The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

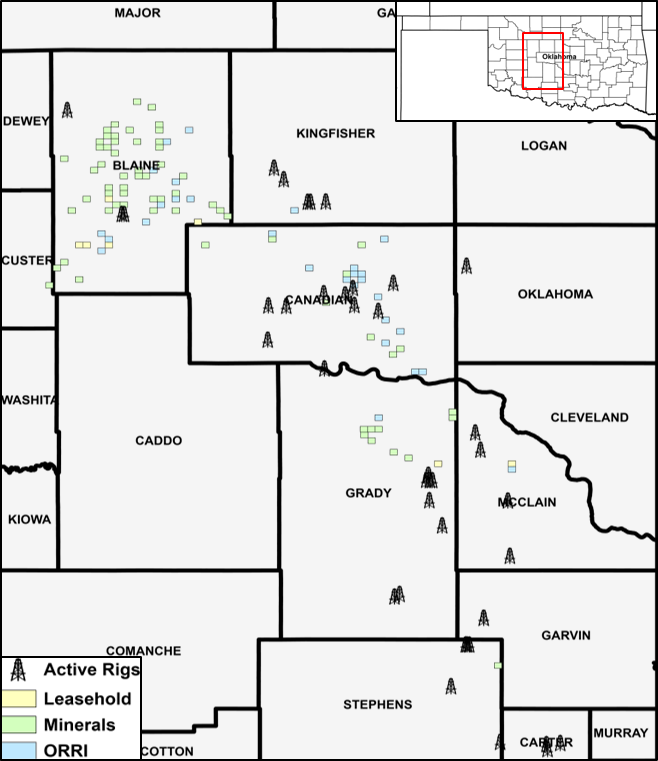

Midwest Energy Investments LLC retained Eagle River Energy Advisors LLC for the sale of mineral, lease and overriding royalty interest (ORRI) assets and associated development rights in the Stack play of Oklahoma.

Highlights:

- About 1,166 Net Royalty Acres (Normalized to 1/8th)

- Minerals: 1,016 Net Royalty Acres (23% Average Royalty Rate)

- ORRI: 150 Net Royalty Acres across 104 Drilling and Spacing Units

- 32 Net Leasehold Acres (82% Average Net Revenue Interest)

- About 112 Boe/d net production (67% Liquids)

- $111,000 per month net cash flow (Average April-September 2019)

- 171 Proved Developed Producing wells provide stable and diversified production profile

- 16 Drilled but Uncompleted wells and 62 proposed wells provide near-term upside

- Signficant remaining Reserves with 900,000 to 2.8 million boe EURs from multibench development across the acreage

- Economic development of the Woodford and Mississippian yield internal rate of returns greater than 50%

- 500-plus remaining, economic drilling locations provide multiple years of stacked-pay development potential

- Recent successful Woodford and Mississippian delineation across entire position

- Additional, unquantified resources potential in multiple other formations currently being tested

- Portfolio operators include Continental Resources Inc., Devon Energy Corp., EOG Resources Inc., Cimarex Energy Co., Marathan Oil Corp. and Encana Corp. (currently operating as Ovintiv Inc.)

- Portfolio operators actively permitting and are drilling with 32 of 53 total active rigs in the Basin

Bids are due 4 p.m. MT March 10. Virtual data room opens Feb. 11. The transaction is expected to have a March 1 effective date.

For information visit eagleriverholdingsllc.com or contact James Barnes, director of Eagle River, at JBarnes@EagleRiverEA.com or 832-680-0112.

Recommended Reading

Beyond Energy: EnergyNet Expands Marketplace For Land, Real Assets

2024-09-03 - A pioneer in facilitating online oil and gas A&D transactions, EnergyNet is expanding its reach into surface land, renewables and other asset classes.

Weatherford Announces Acquisition of Technology Company Datagration

2024-09-03 - The acquisition gives Weatherford International digital offerings for production and asset optimization and demonstrates its commitment to continuously driving innovation across its technology portfolio, the company said.

Voyager Midstream Buys Haynesville G&P Assets from Phillips 66

2024-09-03 - Voyager Midstream acquired about 550 miles of natural gas pipelines, 400 MMcf/d of gas processing capacity and 12,000 bbl/d of NGL production capacity.

DNO Buys Stakes in Five Norwegian Sea Fields from Vår Energi

2024-09-03 - DNO’s acquisition of stakes from Vår Energi includes interests in four producing fields—Norne, Skuld, Urd and Marulk— and the Verdande development.

Transocean Scores $232MM Contract for Deepwater Atlas

2024-09-11 - Transocean’s newest $232 million ultra-deepwater contract follows the company’s $123 million contract for six wells offshore India by Reliance Industries.