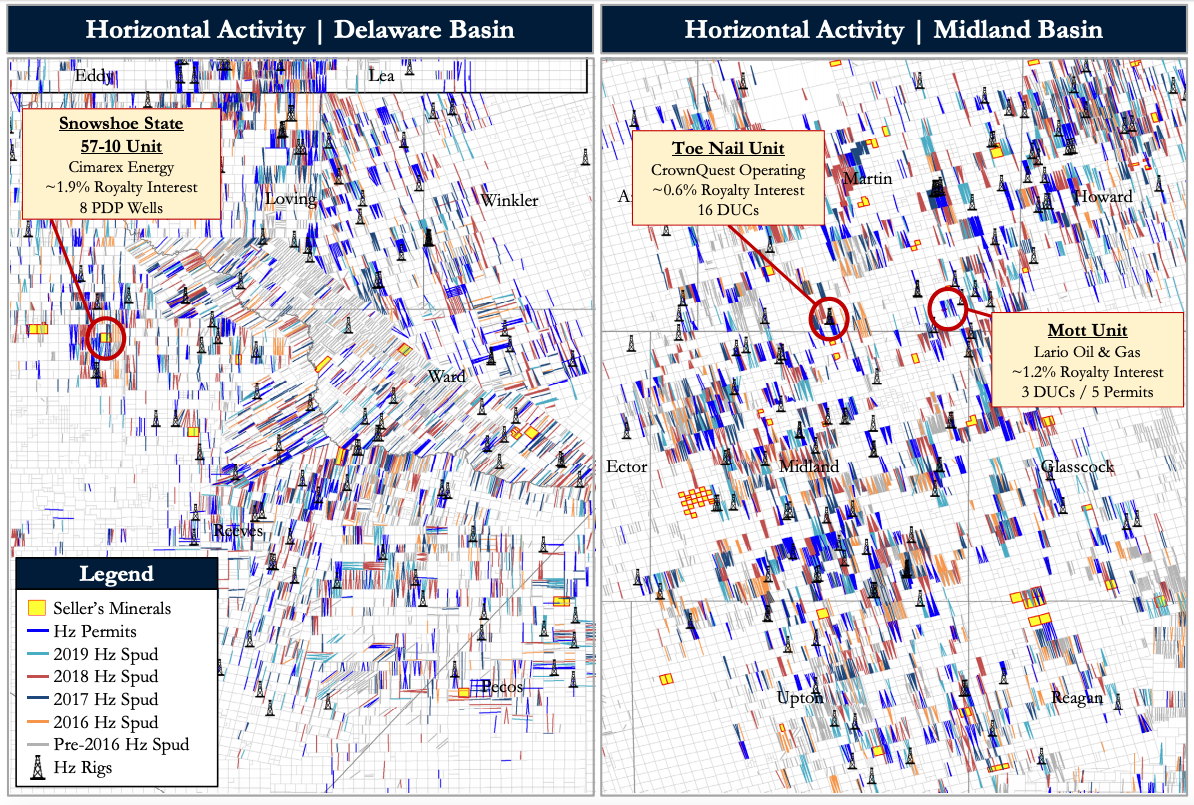

A private seller retained Detring Energy Advisors for the sale of a Permian Basin mineral and royalty package. The offering comprises about 1,700 net royalty acres throughout the prolific Midland and Delaware basins.

According to Detring, the package includes diversified exposure covering the cores of the two highest-returning U.S. basins plus substantial near-term cash flow from about 100 horizontal proved developed producing (PDP) wells and 85 horizontal drilled but uncompleted wells (DUCs) and permits. Detring added that the asset has premier operators drilling extended laterals utilizing next-gen completion techniques and high royalty interest units under development, providing strong near-term cash flow and growth.

Highlights:

- 1,699 net royalty acres (normalized to 1/8th)

- 60% Midland Basin and 40% Delaware Basin

- Premier location with exposure to top operators (Occidental Petroleum Corp., Pioneer Natural Resources Co., Cimarex Energy Co., EOG Resources Inc., Diamondback Energy Inc., etc.)

- $3.6 million next 12-month cash flow from PDP, DUCs and Permits, with attractive long-term growth driven by substantial inventory of economic undeveloped locations

- About 100 horizontal producing wells with near-term growth driven by high royalty interest horizontal DUCs (55) and Permits (30)

- World-Class Inventory Across Multiple Horizons

- Operators completing prolific wells across multiple economic Wolfcamp, Spraberry and Bone Spring targets

- IPs, EURs, and rate of returns consistently top 1,500 barrels of oil equivalent per day, 1 million barrels of oil equivalent and 70%, respectively, in current pricing environment

- About 400 horizontal rigs currently running throughout the Permian ensure mineral value acceleration

Process Summary:

- Evaluation materials available via the Virtual Data Room Oct. 14

- Proposals due Nov. 13

Detring said the seller anticipates executing a purchase and sales agreement by mid-December, with closing occurring in January.

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Shell, Akselos Enter Enterprise Deal for Structural Performance Management

2024-08-28 - Shell Information Technology International will leverage Akselos’ structural performance management software to monitor the health and lifecycle of Shell’s critical assets in Qatar, Canada, the Gulf of Mexico and elsewhere.

CNOOC Makes Ultra-deepwater Discovery in the Pearl River Mouth Basin

2024-09-11 - CNOOC drilled a natural gas well in the ultra-deepwater area of the Liwan 4-1 structure in the Pearl River Mouth Basin. The well marks the first major breakthrough in China’s ultra-deepwater carbonate exploration.

CNOOC Discovers Over 100 Bcm of Proved Gas in South China Sea

2024-08-07 - CNOOC’s Lingshui 36-1 is the world’s first large, ultra-shallow gas field in ultra-deep water.

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

2024-07-08 - Oklahoma City-based Devon Energy is growing its Williston Basin footprint with a $5 billion cash-and-stock acquisition from Grayson Mill Energy, an EnCap portfolio company.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.