The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Merit Management Partners I LP retained EnergyNet for the sale of a nonop Kansas package through a sealed-bid offering closing Oct. 30.

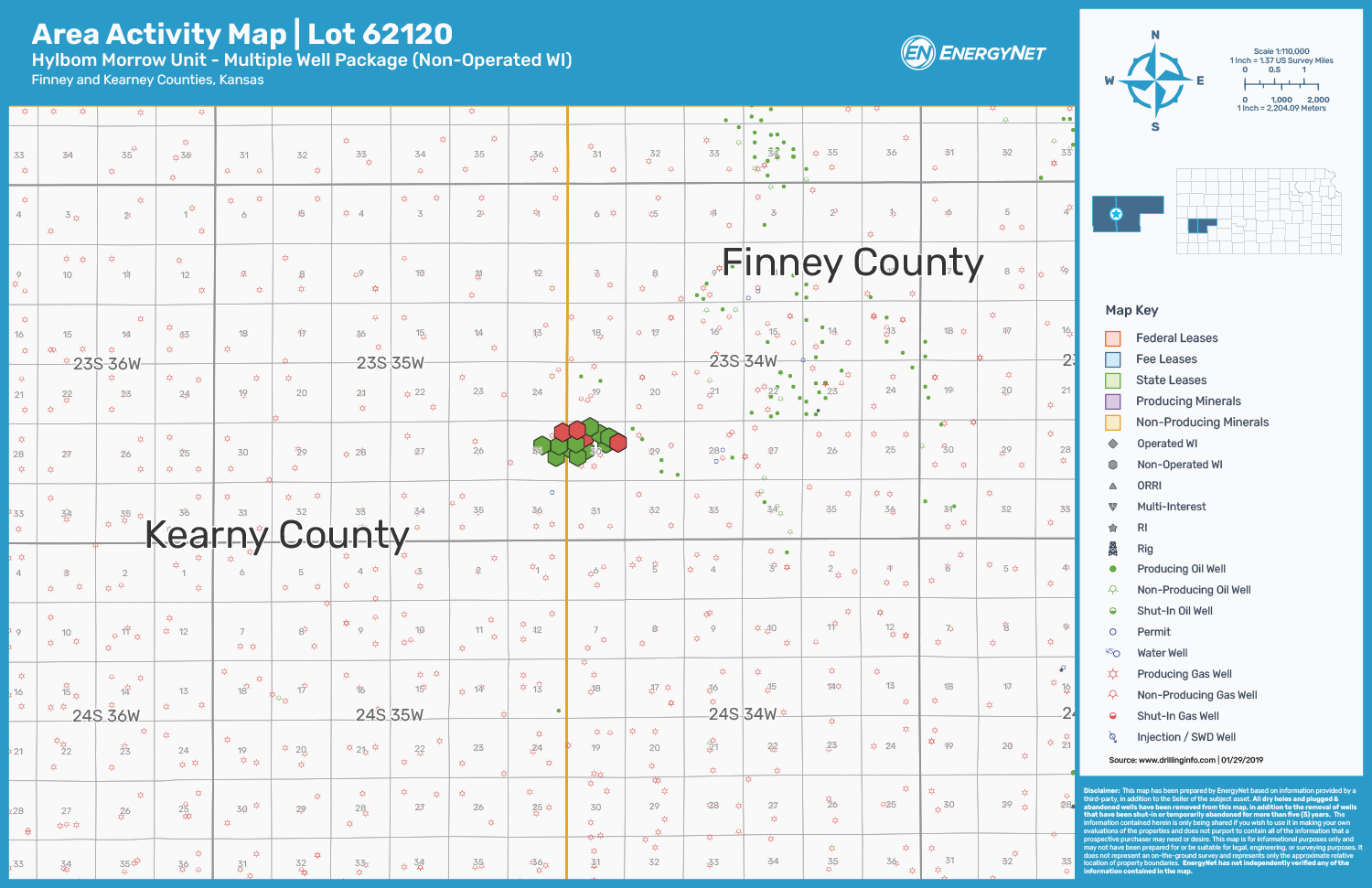

The offer comprises of nonoperated working interest in a 16 well package located in Finney and Kearny counties, Kan. The assets are operated by Merit Energy Co., an affiliate of the seller.

The properties constitute a nonoperated minority working interest. According to EnergyNet, the properties are being sold due to the seller's liquidation of legacy partnerships. Merit Energy will retain ownership of the majority working interest and remain operator of the properties.

Highlights:

- 30.0484% Working Interest / 26.2924% Net Revenue Interest in 16 Wells:

- 11 Producing Wells | Five Active Injection Wells

- Six-Month Average 8/8ths Production: 643 barrels per day of Oil

- Seven-Month Average Net Income: $208,893 per Month

- Operator: Merit Energy Co.

Bids are due by 4 p.m. CDT Oct. 30. For complete due diligence information visit energynet.com or email Michael Baker, vice president of business development, at Michael.Baker@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Matador Offers $750 Million in Senior Notes Following Ameredev Deal

2024-09-20 - Matador Resources will offer $750 million in senior notes following the close of its $1.83 billion Ameredev II acquisition.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.